China Quietly Boost Oil Imports In Preparation For Reopening

Alongside the neverending charade over when/if the Fed will pivot (it will, it just needs to really break the market and the economy first, at which point it will be too late to do anything), a similarly heated – and some would say even more important – discussion surrounds China’s decision to drop its doomed covid zero policy. Here, there has certainly been movement in recent days, with Chinese stocks soaring over the past week amid rampant speculation that Beijing is contemplating easing or rolling back its draconian covid zero restrictions.

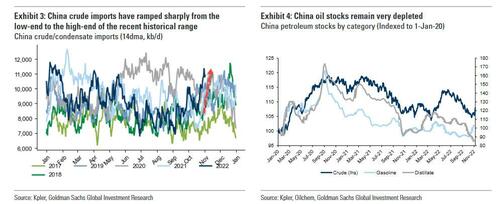

And even though both the local government and skeptical China watchers have repeatedly tried to shoot down any unfounded rumors (based on spurious screengrabs) that China is set to ease its anti-covid measures, a new report from Goldman’s commodity team published late on Monday (and available to pro subscribers), concludes that China has quietly if aggressively ramped up crude imports by more than 2.5m b/d in recent weeks in preparation for an eventual reopening, whose timing Goldman still views as most likely to take place some time in 2Q 2023.

Here are some more details from the Goldman report tiled appropriately enough “China signals the beginning of the end for lockdowns”:

- The oil market remains depleted of its main buffers: inventories and spare capacity. Concurrently, the risk of meaningful supply disruptions in Libya, Russia, Iraq, and Iran is currently elevated. As such, the risk distributions around our current oil forecasts are skewed squarely higher given spot demand continues to realize robustly.

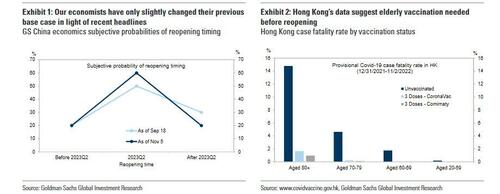

- Nevertheless, positioning in oil and broader commodities are barely above their 2Q20 lows, in part due to concerns on China oil demand – the final significant fundamental downside risk. We believe current lockdowns are subtracting as much as 0.9 mb/d from our Jan-22 expectations.

- Our China economists believe recent headlines simply mark the start of an multi-month preparation period for reopening, and so have maintained their current base case of 2Q23 reopening, once the winter flu season has passed.

- Nevertheless, any news around China reopening can drive rallies in oil, even if only muting uncertainty. To this end, China has already ramped up crude oil imports by more than 2.5 mb/d in recent weeks, in preparation for this event, as well as to replenish depleted inventory.

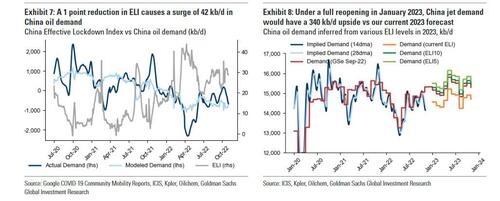

Goldman also conducts an “Effective Lockdown Index”-based exercise for contextualizing what a more rapid reopening may mean for demand and prices.

Not surprisingly, it finds that each 5% increase in the China ELI is worth c.0.2 mb/d of oil demand…

… and that a bull-case early reopening would pose $6/bbl upside risk to the bank’s current $110 Brent 2023 forecasts, while a less-likely full international reopening would amount to almost $15/bbl.

On the other hand, maintenance of the current status quo for restrictions would instead amount to c.$12/bbl of downside to next year’s forecasts. Consistent with this, the bank also finds the oil market-implied increase in the probability of reopening next year increased by 25% last week.

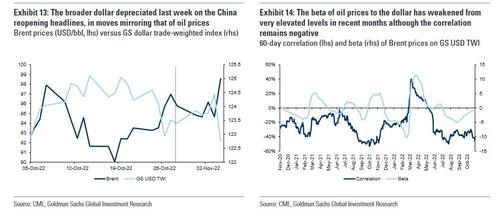

Lastly, an additional macro risk to commodity prices this year has been the dollar, which has endured one of the sharpest appreciations in history.

Goldman expects the USD TWI to depreciate by up to 3% as China reopens, as Asian economies benefit, and broader markets trade more ‘risk-on’. This could support oil prices an additional $3/bbl.

Much more in the full Goldman note available to pro subs.

Tyler Durden

Mon, 11/07/2022 – 23:55

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com