Big Tech Is Unlikely To Find Smooth Comeback In 2023

By Heather Burke, Bloomberg markets live reporter and strategist

Big Tech’s fall from grace has been one of the abiding market themes of 2022. But the earnings outlook, macro backdrop and valuations offer little support for a big turnaround in 2023 after the worst year since the global financial crisis.

The Nasdaq 100 has plummeted more than 30% this year, lagging the S&P 500, as the Federal Reserve and other central banks aggressively hiked rates. Surging bond yields made highly-valued tech stocks look less attractive. This value destruction has made so-called FAANG stocks such as Amazon.com and Apple less important to the S&P 500 as some lost more than a third of their value

Now inflation and monetary tightening have raised the prospect of a global recession. If the US economy contracts, technology stocks will face a drag from lower corporate earnings.

The Nasdaq’s 12-month forward EPS has dropped more than 4% from the start of October through Dec. 16, compared with about 2.7% for the S&P 500. Another measure shows Nasdaq 100 EPS y/y growth has fallen to almost zero.

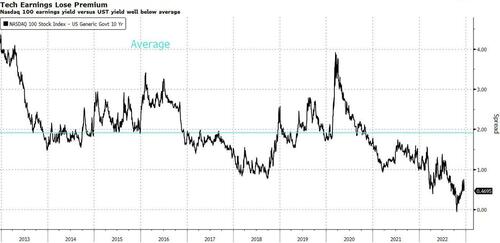

Big-tech earnings also don’t command the premium they used to versus bonds. The spread between the Nasdaq 100’s earnings yield and the 10-year Treasury yield narrowed to the least since 2009 in October. Tuesday’s premium of about 49 basis points is well below a 10-year average of around 191 basis points. This makes tech stocks less attractive, even if the Fed slows tightening.

Inflation may be decelerating in top-line economic data but that doesn’t mean it has fully worked its way through future earnings — especially with the sense that some behemoths have reached peak growth. Amazon projected the slowest holiday-quarter growth in its history and is cutting jobs. Subtracting still-elevated inflation from the Nasdaq 100 earnings yield leaves the real stock yield negative, although improving, and well below a 10-year average.

Tech is often seen as a long-duration play, yet has been unable to benefit from bonds’ horrible year. With debt traders betting on rate cuts in 2023 despite the Fed’s hawkish messaging, long-dated Treasuries could get a bid — further weighing on stocks’ relative attractiveness.

Valuations are a mixed bag. The Nasdaq 100’s 12-month forward P/E of about 20.3 is in line with the 10-year average of ~20.5. While the Nasdaq 100 is nowhere near the valuations seen before the dot-com bust, in 2002 valuations fell below 20. With the prospect of both an earnings and an economic recession, it’s conceivable there’s still froth to be shaken out. Bernstein noted this week that tech is trading at a 29% premium to the market, down from a Nov. 2021 peak of 52%, but still above its historical average of 25%.

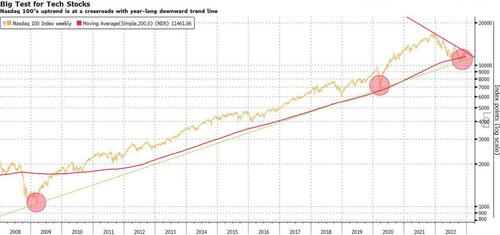

The technical setup is not supportive for the Nasdaq 100. The gauge has been under its 200-DMA for the longest period since the tech bubble. It’s also testing a long-term uptrend in place since 2008 and has failed to overcome a technical downtrend that’s been in place since the start of the year.

To be sure, the Fed could engineer a soft landing and earnings may hold up — companies tend to beat. If, however, the economy holds its poise, earnings may not be affected — but then the Fed would be less likely to cut rates, which won’t augur well for stocks

Tech’s 2023 may not be the nightmare of 2022, but its era of stellar growth has stalled, if not ended.

Tyler Durden

Thu, 12/22/2022 – 12:35

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com