Bankman-Fried’s Alameda Research Took $370k In PPP Loans At A Time When FTX Was Valued Near $1 Billion

As if throwing around billions of dollars in client money as though it was their own wasn’t enough for Sam Bankman-Fried and Alameda Research, LLC, the latter also took out a Federal Paycheck Protection Program loan, according to multiple reports and SBA.gov.

The SBA.gov sourced list at ProPublica lists Alameda Research LLC as having received $370,518 on April 27, 2020.

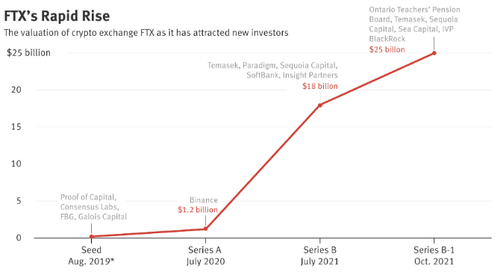

However, the Federal Government will not likely be appearing on the list of creditors in FTX bankruptcy documents, as the loan was reportedly paid back, Bloomberg wrote. And it’s hard to think that the company actually needed the money. At the time, FTX had about a $1.2 billion valuation and had attracted an investment from Binance.

FTX was founded in 2019 and in July 2021 did a $900 million funding round that valued the company at $18 billion. Later that year, it did another capital raise at a valuation of $25 billion. Investors included Tiger Global and Temasek, per Reuters.

In 2022, the company’s valuation went to $32 billion when SoftBank invested near the top in January, putting $400 million into the business.

We bet the company wishes it had the $370k back now…it could probably go a long way towards legal fees.

Tyler Durden

Fri, 11/18/2022 – 18:00

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com