China Cut Treasury Holdings Again In November As World Piled Into US Stocks

The US Treasury reported its international capital flows report this afternoon. As a reminder, we note that the values reported in the TIC report are marked-to-market, hence, a drop in the value of a nation’s holdings in USTs could be due to a) selling of USTs, and/or b) a drop in the price of USTs.

Today’s data is for November, which saw a notable rally in the price (drop in the yield) of USTs (after 3 straight months of price declines)…

Source: Bloomberg

Hence the TIC data will be ‘juiced’ a little due to mark-to-market value increases.

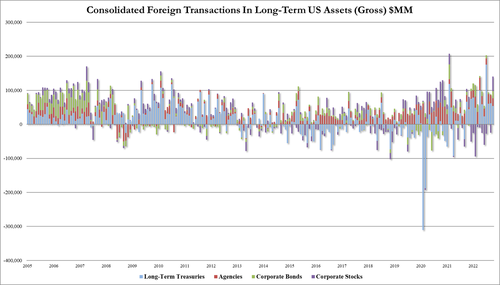

At the highest level, across all entities, all US assets saw buying in November…

-

Long-Term TSY holdings purchased $54.2BN, up from $61.9BN in October

-

Agencies bought $22BN, down from $24.2BN in October

-

Corporate bonds bought $21.5BN, up from $1.9BN in October

-

Corporate stocks $42.9BN, up from $24.4BN sold in October

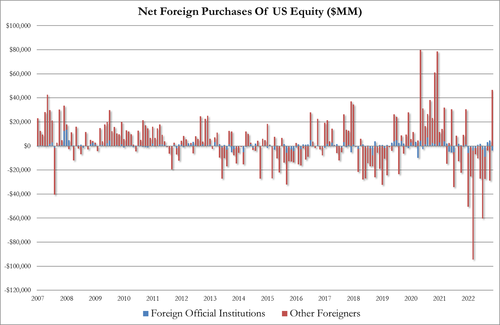

Notably, Foreign purchases of US equities surged in November (the most since Dec 2020)…

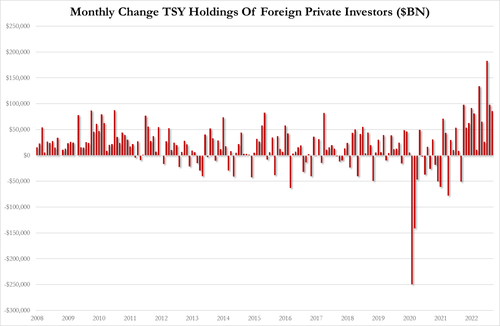

And foreign private investors bought USTs once again…

Among ‘official institutions’, Treasuries were sold for the 10th straight month and US stocks were sold (after 2 months of buying), although the size of the flows was considerably smaller than in recent months…

Source: Bloomberg

Japan remains the largest foreign holder of USTs, and increased its holdings in November (after 4 straight months of declines)…

But, China’s holdings of USTs have been in freefall in recent months, but as Brad Setser pointed out recently, there has been aggressive buying in Belgium (especially), Luxembourg, and the Caymans – all of which at some point could be cover for Chinese buying…

Source: Bloomberg

Finally, we note that the de-dollarization has recently re-accelerated…

Source: Bloomberg

Tyler Durden

Wed, 01/18/2023 – 16:16

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com