JPM Slides After Missing On Trading And IBanking, Warns Of Macro “Deterioration” As It Boosts Credit Loss Reserves By $1.4BN

Perhaps JPM losing its first reporter slot to BofA this quarter was symbolic, because while Bank of America’s earnings were generally solid with beats across the board (despite a generous reserve release), JPMorgan was anything but with the bank missing expectations in several key business segments, including worse-than-expected revenue from its trading units, and warning that this year’s net interest income will be lower than analysts expected (even as the firm set another record for that metric last quarter). This was enough to send its stock sharply lower in premarket trading.

Let’s take a look at how JPM did.

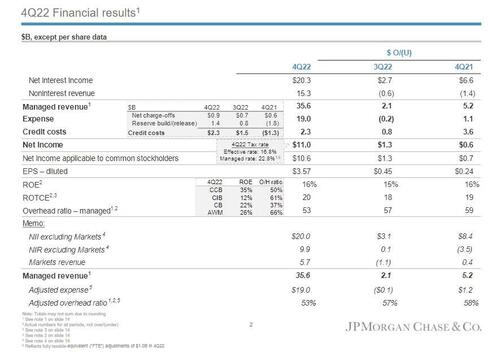

- Adjusted revenue $35.57 billion, beating the estimate $34.15 billion, and up $5.2BN from a year ago

- EPS $3.57, also beating the estimate $3.10, up 24c from a year ago

- Net Income to common was $10.6BN, up $700MM from a year ago, helped by a generously low 16.8% effective tax rate. The results included the impact of a $914 million gain on a sale of Visa Inc. shares, mostly offset by a loss on investment securities

The bank also reported Q4 net charge-offs of $887 million, just below the estimate of $928.3 million; however the reserve build of $1.4BN (vs $1.1BN at BofA) came in higher than expected, resulting in a total provision for credit losses of $2.29BN, also above the estimate of $2.05BN.

Some more good news: just like Bank of America, managed net interest income came in at $20.31 billion, a record, and smashing the estimate of $18.79 billion, and a whopping $6.6BN compared to year ago. This, however, was modestly offset by a $1.4BN drop in noninterest revenue which declined to $15.3BN.

A few more balance sheet details below:

- Average loans of $1.1T were up 6% YoY and up 1% QoQ; this was in line with consensus estimates of $1.13 trillion

- Average deposits of $2.4T were down 4% YoY and down 3% QoQ; they were also below the estimate of $2.42 trillion

A quick look at the expense side shows that while JPM was prudent this quarter and coming below expectations, especially on the compensation side…

- Non-interest expenses $19.02 billion, below the estimate $19.8 billion

- Compensation expenses $10.01 billion, estimate $10.35 billion

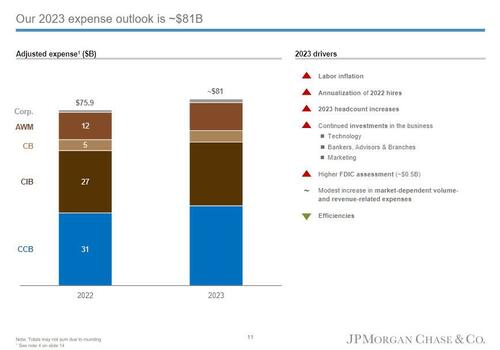

… looking ahead the bank expects a surge in its 2023 expense to $81 billion led by hiring and labor inflation.

Some more “fortress” balance sheet boilerplate:

- Net yield on interest- earning assets 2.47%, estimate 2.24%

- Standardized CET1 ratio 13.2%, estimate 12.7%

- Managed overhead ratio 53%, estimate 54.8%

- Return on equity 16%, estimate 14.2%

- Return on tangible common equity 20%, estimate 17.3%

- Assets under management $2.77 trillion, estimate $2.66 trillion

- Tangible book value per share $73.12

- Book value per share $90.29

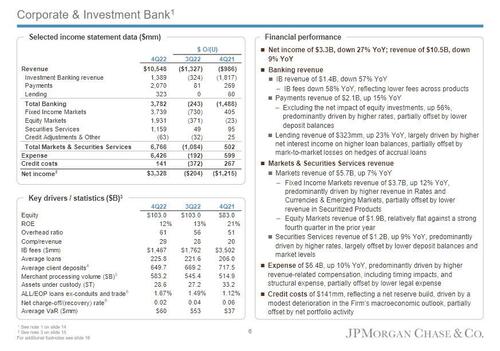

But while most of the above was solid, where the bank disappointed was in its Corporate and Investment Bank where all of the reported numbers missed expectations:

- CIB Markets total net revenue $5.67 billion, +7.2% y/y, missing the estimate $5.89 billion

- FICC sales & trading revenue $3.74 billion, up 12% Y/Y, but missing the estimate $3.91 billion

- This was predominantly driven by higher revenue in Rates and Currencies & Emerging Markets, partially offset by lower revenue in Securitized Product

- Equities sales & trading revenue $1.93 billion, missing the estimate $1.98 billion

- The number was relatively flat against a strong fourth quarter in the prior year

- Investment banking revenue $1.39 billion, down 57% y/y, missing badly the estimate $1.66 billion

- IB fees were down 58% YoY, reflecting lower fees across products

- Advisory revenue $738 million, missing the estimate $743.9 million

- Equity underwriting rev. $250 million, missing the estimate $269.5 million

- Debt underwriting rev. $479 million, missing the estimate $633.9 million

- Corporate & investment bank IB fees $1.47 billion, missing the estimate $1.65 billion

- Securities Services revenue of $1.2B, up 9% YoY, predominantly driven by higher rates, largely offset by lower deposit balances and market levels

On the expense side, the JPM Ibank reported $6.4BN, up 10% YoY, predominantly driven by higher revenue-related compensation, including timing impacts, and structural expense, partially offset by lower legal expense

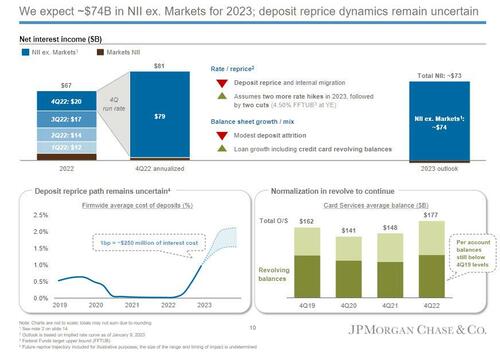

Finally, looking ahead, the bank said it expects about $73 billion in NII for 2023, well below the $74.4 billion estimate. This is also disappointing considering the firm earned about $20.2 billion in NII in just the three months ended Dec. 31, up 48% from a year earlier. It appears the inverted yield curve isn’t helping bank.

Also notably, despite broader layoffs across the finance industry, JPMorgan’s headcount rose 2% to 293,723 from 288,474 last quarter, the company said in its earnings release. This is up 8% from 271,025 in 2021’s fourth quarter.

Commenting on the results, JPM CEO Jamie Dimon said “the US economy currently remains strong with consumers still spending excess cash and businesses healthy,” but warned that “we still do not know the ultimate effect of the headwinds coming” with the bank warning of “modest deterioration” in the macro outlook.

Earlier this week, Dimon said that the Fed may ultimately need to raise rates beyond what’s currently expected, but he’s in favor of a pause to see the full impact of last year’s increases.

JPMorgan temporarily suspended share buybacks last year to quickly meet higher capital requirements while staying flexible to navigate a changing economic environment. Dimon said Friday that JPMorgan has the ability to resume buybacks this quarter “as we deem appropriate.”

In response to the disappointing earnings, JPM shares, which rose 4% this year through Thursday, dropped 3% to $135.5 at 8:0 a.m. in early trading in New York.

The company’s full presentation is below

Tyler Durden

Fri, 01/13/2023 – 08:06

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com