In 2020, The Most Traded Global Good Was Not Crude Oil But Semiconductors

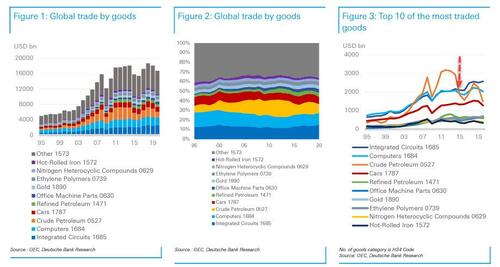

As DB’s Jim Reid writes in his latest Chart of the Day note, it may come as a surprise to many that it was semiconductors, and not crude oil of computers, that were the most traded good in 2020.

Semiconductor chips are used in most electronic devices, from consumer electronics like dish washers to more advanced frontier technologies like AI and supercomputers. Since 2015, semiconductors have taken the top rank for the most traded good, representing 15% of total global goods trade (link here for pro subs).

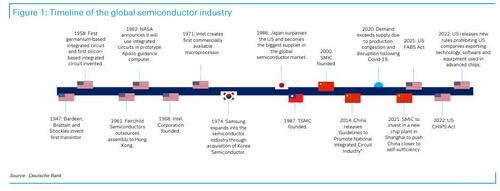

Earlier this week Jim Reid’s team published a note on the chip conflict between the US and China (link here for pro subs), following a recent US ban on American companies from exporting the technology, software, and supercomputers to specific advanced semiconductor companies in China.

The new rules prevent any US citizen, factory or green card holder from assisting Chinese advanced chip-making without a license, as well as expanding US control over non-US companies that use American technology. The new controls reflect growing US concern over China’s use of advanced chips in AI and military technology.

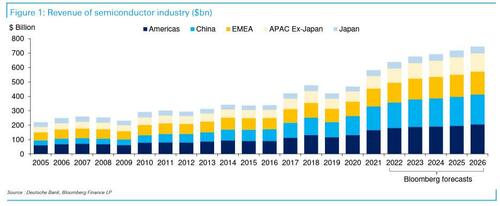

As the DB Chart of the Day below shows, China has become an increasingly important source of revenue for semiconductor firms across the entire supply chain. Although much of China’s comparative advantage has remained restricted to lower value-added stages of chip production such as assembly, packaging and testing, China has made efforts to deepen its indigenous semiconductor capacity. Under its current 5-year plan, China aimed to achieve 70% self-sufficiency in chips by 2025.

It is likely that the US policy shift has also come as the concentration risk in the semiconductor industry becomes increasingly relevant under shifting geopolitical tensions between the US and China. Although Intel in the US is developing its advanced chip capacity, Taiwan’s TSMC dominates advanced chip production. 54% of semiconductors are manufactured by TSMC, and 90% of the most advanced chips. 97% of TSMC’s long-term assets, such as fabrication facilities, are located in Taiwan. If TSMC’s facilities were compromised – perhaps by geopolitical tensions or even by a natural disaster – no question the impact would be felt for years.

Although tensions between the two superpowers seemed to ease at the G20 earlier this month, this report highlights the huge potential global event risk concerning the chips sector and the associated geopolitical battleground.

(More in the linked reports available to pro subs here, here and here)

Tyler Durden

Sun, 11/27/2022 – 13:00

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com