Stocks Spike On Report ECB To Slow Hikes After February

US stocks spiked, with spoos rising above both the closely watched 200DMA and the descending channel resistance level, after Bloomberg reported that echoing the Fed, the ECB is also “starting to consider a slower pace of interest-rate hikes than President Christine Lagarde indicated in December” citing officials with knowledge of their discussions. As the report notes,

While the report notes that the 50 bps hike in February remains likely, “the prospect of a smaller 25-point increase at the following meeting in March is gaining support, the officials said.”

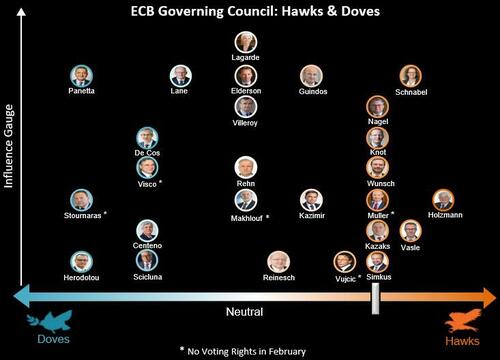

And although the sources were quick to add that “any slowdown in monetary tightening shouldn’t be viewed as the ECB going soft on its mandate” and that “no decisions have been taken, and that policymakers may still deliver the half-point move for the March meeting that Lagarde penciled in on Dec. 15”, the market immediately read between the lines and – realizing that the global tightening wave is almost over – immediately sent expectations for an ECB March rate hike tumbling…

… and sent futures to session highs…

… pushing spoos above both the 200DMA and the descending channel resistance level which had proven insurmountable for the S&P since last April.

Naturally, yields promptly tumbled.

Weaker-than-expected inflation in the euro area, a drop in natural gas prices and the prospect of gentler tightening by the US Federal Reserve have brought some comfort to policymakers as they ponder how to continue the most aggressive rate hikes in ECB history.

While officials opted to slow the pace of increases in December with a 50-basis-point move, they coupled that decision with a sense of heightened vigilance on price stability. Lagarde said then that available data “predicate” a 50-basis-point hike at the Feb. 2 meeting “and possibly at the one after that” — cautioning that decisions will continue to be data-dependent.

As Bloomberg notes, economists currently anticipate moves of that magnitude at the next two meetings, with money markets betting on a half-point hike next month and placing more than 80% odds on a similar increase in March, with the deposit rate expected to peak below 3.5% by July.

Whether and how inflation prospects have shifted will only become apparent with the new forecasts in March, which might help justify a less aggressive pace. That may be one reason for policymakers to be cautious about departing from their outlined hike in February.

Tyler Durden

Tue, 01/17/2023 – 10:14

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com