A Simple And Clear View On Markets And The Economy

By Peter Tchir of Academy Securities

A Simple and Clear View on Markets & the Economy

For better or worse, I want to be on the record with my rather simple view.

- 1. The economy is rolling over and the recession will be sooner, deeper, and longer than whatever the current consensus is (and may have already started).

- a. The 2023 Outlook – PAIN covers this in detail as do the Q1 Deflation and the Rise & Fall of Inflation of Risk Factors pieces.

- 2. Markets, due to positioning and human nature, will initially misinterpret the data as a “soft landing” only to realize that the landing is going to be very hard.

We will look at these two themes again.

Mistaking Hard for Soft Landing

This was discussed in detail in a “Squishy Landing.” It will largely be a function of two factors:

- Positioning will be extremely bearish (check).

- Human nature will want to believe that the Fed was “successful” (soft landing) because most people are not as pessimistic as this former CDX market maker.

The pattern, expressed as pendulums, will be this:

We all see the slowdown, but as the pendulum swings into “recession”, there will be enough mixed signals that many will see a “soft landing”. I don’t see any way for the pendulum to stop anywhere close to a “soft landing” and it will swing all the way through to a “deep recession”. However, we will rally on soft landing hopes (possibly what we started to see on Friday).

Fed Hikes Are Not the Main Problem Going Forward

Part of this “transition” into a “soft landing” will be the hope that the Fed, which continues to sound hawkish, will finally be done hiking (or at least will hike at a significantly slower pace). If Fed hikes were the only problem (or even the main problem), then I could get on board with a bigger rally. We’ve outlined the “main” problems in the outlook piece and others referenced above.

The real problem will occur when markets finally realize that the Fed has already done too much/set too many things in motion that even the end of hikes won’t stop this pendulum from swinging deep into “recession”. The Fed is likely going to continue with QT (even as they talk about the end of rate hikes) and I think that will be problematic as QE and QT have a larger direct impact on asset prices in the short-term compared to cuts/hikes.

Total Number of Jobs Will Not Be the Main Problem

This is far more about the types of jobs lost (higher paying due to the incredible wealth creation) and this will impact a large part of the economy. Catering to the owners, employees, and investors in the companies that soared post Covid created not only wealth, but also a number of high paying jobs. Those jobs are under duress and that will have a larger impact on the economy than the total number of jobs (which is still questionable due to the accuracy of the data).

Annual Versus Monthly

I have no clue why we insist on talking about some data on a monthly basis (you hear almost no one discuss jobs for the past year relative to the number of times you hear the monthly number tossed around). However, some numbers are almost always looked at as an annual number (inflation seems to be viewed annually rather than annualizing it monthly – which is a potential mistake).

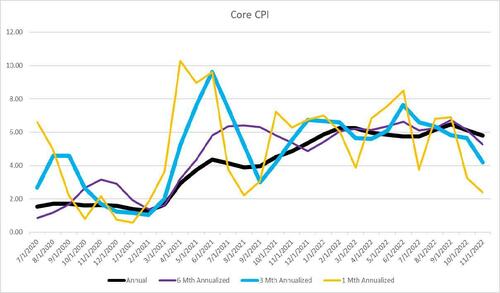

I fully expect that after we get Thursday’s CPI data, we will realize that Q4 Core Inflation is running at an annual rate of right around 3%! That is darn close to mission accomplished. October was 0.2 and September was 0.3, so another 0.3 would put us at a 3.2% annualized rate (which is declining as more of the past policy and market responses filter their way into the data). We looked into this in more detail in 2+2=5, but I think that we are making a huge mistake by talking about annual inflation rather than annualizing recent inflation data.

Even I don’t suggest annualizing monthly data, but even that is probably more useful than thinking about annual data given what has occurred in policy making/markets over the past 12 months!

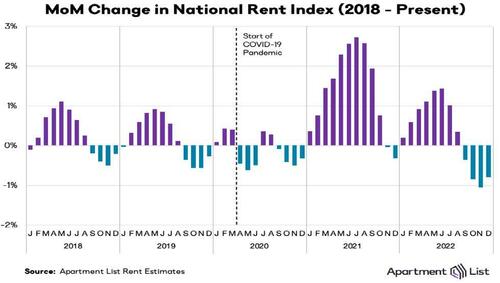

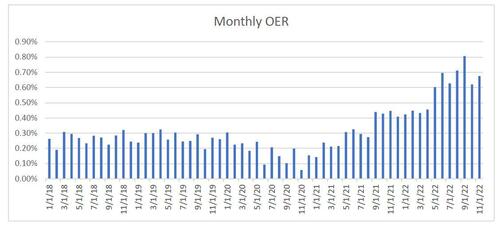

A Word on Housing (or at least a picture or two)

Thanks to Andrew Brenner for turning me onto ApartmentList.com. It meshes well with Zillow data and other contemporaneous measures of rent that I’ve been harping on.

Yes, we had a huge inflation problem in 2021 that was somehow missed or ignored by the powers that be (and the data collectors). Even now, CPI data is currently including the highest rent increases in the cycle in their calculations. I know which graph makes more sense to me!

Last, but Certainly NOT Least!

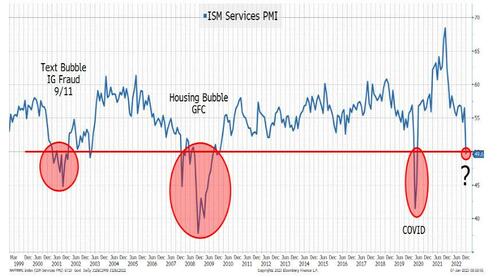

Jobs data was solid across the board, but most of the other data was weak. One piece of data in particular struck me as jaw-droppingly weak and important!

Think about the narrative that we have been spinning on goods for the past year or so:

- Pent up consumer demand and dealing with potential shortages was mistaken for ongoing levels of much higher demand.

- Inventory was built up (and continues to build up) as companies responded to what they thought was higher ongoing demand rather than a one-time confluence of factors.

While so many people were cheering the services sector, maybe it is now going through the same cycle as the product side of the economy. This cycle just started much later because Covid restrictions placed more constraints on the services side of the economy than on the goods side. Some things were slow to open, but many people were also more cautious until they felt safer. Was this bubble in consumption followed by a bubble in services? In the U.S., will it turn out that the consumer put in one last big effort for the holidays and is now about to hunker down?

In any case, this number cannot be ignored given how rarely it breaks 50!

Bottom Line

I think that the economy is headed into a problematic recession.

I think that the Fed has already set this process in motion.

I’m trying to thread a needle by being tactically bullish for the head-fake “soft landing” trading ahead of the real risk-off move to follow shortly thereafter.

At least no one can say that the first week of 2023 was dull! This could be another long year.

Tyler Durden

Sun, 01/08/2023 – 16:00

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com