Bitcoin’s Rapidly Changing Correlation Regime Suggests Investors Are Starting To View It As Safe Haven

After a near-apocalyptic 6 months for bitcoin and the broader digital token segment, which led to the now traditional spike in crypto obituaries, some are wondering if the crypto winter is starting to thaw and is sentiment is about to reverse.

One such tentative ray of hope comes from Bank of America’s latest Global Cryptocurrencies note, in which author Alkesh Shah paints a gloomy picture for most assets, yet one where cryptos may soon start diverging, to wit:

Higher rates, driven by inflation and budget deficits, continue to pressure risk assets including the digital assets sector. Our macro colleagues note early signs of capitulation given max bearishness (see this Oct 20 report) for the 5th consecutive week as hedge funds position less bearishly on equity and an S&P YE price forecast indicating 2% downside from current levels as client flows signal expectations of a potential market bottom. But, rate risks remain.

We expect blockchain and application development to drive token price divergence with blockchains exhibiting a growing application ecosystem and Web3 applications providing real-world functionality and capturing traditional company market share to outperform

Of course, we all know what they say about opinions… but what about other tangible indicators?

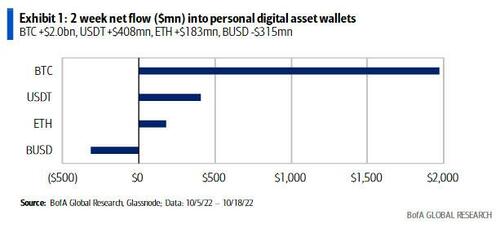

Let’s start with fund flows.

As Shah writes, BTC exchange outflows last week were the largest since mid-June, tight supply (tokens last moved over 1 yr ago remain near all-time highs) and whale accumulation indicate investor HODLing and limited near-term sell pressure (bullish). ETH saw its 3rd consecutive week of muted activity following large exchange inflows pre/post-Merge and as price headwinds continue (-23% since early Aug), signaling limited near-term buy pressure (bearish). Top 4 stablecoin exchange outflow over the last 2 weeks were 80% and 88% below the average weekly inflow/outflow over the prior 6 weeks, respectively, indicating that investors are moving to the sidelines (neutral).

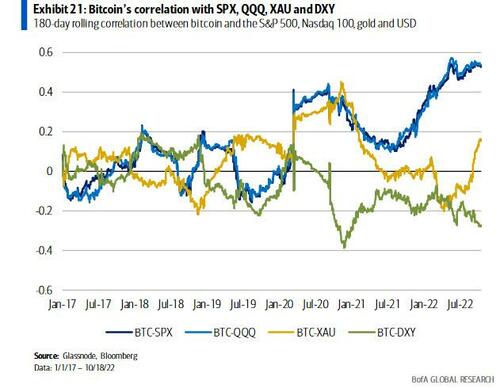

But what was far more notable than flows, is the recent spike in bitcoin-gold correlation. Here again is BofA:

BTC exchange outflows over the last 4 weeks ($2.6bn) were 3.6x larger than exchange inflows over the prior 4 weeks. Exchange outflows for 3 of the prior 4 weeks (BTC +2% last 4 weeks) indicate that investors continue to HODL instead of selling into strength. A decelerating positive correlation with SPX/QQQ and a rapidly rising correlation with XAU indicate that investors may view bitcoin as a relative safe haven as macro uncertainty continues and a market bottom remains to be seen.

And some more observations:

The correlation between bitcoin and the S&P 500 (SPX) reached all-time highs on Sept 13 of this year and the correlation between bitcoin and the Nasdaq 100 (QQQ) reached all-time highs on Sept 13 as well.

The correlation between bitcoin and gold (XAU), which is commonly viewed as an inflation hedge/store of value, remained close to zero from Jun’21 through Feb’22 and turned negative on Mar 2, but the inverse correlation decreased from Apr’22 through Aug’22 before the correlation turned positive on Sept 5 and continued to increase. The inverse correlation between bitcoin and the dollar (DXY) has increased since Jul 14.”

Of course, such divergence in correlation between risk assets and bitcoin, and convergence between gold and bitcoin, is precisely what should be happening for an asset that was designed to be diversifying, and to hedge inflation, not to be an highly-levered beta on tech names. That said, it is still too soon to tell if bitcoin can move sharply higher as stocks continue to slide and the dollar surges. Incidentally, such a reversal in crypto, where it trade not as a high-beta tech stock, but as an actual alternative to the dollar would be the best news long-suffering crypto bulls will have gotten in a long time.

Tyler Durden

Mon, 10/24/2022 – 03:30

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com