Bank of America Has Bad News For Its Clients: We Are A Long Way From The Market Bottom

Two days ago, before today’s monster market reversal, Bank of America’s quant team published an interesting note in which the BofA strategist Jill Carey Hall wrote recent client flows “suggest investors believe market may have bottomed.”

Why did she make this observation? As she explains, “last week, during which the S&P 500 rallied 1.5% off recent lows, clients were big net buyers of US equities ($6.1B; third largest inflow in our data history since ’08 and the fifth consecutive week of inflows).” Digging into the details, BofA’s clients bought both single stocks and ETFs (biggest single stock inflows since April), and bought both large and mid caps while selling small caps for a second week.

- Clients bought ETFs across styles/sizes, led by large cap and Value ETFs. Value ETF flows were the fourth largest in our data since 2017 and the ninth week of inflows.

- Clients bought ETFs in six of the 11 sectors, led by Energy (biggest inflows since late July). Materials and Financials ETFs saw the largest outflows

Unlike previous weeks when client group flows mutually offset each other, this time all client groups (hedge funds, institutional, private clients) were net buyers, led by Institutional clients (first inflow in a month and biggest inflow since Dec. 2020).

Meanwhile, as we have been warning for weeks, stock buybacks have slowed to a trickle (max blackout window was last Friday), and begin to pick up over the next four weeks of earnings, with Halloween expected to be the day most buybacks are again in the market.

And with stocks today staging a powerful reversal off of 2022 lows and exploding higher in a powerful thrust, which many say is a telltale sign of market bottoms, many are wondering – are Bank of America’s clients right in believing that we have finally bottomed?

The answer, according to the bank itself, is that we have a long way to go still before the market bottoms.

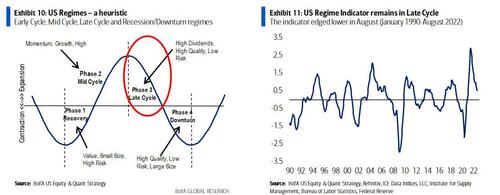

As BofA head quant Savita Subramanian writes, there are two reasons why it is far too early to declare a bottom. The first one comes from the bank’s Regime Indicator, to wit:

Our US Regime Indicator declined for the 14th consecutive month in September, still in Late Cycle but inching closer to Downturn (from 0.5 in August to 0.4). Historically, the Late-Late cycle phase (i.e., moving from the +0.5 level to negative territory) has lasted ~4 months, which means the current Late Cycle might persist through year-end, favoring Value, Risk, Low Quality and Small Caps for 4Q22. In our history since 1990, once the Regime Indicator declined below the 0.5 level in Late Cycle, it inevitably proceeded to decline into the next phase, Downturn.

It’s not just the macro regime indicator, however, as BofA’s bull market signposts – a composite of 10 indicators that have historically signaled market bottoms – continue to suggest risk that the market hasn’t yet bottomed. In fact, of the 10 indicators, only 20% were triggered in September, down from 40% a month ago, when the unemployment rate and the ISM both declined (no longer triggered). As BofA notes, “prior market bottoms coincided with over 80% being triggered” so we have a long way to go.

Bottom line: today’s rally was just the latest spectacular bear-market rally, a combination of a short squeeze, technicals, positioning and a little chart voodoo. But for the true bottom, what the market needs more than anything is a capitulation by the Fed: that won’t happen until inflation moderates, which won’t happen for a long time, if ever, since most of the remaining inflation is supply-driven and the Fed has no control over that, or when something really big finally breaks. Our money is on the latter.

More in the full note available to pro subs.

Tyler Durden

Thu, 10/13/2022 – 21:20

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com