JPMorgan Sees Oil Rising Back Over $100 If These Five Conditions Are Met…

The OPEC+ meeting has come and gone, with “Fist-bump bro” Biden humiliated…

TL/DR pic.twitter.com/UQIEmYNktY

— zerohedge (@zerohedge) October 5, 2022

… and the White House scrambling to save at least a little face…

*US HAS MADE ITS VIEWS CLEAR TO OPEC MEMBERS: BLINKEN

OPEC made its views clear to the White House as well

— zerohedge (@zerohedge) October 5, 2022

… and failing.

And so, with oil surging – even as the dollar spikes sharply higher – traders are asking two questions: i) is the drop in oil over and ii) how much higher can it get.

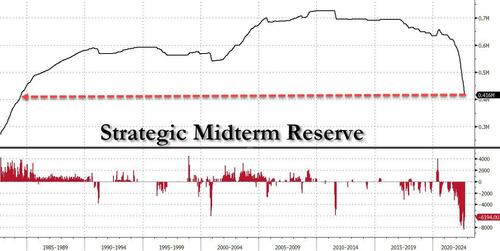

Here are the answers: i) with just a few more weeks left on Biden’s SPR drain mandate, which has soaked up a record 30% of all the “emergency” oil inventory this year…

… and with even less supply coming to market now, Europe about to go turbo on gas to oil switching, and China set to rebound post this month’s congress when Covid Zero will be gradually phased out, we can decisively say that the drop in oil is over.

As for ii), we go to the head of JPM commodity strategy, Natasha Kaneva, who repeats her long-standing 4Q22 price target of $100/bbl, and says that to realize it, five key forecasted conditions need to play out:

- demand needs to bounce 0.9 mbd yoy in 4Q, most of that from gas to oil substitution;

- sanctions on Russia need to constrain supply by 600 kbd;

- Saudi Arabia production needs to normalize from 11 mbd in September to a sustainable 10.6-10.7 mbd pace;

- US SPR releases need to end in October or sooner; and

- the US dollar needs to stabilize.

Kaneva concludes that if four of the above supply-demand conditions materialize, the bank’s models suggest a return to deficits in 4Q22 as supply declines (lower Russian and Saudi production and the end of SPR releases) and demand is supported by incremental gas to oil switching. Adding a stable US dollar to the deficit should result in prices once again re-testing $100 later in the quarter, according to JPMorgan.

More in the full note available to pro subs.

Tyler Durden

Wed, 10/05/2022 – 11:40

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com