A “Shocked” Wall Street Reacts After Nike Plummets On “Unexpected” Inventory Surge

It was all the way back in May when we first warned that a reversal of the “shortage of everything” bullwhip effect was coming, as soaring inventories (the result of covid-era overordering due to snarled supply chains) are about to hit a slowing economy brick wall, and prices are about to fall off a cliff as companies are forced to liquidate said inventories into a recession (see “Bullwhip Effect Ends With A Bang: Why Prices Are About To Fall Off A Cliff” from May 23), a point we also made repeatedly in the months that followed (“Bullwhip-Effect Reversal Is The Major Downside Growth Risk“; “The ‘Bullwhip Effect’ Will Frustrate The Fed“). And while the market largely ignored what was coming with the occasional exception…

Reverse bull whip effect strike again this time at NVDA which takes $1.3BN inventory charge: “Second quarter results are expected to include approximately $1.32 billion of charges, primarily for inventory”

— zerohedge (@zerohedge) August 8, 2022

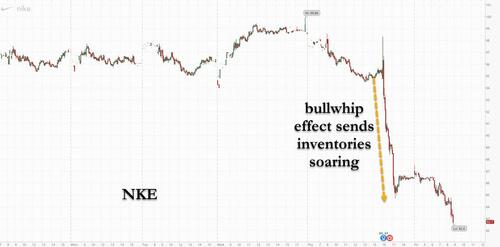

… it wasn’t until last night’s Nike earnings “shock” that the full extent of the reverse bullwhip became apparent.

For those that missed it, NKE shares plunged some 10% overnight, their biggest post-earnings drop in 20 years, after the sportswear giant cut its margin outlook for the year while reporting precisely what we warned would happen as the reverse bullwhip effect kicks in, namely surging inventory, fueling worries over consumers’ ability to spend as inflation takes a toll. And even though all of this was perfectly visible for those who bother to look, the market was so shocked that Nike stock is in freefall this morning, suffering one of its biggest post-earnings drop on record.

And, as they always do after the fact, analysts slashed their targets on the retailer, saying that even a big brand like Nike isn’t immune to macro pressures, even if the longer-term outlook is rosier. Here is what analysts are saying:

Morgan Stanley (overweight, PT cut to $120 from $129)

- Analyst Alex Straton flags high macro and supply chain volatility, full- year numbers falling, and long-term targets pushed out

- While Nike’s discounted valuation feels fair, it also makes for a potentially attractive entry point for long-term investors

Guggenheim (buy, PT cut to $135 from $155)

- Analyst Robert Drbul continues to believe that many of the issues Nike is facing are transitory, including “bloated” inventory levels and supply/demand imbalance, with “significant” gross margin pressure

RBC (outperform, PT cut to $115 from $125)

- Excess inventories in North American have been the main “fear” among investors in recent weeks and months, writes analyst Piral Dadhania

- Nike’s results show that it too isn’t immune, with material inventory build, lower than expected gross margin and a guidance cut

- Keeps outperform rating on strong revenue growth and potential China recovery

Stifel (buy, PT cut to $110 from $130)

- Nike’s demand strength was overshadowed by ballooning inventories that will weigh on margin, analyst Jim Duffy says

- Among positives, highlights solid back-to-school, and better-than-feared Greater China results

Citi (neutral, PT $93)

- While the inventory buildup is mainly due to supply chain timing issues, Nike must walk a fine line between heavy liquidation sales and protecting the health of its brand near and longer-term, analyst Paul Lejuez writes

- Risk remains even for a strong brand like Nike, especially if macro environment weakness further

BMO Capital Markets (outperform, PT cut to $110 from $128)

- Analyst Simeon A Siegel notes Nike beat on revenues and EPS, missed margins and lowered its guidance

Jefferies (buy, PT cut to $115 from $130)

- Analyst Randal Konik notes Nike still has strong demand and remains attractive in the long term, but cuts its PT on near-term volatility

- Points to healthy top-line performance, EPS beat driven by cost discipline as positives for the quarter. Elevated inventories and below-consensus China sales were cited as negatives

Wells Fargo (overweight, PT $130)

- Analyst Kate Fitzsimons pointed to revenue upside and cost controls, but noted gross margin missed on outsize freight and logistics costs, FX headwinds and higher markdowns

Commenting on the collapsing price, Bloomberg technician William Maloney writes that NKE is in long-term downtrend from November peak; and is already well below the pre-pandemic high. Chartists will note that a potential initial support zone is $84- $86, and if $84 fails, next potential support $78, $81.

While it is unclear if NKE will plunge that far, one thing is certain: get ready for a whole lot of 50%-off deals on Nike sneakers.

Tyler Durden

Fri, 09/30/2022 – 09:13

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com