What Will Break First As The Fed Continues To Tighten: Financial Giants Duke It Out

One week ago, in its latest and quite apocalyptic note which was a must-read for every finance professional (and is still available to pro subs), Elliott Management not only previewed the dire endgame of this monetary experiment, and for those who missed it here it is again…

… the Fed has never raised rates into a struggling economy, as it is now doing. What level of rates will occasion a crash? Or will it be some combination of a melee factor and rates? We can’t know. A crash would certainly put a strong damper on consumer and producer prices. Will they just keep raising rates until the economy does crash? Central bankers actually say that they are aiming for a soft landing. But they are not puppeteers. They do not have the control that they profess to have. Whether there is a soft landing or a “hard” landing (crash) is completely unknown at present.

As one final example, policymakers state their determination to tame inflation, but QE has not truly reversed. Mortgages on central-bank balance sheets are not being sold. They are raising interest rates like crazy, and the natural way for inflation to go from 10% to 2% is through a serious recession. There is still $30 trillion on central banks’ balance sheets. So what happens when the recession is in full force? Do the central bank balance sheets go to $50 trillion?

The world is on the path to hyperinflation, which is the direct route to global societal collapse and civil or international strife. It is not baked, but that is the path that we are treading. Uplifting, right

… the hedge fund with nearly 50 years of capital markets experience also laid out a list of triggers that could “break” the market and lead to the next crash, including:

- Banks and other lenders are starting to be forced to recognize large losses on bridge financings and loans;

- Leveraged holders of mortgage-backed securities, and structured-debt products and CLOs, may be facing substantial markdowns;

- Liquidity in rates and credit markets has been dramatically reduced;

- Leveraged private equity will be under severe stress in the event of a meaningful recession; and

- Housing unaffordability has taken the largest and quickest jump in history (the combination of the 45% rise in home prices from 2019 through 2022 and the extraordinary and rapid rise in interest rates).

A “market break” is, of course, a topic that has been near and dear to our heart ever since we first predicted in January that the Fed’s rate hikes will inevitably lead to something snapping.

Remember, every Fed tightening cycle ends in disaster and then, much more Fed easing pic.twitter.com/zX7Dur8nLG

— zerohedge (@zerohedge) January 5, 2022

And while last week’s near-record market meltup on hopes that the CPI miss means the Fed will slowdown and/or pivot, we still have a lot of rate hikes and tightening pain to go, meaning that the odds of something big “breaking” remain dangerously high. So high in fact that Goldman’s research team, after coming out with a laughable (in retrospect) S&P500 target of 5,100 exactly one year ago, has become outright apocalyptic on stocks (if there was one reason to turn bullish on stocks, that’s it), and in its most read report last week, asks “What Could Break?” as a result of central bank tightening.

While Goldman does cover a lot of potential trigger point in the full report (which we recommend all pro subs read), we focus on the summary from Goldman editor Allison Nathan who partitions the findings into several core sections as follows:

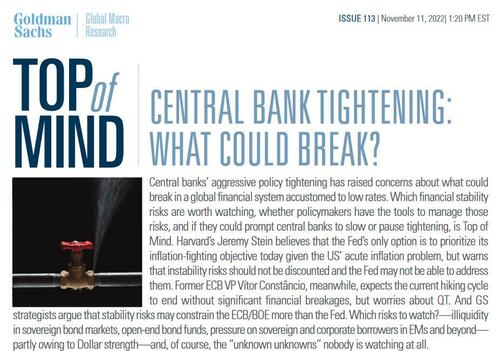

Although the market apparently took comfort from October’s better-than-expected US CPI print, with inflation still far above target, it’s clear that the major central banks’ inflation fight is far from over. The aggressive policy tightening so far—and still in the pipe—has raised concerns about what could break in a global financial system that has grown accustomed to low rates. Which financial stability risks are worth watching, whether policymakers have the tools to effectively manage those risks, and if they could prompt central banks to slow or even pause the pace of tightening, is Top of Mind.

We first speak with Jeremy Stein, Professor at Harvard University, who was a vocal advocate of the view that monetary policy should be implemented with financial stability in mind during his tenure on the Fed’s Board of Governors in the aftermath of the Global Financial Crisis (GFC). Despite this long-held view, he argues that the still-acute inflation problem the US faces today means that “the Fed’s only option is to continue to make inflation its number one policy priority for now.” That said, he warns that financial instability risks should not be discounted, and that the Fed’s ability to address those risks is probably more limited than the market expects and than in past episodes of stress. That’s not only because actions to quell stability risks—the so-called “Fed put”—would almost certainly run counter to the prevailing monetary policy goal of slaying inflation, but also because we can’t assume that the tools that addressed past crises—such as the emergency credit facilities implemented at the beginning of the pandemic—could be employed today.

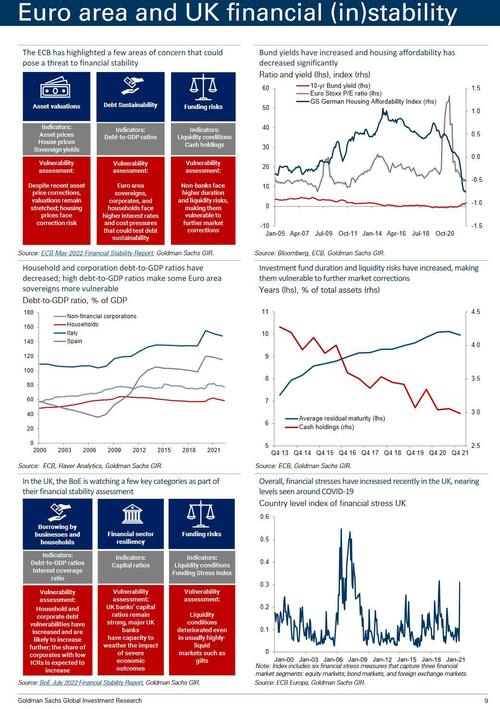

Vítor Constâncio, former Vice President of the ECB, has historically taken the opposite view of Stein—arguing that monetary policy should not respond to financial stability concerns—a view he stands by today even as the ECB now formally includes financial stability considerations in its policy decisions. But given that both the Fed and the ECB are already approaching the expected peak in policy rates, he expects the current hiking cycle to end before significant financial stability concerns arise that could force a recalibration of monetary policy. However, he worries about the potential effects of quantitative tightening (QT), especially in the Euro area, where incentives for banks to repay their TLTRO loans early will likely lead to an already sizable reduction in the ECB’s balance sheet even before the ECB embarks on formal QT. That said, he believes Euro area policymakers have all the tools they need nowadays to avoid a repeat of the 2010 sovereign bond crisis.

But GS European rates strategists George Cole and Simon Freycenet are less sure that financial stability risks won’t affect monetary policy in Europe. In their view, concerns about rate-sensitive debt in both the Euro area and the UK constrain the ECB and BoE compared to the Fed in their inflation fight, likely leading to a more cautious approach from both. These risks, they say, may force an implicitly higher tolerance for inflation in Europe, although Stein and Constâncio believe that the US could potentially be headed in a similar direction as well.

* * *

So which risks—outside of a monetary policy mistake in itself—are worth watching? On both Stein and Constâncio’s lists is illiquidity in the US Treasury and other sovereign bond markets. Praveen Korapaty, GS Chief Interest Rates Strategist, explains why cracks in the plumbing of the market’s microstructure have appeared: a surge in outstanding sovereign debt that has far outpaced intermediation capacity mainly owing to post-GFC regulations that discourage market-making in these securities. Although Stein says that these issues are easily fixable, unless and until they are, Korapaty argues that the Fed and other major central banks may be increasingly forced to use their balance sheets to maintain orderly market functioning rather than to conduct monetary policy.

Constâncio and Stein are also concerned about the asset-liability mismatches of mutual funds, and especially of open-end bond funds, that have the potential to trigger asset fire sales in times of stress. This structural fragility was on full display in the US in early 2020 and never went away, Stein says, because the Fed bailed out these funds, but may not be able to do so the next time around. They are also worried about mounting pressure on sovereign and corporate borrowers in Emerging Market (EM) economies and beyond, especially, as Stein notes, given the sharp appreciation of the Dollar—a vulnerability that will likely persist according to GS FX strategists Kamakshya Trivedi and Sid Bhushan, who make the case that Dollar appreciation has further room to run.

Indeed, although GS FX strategist Karen Reichgott Fishman finds that FX intervention by many EM central banks (and the BoJ) has slowed the pace of domestic currency depreciation against the Dollar—if not prevented it—GS FX and EM strategists Ian Tomb and Teresa Alves point out that several Frontier economies are already in the midst of classic EM crises precipitated by a Dollar funding squeeze. That said, most major EMs have proven relatively resilient to these stresses, and globally-systemic EM risks appear low, in their view.

Even beyond EM, corporate borrowers are worth keeping an eye on, according to GS credit strategists Lotfi Karoui and Vinay Viswanathan. They argue that while fundamentals are still healthy for these borrowers, companies that have issued floating-rate leveraged loans, as well as commercial real estate (CRE) borrowers, are vulnerable to a higher-for-longer cost of funding shock. But they believe the risk of this shock threatening financial stability is lower than in past cycles.

And what about perhaps the most obvious place to look— pension funds—given that they were at the epicenter of the

most recent stress episode that arguably increased market focus on financial breakages in the first place? GSAM strategists Ed Francis, Matthew Maciaszek, and Michael Moran explain the recent pressure in the UK pension fund industry and why a similar crisis is less likely to repeat elsewhere, which Freycenet generally agrees with.Finally, GS global economists Daan Struyven and Devesh Kodnani take a survey approach to assess the above—and other—financial stability risks that GS research analysts are watching. But, after all this discussion and monitoring of known risks, perhaps the biggest risks of all remain the “unknown unknowns” that we aren’t watching at all.

To summarize, the most likely market “fracture points” according to Goldman are, or should be familiar to regular ZH readers as we have discussed many if not all of these repeatedly in recent months, and include:

- Treasury (il)liquidity

- Asset-liability mismatches of open-end mutual bond funds

- EM and Frontier economy crises spiraling out of control as a result of the record dollar short squeeze

- Corporate borrower weakness, especially among those who have exposure to floating rates

- Pension funds

Below we excerpt some more from the Goldman report, and specifically the interview with former Fed governor Jeremy Stein:

Allison Nathan: One area of concern seems to be Treasury market liquidity. Is that concern warranted?

Jeremy Stein: Yes; the spike in Treasury market volatility in March 2020 proved that concerns over market liquidity are warranted. But the Fed could at least partially address this vulnerability with some relatively simple fixes. For example, the supplementary leverage ratio, which is a risk-insensitive capital requirement imposed on systemically important banks in the wake of the Global Financial Crisis (GFC), was unhelpful in the March 2020 episode, because it discourages banks from making markets in Treasury securities. The Fed could easily adjust this requirement so that it serves its intended purpose of acting as a backstop rather than as a primary binding constraint on market-making, and do so without weakening overall capital in the banking system by making a compensating adjustment in the risk-based requirements so that capital in the system remains the same.

The Fed could also make its standing repo facility—which lends against Treasury securities as collateral—accessible to a larger set of financial market participants beyond banks and primary dealers. If access to the facility was expanded to allow any hedge fund, mutual fund, etc. to bring Treasuries to the Fed and get cash at a moment’s notice, the asset fire sales that characterized the March 2020 stress episode may not have occurred to the same extent. I have heard some express the view that such broader access could create a moral hazard problem, but what is the bigger problem—lending against Treasury collateral, or, as recently occurred in the UK, getting cornered into buying a lot of Treasuries at a time when you’re supposed to be tightening monetary policy?

* * *

Allison Nathan: What other financial stability risks are worth watching?

Jeremy Stein: I continue to worry about the open-end bond fund complex, which the Fed basically bailed out in March 2020 by creating credit facilities that had a very powerful effect in stemming the large outflows and liquidations of assets from these funds at the time. While that was absolutely the right thing to do, it prevented us from learning more about the real fragility of some of these funds and created a moral hazard problem—credit spreads tightened, and business went on as usual with very little—if any—change in the underlying structure of these funds.

I also worry that the sharp appreciation of the Dollar resulting from the Fed’s aggressive rate hikes is putting stress on pockets of the financial system. Corporates in many Emerging Markets borrow in dollars, which can be an inexpensive source of funding but puts substantial pressure on these economies when the Dollar strengthens. Many of these countries are relatively small, so the trade spillovers may turn out to be limited, but the bigger risk is that cracks in the financial system could emerge—when loans go bad, what banks are overexposed to these borrowers? Japan is also a potential source of concern in this context. Its debt-to-GDP is running at more than 200%, with much of that debt effectively rolling on an overnight basis given the effect of their massive QE on consolidated debt maturity. That’s not a problem when interest rates are at zero, but if Japan begins to import inflation given global inflation trends and the strength of the Dollar, and the BoJ must start fighting inflation, this could become quite problematic. Many countries are facing the same issue, but Japan is an extreme case that bears watching.

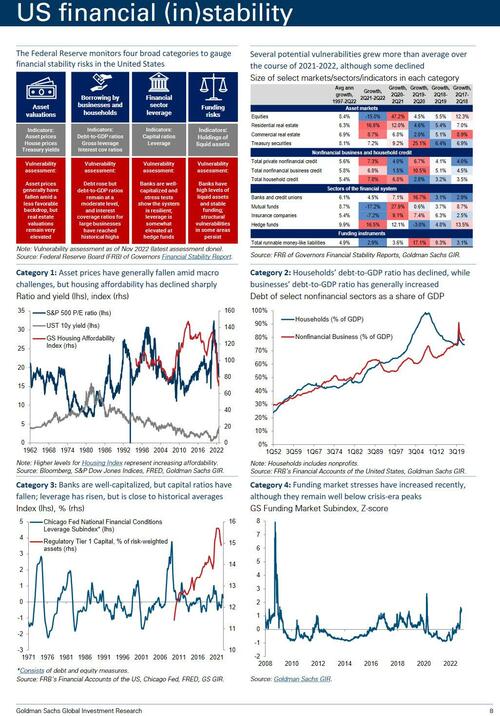

Next, for the visual learners, a primer on US financial instability…

… and also Euro area.

There is much more in the full note, including Goldman’s take on FX interventions (they buy time, and “central banks will likely continue to conduct FX interventions over the near term as the Dollar continues to strengthen”), on when the US Dollar will peak, an assessment of the risk of a funding shock, can the UK pension fund crisis repeat and where, how long can the ECB and BOE keep fighting inflation with both economies now in recession, what the risk is in “risk free” rates, and more.

As noted above, all professional subscribers are encouraged to read the full note available in the usual place.

Tyler Durden

Sun, 11/13/2022 – 21:44

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com