Stock Rally Fizzles Following Return Of Hawkish Fed Comments

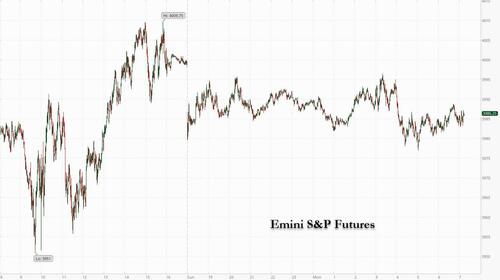

The rally in US index futures paused after Wall Street stocks posted their best week in several months, following comments from a Federal Reserve official that the fight against inflation has further to run. Contracts on the S&P 500 were down 0.3% at 7:30 a.m. ET…

… while Nasdaq 100 futures fell 0.7%, after Fed Governor Christopher Waller said on Sunday that policymakers had “a ways to go” before ending interest-rate hikes. His comments also lifted 10-year Treasury yields by 9 basis points.

Waller: The FOMC statement in November was designed to signal a potential step down to 50 basis points.

“We knew the markets were going to jump for joy.”

So the Fed used Powell’s press conference to “drive the point home” that it’s the ultimate level for rates that matters.

— Nick Timiraos (@NickTimiraos) November 13, 2022

In premarket trading, beside the surge of Chinese stocks listed in the US following China’s announcement of a “rescue package”, Advanced Micro Devices shares also rose after brokers UBS and Baird upgraded the chipmaker to buy and outperform, respectively. Biogen (BIIB US) shares rise as much as 5% in premarket trading, after Roche’s Alzheimer’s drug, a potential competitor to Biogen’s, failed a pair of large studies.

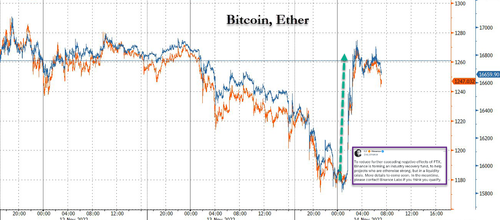

On Monday, the dollar traded near its best levels of the day, pressuring all of its Group-of-10 counterparts. Treasury yields rose across the curve, led by 10-year rates that climbed for the first time in a week. Oil fell with gold, while Bitcoin gains exceeded 2% after earlier sliding more than 3%; the drop in crypto was halted after Binance CEO Changpeng Zhao said the world’s largest digital-asset exchange plans to set up an industry recovery fund.

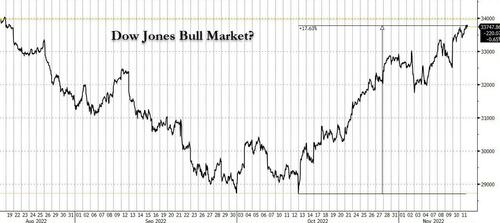

Last week, a big miss across the board in CPI data fueled bets that the US central bank would temper its hawkish narrative. The Dow Jones Industrial Average ended the week 2.1% short of recording a 20% gain off its Sept. 30 low — the technical definition of a bull market. The S&P 500 chalked up its biggest weekly rise since June, while the tech-heavy Nasdaq 100 climbed 1.9% for its best two-day gain since 2008.

“The burst of euphoria which erupted over US markets and spread more widely at the end of last week is ebbing away after fresh warnings that the fight against inflation is still a hard slog yet to be won,” said Susannah Streeter, senior investment and markets analyst Hargreaves Lansdown.

That comes after a tumultuous weekend for rival FTX, which was once seen as among the best-run exchanges but has filed for Chapter 11 bankruptcy. Worrying details that have emerged include the fact that just before filing for bankruptcy, FTX Trading International held just $900 million in liquid assets against $9 billion of liabilities, according to sources familiar with the matter.

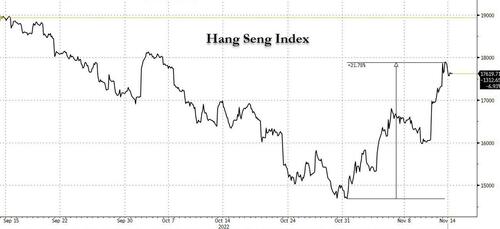

Chinese stocks listed in the US also were also higher, and were set to extend their rally to a third day, after Beijing issued a 16-point plan to boost the real-estate market on Friday, the strongest sign yet that President Xi Jinping is turning his attention toward shoring up the world’s second-largest economy. The move pushed Chinese stocks into a bull market, even as the Hang Seng China gauge holds on to a loss of more than 25% this year.

After a dismal earnings season, which saw mega-cap tech stocks underperform while earnings growth waned, some are skeptical about the earnings outlook. “Investor euphoria over the prospect of a ‘Fed pivot’ contrasts with the deteriorating profit margins and darkening business outlook expressed by many S&P 500 firms,” Goldman Sachs Group Inc. strategists led by David Kostin said in a note.

In Europe, stocks are steady, holding on to early session gains as personal care, telecoms and media outperform while travel and real estate lag. The Stoxx 600 rose 0.1%; Roche dropped after the news on its much-awaited experimental Alzheimer’s drug. Here are the most notable market movers:

- Informa shares jump as much as 8.8%, the most in two years, after the company raised full-year revenue and operating-profit guidance, despite assuming zero revenue from live and on-demand events in China in November and December

- German pharmaceuticals giant Merck KGaA rises as much as 6.4% after Bank of America upgraded to buy from neutral, flagging Phase III data for multiple sclerosis drug Evobrutinib which it says could be a “game-changer” for the company’s “perceived lackluster pharma business.”

- Pepco Group soars as much as 19% in Warsaw after the discount retailer was added to MSCI’s global standard indexes in a semi-annual review published after markets closed on Nov. 10.

- Teleperformance rises as much as 5.6%, clawing back more ground following the slump it suffered last week sparked by a report involving its Content Moderation unit in Colombia.

- Rheinmetall climbs as much as 5.2%, touching the highest since Aug. 18, following the German defense company’s acquisition of Spanish ammunition maker Expal in a deal that Warburg says looks like a “good strategic fit.”

- Close Brothers falls as much as 6.5% as the UK financial services firm is cut to sell from hold at Investec, which says the shares now look “a little too expensive.”

- Tremor falls as much as 27%, the most since Aug. 16, after a “challenging 3Q market” led to reported revenue missing analyst estimates.

- Ferrexpo slumps as much as 9.7%, the most since Oct. 24, after Credit Suisse downgrades the stock to neutral from outperform, citing a deteriorating operating environment in Ukraine.

- Roche falls as much as 5.7%, the most since May, after the Swiss pharmaceutical company said its long-awaited Alzheimer’s treatment failed its phase 3 trial, with its research partner MorphoSys plunging as much as 33%, the most in two decades.

In Asia, Chinese stocks extended recent gains on hints of shifting Covid policy along with more support heading toward the property sector. US chipmakers could be in focus, with President Joe Biden and Chinese leader Xi Jinping meeting in Bali, Indonesia, on the sidelines of the Group of 20 summit.

Asian stocks were steady as weakness in markets such as Japan countered gains in China, where authorities issued a sweeping rescue package to bail out the property sector. The MSCI Asia Pacific Index pared an earlier gain of as much as 0.8% to trade flat. While gauges in China pared a bulk of their early gains, the Hang Seng China Enterprises Index closed up nearly 2%, taking its surge this month to 21%.

Vietnam’s benchmark was the worst performer in the region, while Japanese shares also slipped. SoftBank Group’s plunge weighed the most on the regional benchmark. China’s property stocks surged as financial regulators issued a 16-point plan to boost the real estate market. Along with Friday’s easing of some Covid controls, the measures gave traders confidence that China is finally taking concrete steps to tackle the two biggest sore points for its economy and markets — Covid Zero and the property crisis. READ: Chinese Stocks Storm Into Bull Market on Covid, Property Shifts The MSCI Asia index is up about 11% so far in November, heading for its first monthly gain since July. It is still down more than 21% this year. Traders will be closely watching any further progress on China’s reopening and whether the downshift in US inflation paves the way for a moderation in future Fed interest rate hikes. “We see next year as a much better one for Asia/EM equities, following the longest bear market in history,” Morgan Stanley strategists including Jonathan Garner wrote in a note. The softer-than-expected US inflation will allow the Fed to finish hiking in January, while growth in the region will likely pick up from the second quarter of 2023 helped by China’s reopening, they added

Japanese equities ended lower as investors worried over the strengthening yen and possible cryptocurrency contagion risk amid FTX’s deepening woes. The two factors overpowered the initial optimism over China’s moves to support eventual reopening and beleaguered property sector. The Topix Index fell 1.1% to 1,956.90 as of market close Tokyo time, while the Nikkei declined by a similar magnitude to 27,963.47. SoftBank Group Corp. contributed the most to the Topix Index decline as it plunged 13%, the most since March 2020 after disappointing second quarter results. Out of 2,165 Topix members, 575 rose and 1,524 fell, while 66 were unchanged. “The Nikkei Stock Average last week rose sharply and recovered to the 28,000 yen level, and stocks are being sold off for profit-taking,” said Hitoshi Asaoka, strategist at Asset Management One. The strengthening of the yen is also playing into today’s move, he added.

Key stocks gauges in India fell after benchmark Sensex surged to a record high on Friday, weighed by fast-moving consumer-goods companies while the country’s earnings season nears completion. The S&P BSE Sensex fell 0.3% to 61,624.15 in Mumbai, while the NSE Nifty 50 Index dropped 0.1%. The 50-stock Nifty index is still less than 1% short of its record level seen in October last year. Volatility in local stocks surged 3%, the most since Oct. 11, while the benchmark Sensex is trading at 14-day RSI of 66, close to levels that traders consider as overbought. Of 49 Nifty companies, which have so far reported earnings, 32 have reported profit in-line or above consensus estimates while 14 have missed. Oil & Natural Gas Corp will be releasing its number later today. ICICI Bank contributed the most to the Sensex’s decline, decreasing 1.3%. FMCG firms ITC and Hindustan Unilever were also among prominent decliners

In FX, the Bloomberg dollar resumed its ascent after crashing last week, rising 0.5% as the greenback gained versus all of its Group-of-10 peers. CAD and EUR are the strongest performers in G-10 FX, JPY underperforms, breaking above 140.40/USD.

- The euro fell to trade around $1.03 after earlier rising to $1.0367, the highest level since Aug. 10. Yields on Bunds and Italian bonds fell. ECB’s Guindos, Centeno and Nagel speak later. The new Italian government will likely miss its fiscal targets amid headwinds to growth, Moody’s said in a statement last week; Fitch reviews Italy, Moody’s reviews Portugal and S&P reviews Ireland on Friday

- The pound pulled back from a 2 1/2-month high versus the greenback. The gilt curve bull-flattened ahead of the UK government’s Autumn Statement due later in the week The Office for Budget Responsibility expects government borrowing to rise to nearly £100b in 2026-27, Financial Times reported on Sunday, citing an “ally” of UK Chancellor Jeremy Hunt

- Australian and New Zealand sovereign bonds fall across the curve on the hawkish Fed comments. The Aussie and kiwi both weakened on the back of broad-based US dollar strength

- The yen was the worst G-10 performer and fell below 140 per dollar. Bank of Japan Governor Haruhiko Kuroda said it’s “very good” that rapid weakening of the yen has halted for now after one-sided moves

In rates, the Treasury yield curve steepened after the hawkish Fed comments and Friday’s moves in Bunds. The 10-year yield rose 6 bps after earlier adding 9bps to touch 3.90%, erasing a portion of Thursday’s historic gains sparked by softer-than-expected October CPI data. Treasury futures had erased a portion of the gains on Friday when the cash bond market was closed for US Veterans Day. Yields are higher by 5bp-8bp Monday, little changed from where they began the Asia session, after Fed Governor Waller, speaking during US evening hours on Nov. 13, said the central bank still has “a ways to go” before it stops raising interest rates, and that the market got “way out in front” after the inflation data. The 5-year TSY, higher by 7bp at 4%, is back in line with its 50-DMA after falling below it Thursday for the first time since Aug. 19. Interest-rate strategists at Goldman Sachs were among those saying the market reaction to October CPI was excessive; the yield declines are “likely overdone,” as risks remain skewed toward an extended Fed tightening cycle, they wrote. Gilts lead latest push, 10-year yields outperform bunds by about a basis point; USTs 10-year yields lag, rising 7bps as they catch up after being closed on Friday.

In commodities, WTI crude futures fall below $88 as initial upside on the USD’s pullback dissipated with the DXY now back above 107.00. Benchmarks are near session lows on the above action and also amid a further strengthening of COVID measures within Beijing after the city reports the highest number of cases in a year. Janet Yellen said India can buy Russian oil at any price if it does not use Western insurance or maritime services, according to a Reuters interview, and said the existence of a G7 oil price cap will give India and other developing countries leverage in bargaining with Russia on oil. Yellen said they are happy for India, China, and Africa to get a “bargain” on Russian oil, inside or outside the price cap. An Indian government official said they do not believe India will follow the price cap mechanism and have communicated that to the countries. OPEC+ “may discuss adjustments to members’ oil production baselines in early December as many of them struggle to meet their agreed quotas”, according to Energy Intel. “Delegates said it is too early to predict what might happen in Vienna in terms of any potential changes to the alliance’s production policy or baseline adjustments. “

There is nothing on today’s economic calendar; we get earnings from Tyson Foods; Fed’s Williams and Brainard speak, ECB’s Panetta, Centeno and Guindos speak

Market snapshot

- S&P 500 futures down 0.5% to 3,981.25

- STOXX Europe 600 up 0.2% to 433.04

- MXAP down 0.1% to 151.66

- MXAPJ up 0.7% to 490.04

- Nikkei down 1.1% to 27,963.47

- Topix down 1.1% to 1,956.90

- Hang Seng Index up 1.7% to 17,619.71

- Shanghai Composite down 0.1% to 3,083.40

- Sensex down 0.1% to 61,714.09

- Australia S&P/ASX 200 down 0.2% to 7,146.35

- Kospi down 0.3% to 2,474.65

- German 10Y yield down 0.9% to 2.14%

- Euro down 0.2% to $1.0323

- Brent Futures down 0.6% to $95.38/bbl

- Gold spot down 0.7% to $1,759.48

- U.S. Dollar Index up 0.51% to 106.84

Top Overnight News from Bloomberg

- Further interest rate hikes are expected to ensure inflation’s return to our medium-term target of 2%, ECB’s governing council member Constantinos Herodotou says in an interview with Greece’s Naftemporiki website

- Germany’s biggest labor union is locked in talks with employers over a pay deal for about 3.9 million workers, in one of the most significant domestic showdowns of Europe’s energy crisis so far

- The ECB will probably receive several hundreds of billions of euros in early repayments of long-term loans this year after officials toughened the terms of the program to aid their fight against inflation

- China issued sweeping directives to rescue its property sector, adding to a major recalibration of its pandemic response in the strongest signs yet that President Xi Jinping is turning his attention toward shoring up the world’s second-largest economy

- The EU is “ready to go” with an effort to impose a price cap on Russian oil, Ursula von der Leyen, the president of its executive arm, said Mondayd

A more detailed look at global markets courtesy of Newqsuawk

APAC stocks eventually traded mostly lower despite the positive lead from Wall Street on Friday. ASX 200 was contained on either side of the flat mark with losses in Industrials, Telecoms and Healthcare offsetting the gains from the Metals, Mining, and Materials sectors. Nikkei 225 saw its losses lead by Softbank shares tumbling over 12% following its earnings on Friday, which saw the Co’s Vision Fund post a quarterly net loss. KOSPI eventually faded earlier gains following the trilateral meeting between the US, Japan, and South Korea over the weekend, in which White House National Security Adviser Sullivan said the US, Japan, and South Korea have a coordinated response if North Korea carries out its 7th nuclear test. Hang Seng and Shanghai Comp traded in the green for most of the session, with Hong Kong outperforming following source reports that the PBoC and China’s Banking and Insurance Regulator told financial institutions to extend support for property firms, with the Hang Seng Property index surging over 15% in early trade, but traders remain cognizant of the Biden-Xi meeting poised to take place on Monday at 09:30GMT/04:30EST.

Top Asian News

- eijing authorities stated on Monday to further strengthen COVID prevention and control measures and reminded residents not to go out unless necessary. The measures are seen as a response to the mounting pressure of soaring cases in the city, according to Global Times.

- China reported 1,794 new confirmed COVID cases in the Mainland on Nov 13th (vs 1,711 on Nov 12).

- Beijing reported the highest number of local COVID cases in over a year, reporting 404 cases on Sunday, according to Bloomberg.

- The PBoC and China’s Banking and Insurance Regulator told financial institutions to extend support for property firms, according to Reuters sources. Bloomberg reported that China’s real estate rescue package consists of a 16-point playbook for finance officials across the country, according to sources.

- China’s Securities Journal noted that China is expected to inject liquidity via a new MFL (unverified).

- PBoC injected CNY 5bln via 7-day reverse repos with the rate at 2.00% for a CNY 3bln net drain.

- PBoC issues a notice to further support the extension of loan repayments for small firms.

- BoJ Governor Kuroda said the Japanese economy is picking up; now is the stage to continue monetary easing to support the economy, according to Reuters. Kuroda said they are closely watching the impact of raw material inflation and currency moves on firms and households. Kuroda said the BoJ and the government are closely monitoring the impact of FX, and market moves on the economy and prices; and said abnormally one-sided sharp JPY weakening appears to have paused, partly thanks to the government’s FX intervention.

- Earthquake shakes buildings in Tokyo, Japan, via Reuters; prelim. magnitude of 6.1 via NIED. Magnitude 5.6 earthquake near the S. Coast of Honshu, Japan, via EMSC

European bourses are posting mild gains, Euro Stoxx 50 +0.2%, with participants awaiting the conclusion of the Biden-Xi meeting.

Sectors were predominantly in the green, though performance has turned more mixed as the session progresses.

Stateside, futures are pressured as the recent rally seemingly runs out of steam and also following Fed’s Waller pushing back on the post-CPI reaction, ES -0.4%.

Top European News

- UK Chancellor Hunt said he will set out a long-term plan for energy, and said we do have to increase taxes and cut spending. He said he wants to make sure a recession is as short and shallow as possible if the UK falls into one. He added that he will be talking about constraints on the labour force in the budget plan, via Reuters.

- UK Chancellor Hunt said the OBR forecasts will likely present a similar picture to recent BoE forecasts of a recession. Hunt plans to commit around GBP 20bln to extend the energy price guarantee scheme by six months from April and is eyeing a multi-billion-pound package to shield pensioners and benefit claimants from the increases in power bills, according to The Times.

- UK Treasury discussing raising energy price cap from April; department considers making policy announcement in the autumn statement rather than waiting until spring, according to Guardian sources. It is understood that continuing some universal level of support, possibly in the form of a higher energy cap, is also on the table.

- Germany’s IG Metall union has called for further strike action on Monday. Strikes will take place at targeted locations in the states of Hesse, Thuringia and Rhineland-Palatinate, according to the union cited by Reuters.

- ECB’s Panetta says monetary policy needs to tighten so that inflation does not become entrenched, the consequences of possible errors may not be perceptible today, but they would become evident over time. It may then be too late to fully reverse them.

FX

- DXY spent much of the morning attempting to reclaim the 107.00 mark, with peers deriving modest upside as such though this was mixed with EUR and GBP a touch softer, for instance.

- However, the index has since surpassed the 107.00 handle and lifted to a 107.19 peak to the detriment of peers across the board, though EUR and GBP haven’t slipped much further and reside around 1.03 and 1.1750 respectively.

- Traditional havens CHF and JPY are the current laggards, with the JPY particularly impaired and USD/JPY above 140.50 as such and was perhaps spurred by Governor Kuroda reminding that they are to continue with monetary easing.

- Yuan drew much of the focus overnight after the PBoC set its strongest fix since late-September and amid two-way newsflow for the region regarding property support and COVID controls; CNY concluded the domestic session at 7.0378.

- PBoC set USD/CNY mid-point at 7.0899 vs exp. 7.0896 (prev. 7.1907); strongest fix since Sep 27th

- RBI Governor Das said India has a major challenge with regard to inflation. He added that the RBI’s FX interventions are impacted by day-to-day developments, and the objective is to prevent excessive volatility. Das added that the RBI’s reserves are very comfortable, via Reuters.

Fixed Income

- Core benchmarks were relatively rangebound in the European morning, with the benchmarks struggling to derive any lasting traction from brief forays some 30/40 ticks either side of the unchanged mark.

- However, a concerted bid has been seen most recently in EGBs and Gilts; perhaps spurred by ECB’s Panetta who placed emphasis on the risk of policy errors.

- Stateside, USTs are a touch softer and are playing catchup to the Veteran’s Day holiday on Friday and also conscious of remarks from Fed’s Waller who has pushed-back on the post-CPI pricing.

- As such, USTs are lower by a handful of ticks towards the mid-point of 111.27+ to 112.06+ parameters with yields elevated though the 10yr is sub-4.00% and significantly shy of last week’s 4.24% peak.

In commodities

- Crude benchmarks have been slipping throughout the European morning as initial upside on the USD’s pullback dissipated with the DXY now back above 107.00.

- Benchmarks are near session lows on the above action and also amid a further strengthening of COVID measures within Beijing after the city reports the highest number of cases in a year.

- US Treasury Secretary Yellen said India can buy Russian oil at any price if it does not use Western insurance or maritime services, according to a Reuters interview, and said the existence of a G7 oil price cap will give India and other developing countries leverage in bargaining with Russia on oil. Yellen said they are happy for India, China, and Africa to get a “bargain” on Russian oil, inside or outside the price cap. An Indian government official said they do not believe India will follow the price cap mechanism and have communicated that to the countries.

- OPEC+ “may discuss adjustments to members’ oil production baselines in early December as many of them struggle to meet their agreed quotas”, according to Energy Intel. “Delegates said it is too early to predict what might happen in Vienna in terms of any potential changes to the alliance’s production policy or baseline adjustments. “

- Iraq’s Prime Minister said Iraq is keen to commit to OPEC policies and decisions but the OPEC production quota should be reconsidered by OPEC members. Iraqi PM added that Iraq needs to raise its oil production to generate more revenues and is keen to maintain stable oil prices of “not above USD 100/bbl”. Iraq said it will have a discussion with OPEC members to increase its production quota, via Reuters.

- ExxonMobil (XOM) announced the first LNG cargo from the Coral South FLNG project in Mozambique, the floating production vessel is expected to produce up to 3.4mln metric tons of LNG per annum, via Reuters.

- JPMorgan expects Brent to re-test USD 100/bbl in Q4-2022 and average USD 98/bbl in 2023, via Reuters.

- Earthquake magnitude 6.4 hit around 20km North-west of Lebu, Chile, according to EMSC.

- Both precious and base metals have succumbed to the USD’s relative resurgence with additional headwinds from the mentioned COVID controls. Specifically, spot gold has slipped back towards the USD 1750/oz mark.

Crypto

- FTX was subject to a hack with “mysterious” outflows totalling over USD 600mln, according to CoinDesk. FTX said it has been hacked and instructed users not to install new updates and to delete all FTX apps.

- FTX CEO John Ray said unauthorised access to certain assets has occurred. FTX is in the process of removing trading and withdrawal function to a new cold wallet custodian, via Reuters.

- Hedge fund Galois Capital said that close to half of its capital is stuck on the FTX Exchange, according to FT.

- Hong Kong’s AAX Exchange is suspending withdrawals for up to 10 days, as the failure of FTX reverberates through crypto markets, according to CoinDesk.

- Crypto lender BlockFi has paused withdrawals and limited platform activity amid FTX collapse, according to Bloomberg

- Crypto Exchange Huobi says it will continue to take all appropriate steps to withdraw crypto assets from FTX as soon as possible; the incident does not currently affect normal business operations of the group, according to Reuters.

- Visa (V) has terminated its global debit card agreement with FTX, according to a Visa spokesperson via Reuters.

- Binance CEO, on crypto exchanges, said there are still quite a lot of players that cut corners, via Reuters. Subsequently, says they are forming an industry recovery fund, to assist projects which are otherwise strong but are in a liquidity crisis.

Geopolitics

- Ukrainian Foreign Minister said Russian counterpart Lavrov has not asked for a meeting, according to Reuters.

- Ukrainian President Zelensky said Kyiv’s forces have taken control of over 60 settlements in the Kherson region. He added that Ukrainian forces are holding firm as brutal battles take place every day in the Donetsk region, via Reuters.

- US President Biden and Russian Foreign Minister Lavrov arrived in Indonesia for the G20 Summit, according to Reuters.

- US Treasury Secretary Yellen said some Russian sanctions could be extended beyond the end of the war in Ukraine, according to WSJ.

- US Treasury Secretary Yellen said they will determine the price level for the Russian oil price cap in the coming weeks, via Reuters.

US-China latest

- US President Biden says US and China can manage differences and stop competition from turning into conflict, expects US and China to play a role in address climate and food shortages.

- Chinese President Xi says has stayed in touch with US President Biden via video but it is no replacement for in-person meetings, both nations need to chart their course and find the right direction for the relationship and elevate it. Prepared to have a candid and in-depth exchange of views on the US-China relationship.

- The White House said further engagement after the Biden-Xi meeting could include face-to-face meetings, according to Reuters. Stated prior to the meeting

- US President Biden will make it clear in the meeting with Chinese President Xi that the US does not seek competition or conflict, and the meeting could last “a couple of hours”, according to Reuters citing the White House National Security Adviser Sullivan. Stated prior to the meeting

- US President Biden underscored that freedom of navigation and overflight must be respected in the East China Sea and the South China Sea, via Reuters.

- US President Biden will raise the issue of North Korea with Chinese President Xi at the G20 Summit, according to the White House. Biden will tell Xi that if North Korea continues, there will be more enhanced US military presence in the region.

- Blackrock (BLK) has shelved its China bond ETF amid growing tensions between the US and China alongside a reversal in the China-US yield differential, according to FT.

- US Treasury Secretary Yellen will ask for clarity on China’s plans to ease COVID restrictions alongside issues in the Chinese property market, in a meeting with the PBoC Governor, according to Treasury officials cited by Reuters.

- US Treasury Secretary Yellen said the US will likely discuss export controls with Chinese officials, according to Bloomberg.

US Event Calendar

- Nothing scheduled

Central Bank Speakers

- 11:30: Fed’s Brainard Discusses the Economic Outlook

- 18:30: Fed’s Williams Moderates Panel at the Economic Club of New York

DB’s Jim Reid concludes the overnight wrap

It’s feels to me we’re in a race against time for markets and the global economy over the next 12 months. Can inflation slow quickly enough for central banks to be able to slow down their hiking cycles enough to avoid systemic accidents? Last week was a great mini case study of the race to come as the bankruptcy of crypto exchange FTX battled it out with a big downward surprise in US inflation. Ultimately the latter won out handsomely, but you can’t help thinking that the rate hiking cycle has claimed another victim with regards to FTX even if other things might also be at play with this company. In a world of free liquidity seen over the prior decade, lots of money has flowed into things that on the surface make little sense but have been transformed into multi-billion or even multi-trillion industries.

Most people I speak to don’t think the current crypto implosion is systemic and this could very well be correct. However, what’s next to unwind/unravel in a hiking cycle that’s not over yet even with slower US inflation last week? The way I like to think about it is that it’s much easier for things not to be systemic when US payrolls are still averaging +289k as they have been over the last 3 months. They averaged +444k in H1. Fast forward 6-9 months when they’re likely to be negative and things that break in the financial system could easily turn more systemic.

In the near-term the technicals and fundamentals continue to be more supportive. Impressive levels of European gas storage due to the weather, very short positioning in US equities, mid-terms being out the way, positive seasonals, less event risk in the Russian/Ukraine war, and now softer US inflation than expected are all helping. However, it’s completely feasible to see a year-end rally and still think risk markets will ultimately be a lot lower in 12 months’ time. Indeed, this morning my new Credit Strategy team have just updated a tactical bullish piece (link here) we put out at the end of October (link to that piece here) suggesting that spreads have room to rally through year-end and early Q1’23, especially with investors bearishly positioned into a period of bullish seasonals. We prefer cash credit over synthetic with banks the favoured sector. Our bearish YE 2023 targets haven’t changed since early April but we’ll be updating this in our 2023 outlook next week.

The most interesting thing about Friday was that European yields, which rallied hard with the US on Thursday, reversed their entire gains on Friday with 10yr Bunds -15bps and then +15bps. The China 20-point Covid restriction easing plan released earlier that day seemed to help. As the US bond market was closed on Friday it’s only responded this morning and 2 and 10yr yields are both around 8bps higher, trading at 4.41% and 3.89%, respectively, as we go to press. Helping that move, this morning in Sydney, Fed Governor Christopher Waller stated that policy makers still had “a ways to go” before stopping interest-rate hikes despite inflation softening in October. He added that the Fed would like to see a similar run of soft CPI readings to take a foot off the brake. He also seemed worried that the market reaction last week was similar to that seen in July where financial conditions loosened more than the Fed wanted. We’ll see how the other Fed speakers react to last week’s CPI later this week.

Elsewhere in the overnight session, not content with a 20-point Covid plan, China also released a 16-point plan to support the fragile domestic property sector. This came public over the weekend. So it seems that the passing of the party congress has led to a loosening of both restrictions and policies. With the new composition of the ruling party it wasn’t clear that this was going to be the case, so this is welcome news for anything China growth related, though the news need to be factored in against the increasing number of Covid cases recorded across the country.

Asian equity markets are mixed this morning, but with China risk leading the way. The Hang Seng (+2.92%) is leading gains with mainland Chinese equities also rallying with the Shanghai Composite (+0.75%) and the CSI (+1.16%) both edging higher. Elsewhere, the Nikkei (-0.82%) is trading in negative territory as heavyweight SoftBank plunged more than -10% after its Vision Fund posted further losses while failing to announce a widely expected share buyback. Meanwhile, the KOSPI (-0.02%) is struggling to find direction. Looking forward, US equity futures are pointing to a negative start today, with contracts tied to the S&P 500 (-0.29%) and the NASDAQ 100 (-0.49%) edging lower. Crypto has remained under pressure as Bitcoin fell as low as $15,846, recording its lowest levels in around two years amid FTX’s deepening woes. It was over $20,000 early last week.

Looking forward and it’s not a blockbuster week for data but there are still some important potential highlights. The US consumer will be in focus, with retail sales (Wednesday) and major retailers’ earnings including Walmart and Home Depot (tomorrow) due amongst others. Other major US data releases will include housing market indicators and the PPI (tomorrow). In geopolitics, the G20 summit will run from Tuesday to Wednesday and the COP27 will end on Friday. The G20 will be watched closely for signs of how aligned the members are on the continued war in Ukraine and also for any headlines around Presidents Biden and President Xi’s side meeting.

China macro and micro will also be in focus with industrial production and retail sales data (both tomorrow), as well as earnings from major tech firms like Tencent and Alibaba. Japan’s GDP and inflation will also be due. In Europe, the UK will release inflation (Wednesday) and employment (tomorrow) data with the government’s autumn statement is taking place on Thursday. The latter is less important now that policy credibility has been restored but will still give us a lot of info about the direction for travel in UK policy.

In more detail on some of the main events now. The US PPI tomorrow deserves some decent attention as it will give some insight into the upcoming core PCE which clearly remains the Fed’s preferred inflation measure. October’s headline (+0.4% forecast vs. +0.4% previously) and core PPI (+0.3% vs. +0.3%) are expected to show similar gains to the prior month but the real focus will be on health care services series, which is a direct input into the core PCE deflator. This series has been very volatile of late but has shown signs of easing. So all eyes on this. Heath care was a huge downside surprise in last week’s CPI.

Speaking of inflation, housing data will also be in focus after this week’s CPI print showed some moderation in rental price pressures and also with mortgage rates having recently been at 22-year highs. Among indicators released will be housing starts and permits on Thursday and existing home sales on Friday.

In terms of corporate earnings, there won’t be many major American companies reporting aside from the aforementioned retailers with over 90% of the S&P 500 members having already released results. In tech, we will get NVIDIA and Cisco on Wednesday and Applied Materials and Palo Alto Networks on Thursday. Over in Europe, notable companies reporting include Vodafone and Infineon on Tuesday and Siemens on Thursday.

The day-by-day calendar is at the end as usual and as you’ll see it also includes numerous ECB and Fed speakers throughout the week, including President Lagarde (Wednesday and Friday).

Recapping last week now and it was yet another wild week that saw a US election, major battleground advances for Ukrainian forces, a major crypto blowup, and a below expectations CPI report that gave the market signs of a potential Fed pivot that it has been desperately hoping for. All in four days on a holiday shortened week for fixed income markets in the US.

Starting with bonds, Treasury yields rallied big this week following the below expectations October CPI report. That saw 10yr yields down -34.6bps and 2yr yields -32.6bps lower, the largest weekly decline in both tenors since the initial Covid onset in March 2020, as pricing for the December meeting finished the week just shy of 50bps at 49.8bps, while terminal pricing ended the week at 4.89% for next spring, its first close below 4.9% in two weeks.

10yr yields also fell in Europe, but lagged the US move, where bunds fell -13.5bps (+15.1bps Friday) and gilts were -17.9bps lower (+6.6bps Friday). European yields sold off Friday when Treasury trading was closed, following reports that China was easing more of their Covid restrictions and with University of Michigan inflation expectations over the next 5 years hitting their highest level in 5 months at 3%. The S&P 500 gained +5.90% (+0.92% Friday) while the Nasdaq +8.1% (1.88% Friday) outperformed with the index being comfortably lower for the week before Thursday’s CPI. European shares also climbed, with the STOXX +3.66% higher (+0.09% Friday) and the Dax up +5.68% (+0.56% Friday).

Finally, reports that FTX, the second-largest crypto exchange was going under, drove a route in crypto assets, that saw Bitcoin fall -20.72% over the week and -5.95% on Friday.

Tyler Durden

Mon, 11/14/2022 – 08:06

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com