Subpar 30Y Auction Tails As Foreign Buyers Stay Away

After yesterday’s unexpectedly ugly (if not quite catastrophic) 10Y auction, few were expecting anything good from today’s 30Y auction in the form of a reopening of Cusip TJ7. Which is good, because they didn’t get it, largely as a result of today’s wild swing across the curve which kept potential buyers away.

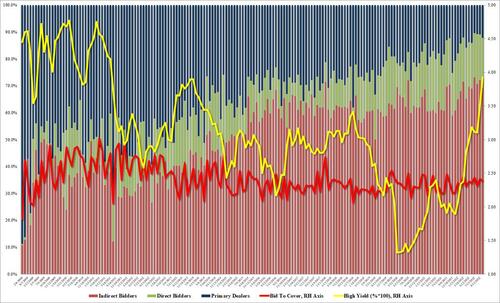

The $18BN auction stopped at a high yield of 3.930%, above last month’s 3.511% and the highest since the US ratings downgrade in August 2011. The Auction also tailed the When Issued 3.920% by 0.1bps, a reversal from last month’s stop through.

The bid to cover of 2.386 dropped from September’s 2.419 but just above the recent average of 2.366.

The internals were also mediocre at best, with foreign buyers taking down just 69.1%, the lowest since June and just below the 70.0% six auction average; and with Directs awarded 18.7%, a little over the recent average, Dealers were left holding 12.2%, the most since June (they can’t be too happy about that… unless they expect yields to tumble).

Overall, this was another tailing, mediore auction but like yesterday’s 10Y, it could have been much worse.

Tyler Durden

Thu, 10/13/2022 – 13:50

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com