Treasuries Drift Higher After BOJ Reversal, Await PPI And Retail Sales

US stock-index futures were muted on Wednesday, swinging between gains and losses, as investors initially welcomes a dovish announcement by the BOJ which refrained from further expanding its yield curve control band, then turned to corporate earnings for more clues on the health of corporate America amid growing prospects for a recession. Nasdaq 100 and the S&P 500 futures were up 0.2% as of 7:15 a.m. in New York. Treasury and JGB yields tumbled after the BOJ kept monetary settings unchanged, while the yen first slid against the dollar but then recovered all losses amid expectations the BOJ has only bought a few weeks of time. WTI crude added 1.7% this morning and has been holding above $80 amid optimism around China reopening demand. Dollar is weaker; DXY at 102 helping gold trade back over $1900.

Among notable movers in premarket trading, Moderna Inc. climbed 6.7% after saying its vaccine against respiratory syncytial virus infections met targets. IBM dropped 1.9% after Morgan Stanley cut the stock to equal-weight from overweight, saying that it is transitioning out of more defensive IT hardware name. Bank stocks are mixed as investors await the release of key economic data, including the Beige Book and retail sales. Coinbase said it’s halting operations in Japan. Meanwhile, Bank of Montreal has received approval from the Federal Reserve to acquire San Francisco-based Bank of the West. Here are the other notable premarket movers:

- United Airlines (UAL US) rises 2.6%, boosting carrier peers, after the airline operator’s guidance for the first quarter and 2023 beat analyst estimates. Brokers pointing to strong growth in sales, assuaging any worries over demand taking a hit from an economic slowdown. American Airlines +1.4%, Delta Air +1%

- GoDaddy (GDDY US) gains 3% after the website domain company was upgraded to outperform from inline at Evercore ISI, with the broker highlighting the firm’s relatively recession- resistant business model and new-product cycle.

- International Business Machines (IBM US) drops 1.9% after Morgan Stanley cut the stock to equal-weight from overweight, saying that it is transitioning out of more defensive IT hardware names.

- Skechers (SKX US) slides 2.1% after Morgan Stanley downgraded it to equal-weight on valuation, risk of FY23 guidance missing expectations and as the market shifts to early-cycle names. The broker raised Gap (GPS US) to equal-weight and anticipates a 2023 of two halves for US specialty retail and department stores.

- SmileDirectClub (SDC US) jumps 13% after the maker of dental aligners projected a narrower Ebitda loss for 2023 and said that it planned to rejig its global workforce and introduce additional cost savings. Jefferies, however, remains cautious on the stock, saying that the company saw a “weak” finish to a tough year.

- Oatly (OTLY US) gains 6.3% after Mizuho Securities upgrades its rating on the oat drink company to buy from hold, with long-term growth seen still intact.

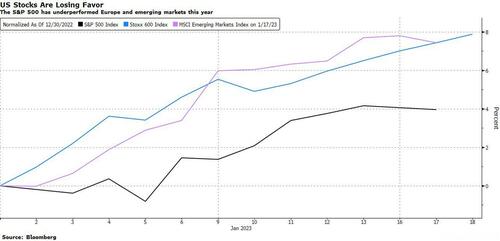

While US stocks have gained in the new year as cooling inflation spurred bets of a softening in the Federal Reserve’s policy, they’ve dramatically underperformed international peers as investors worry that the combination of rising interest rates and slowing consumer demand could trigger an economic contraction. A weaker dollar and optimism around a China reopening have lured investors to non-US stocks. Goldman Sachs strategists said US equity funds have seen outflows in the first two weeks of the year, while Europe has seen inflows — both major trend reversals from 2022. UK inflation as well as a more muted start to the US earnings-reporting season boosted those who believe monetary easing would have to begin this year.

The yen dropped as much as 2.6% against the dollar after Japan’s policymakers doubled down on defending their stimulus, defying intense market speculation. The currency later trimmed the losses to 0.7%. Even as investors remain on guard for the central bank to continue large scale bond buying to protect its yield goal, there are doubts about how long it can continue. The yen’s drop proved to be an idiosyncratic trend in the foreign-exchange markets as the dollar fell against all but five of its 31 major peers including the Japanese currency.

Meanwhile, Analysts expect fourth-quarter earnings to show a drop of 2.7%, the first year-over-year decline since 2020, according to data from Bloomberg Intelligence. “Given the difficult backdrop, there’s fear among some parts of the market that US earnings forecasts might still be too high for 2023 and that stocks might not be able to sustain their current strength,” said Russ Mould, investment director at AJ Bell. He added that reports from the likes of Procter & Gamble Co., Schlumberger Ltd., Microsoft Corp. and Tesla Inc. “will certainly be ones to watch as their fortunes could have a major influence on market sentiment.”

European equity markets are mixed after the BOJ sent the yen spiraling lower by leaving its policy settings unchanged. The Stoxx 600 is up 0.1% with gains in the CAC and FTSE 100 while the DAX trades lower; today’s move brought the total Stoxx 600 gains since a Sept. 29 low to more than 19%. If the index closes at 20% or higher, it will join other regional peers in confirming a technical bull market. Tech, travel and miners are the best performing sectors while chemicals and real estate fall. Here are the notable European movers:

- Richemont shares gain as much as 2.8% in Europe despite the Cartier owner posting worse-than-expected 3Q sales as investors take the view that disruptions in China caused by a surge in Covid infections may prove temporary.

- Just Eat Takeaway.com jumps as much as 16% after 4Q Ebitda beat estimates as the food delivery firm said it remains focused on improving profitability. Peers Deliveroo and Delivery Hero rose as much as +5.5% and 6.3% respectively

- ASM International shares rise as much as 8.7% after 4Q update shows a strong beat on sales that is likely to boost sentiment on the semiconductor-equipment maker, analysts say. ASML shares rise as much as 2.1% in sympathy.

- Capgemini shares rise as much as 3.5%, hitting highest in just over a month, after Barclays upgrades the IT services firm to overweight on greater resilience in its business mix and on utilization.

- EQT shares drop as much as 8.4%, the most in more than three months, after the investment firm delivered results which analysts say missed on adjusted Ebitda.

- Continental shares fall as much as 5% after the German car-parts and tiremaker said late Tuesday that it expects FY22 adjusted free cash flow of €200m, below its outlook range of €600m to €800m.

- Encavis shares fall as much as 5.3% after Barclays analyst cut the recommendation to underweight from equalweight, Orsted also downgraded. Barclays notes that growth pipeline valuations for the two energy companies have moved significantly above vertically integrated peers.

- Wise shares drop as much as 5%, extending yesterday’s double-digit losses, after the UK money- transfer firm’s growth slowed and missed analyst expectations.

Earlier in the session Asian stocks edged higher as Japanese shares advanced after the Bank of Japan announced no change to its yield curve control policy, countering broader caution ahead of the Lunar New Year holidays. The MSCI Asia Pacific Index erased an earlier loss of as much as 0.7% to rise 0.5%, lifted by communication services and health care shares. Japanese equities jumped as the yen fell after the BOJ kept policy on hold, pushing back against intense market speculation of policy change by ramping up the defense of its stimulus framework.

“What has been happening so far is a fairly easy pattern to understand,” said Makoto Furukawa, chief portfolio strategist at Mitsubishi UFJ Morgan Stanley Securities. “I think the pattern of bank stocks rising and exchange-rate-sensitive stocks being hit will continue. Expectations for further revisions to the BOJ’s policy will emerge.” South Korea was among the biggest losers on Thursday, dragged by a loss in Samsung Electronics. Chinese benchmarks were mixed in thin volumes before market closures next week. The MSCI Asian stock benchmark has gained more than 20% from an October low to enter a bull market, outperforming US and European peers. Japanese stocks have underperformed, with the Nikkei down almost 1% in the same span, hurt in part by the BOJ’s December move to widen a band on bond yields.

Australian stocks edged higher: the S&P/ASX 200 index rose to close at 7,393.40, as healthcare and technology shares buoyed the benchmark. In New Zealand, the S&P/NZX 50 index rose 0.3% to 11,920.41. The nation’s home sales fell 39% y/y in December, according to the Real Estate Institute of New Zealand.

The Bloomberg Dollar Index is down 0.3%, swinging to a loss in European trading as the greenback weakened against all of its Group-of-10 peers apart from the yen; the JPY traded well off its worst levels. EUR gained after ECB’s Villeroy said he was surprised by the sources story suggesting they are considering smaller hikes beyond February. GBP rose after data showed UK core CPI was slightly stronger than expected in December. Some more details:

- The yen slumped as much as as 2.6% against the dollar, hitting 131.58, and Japan’s bond yields fell by up to 11bps after the BOJ pushed back against intense market speculation of policy change by ramping up the defense of its stimulus framework. Risk reversals in the front-end rallied in the run-up to the BOJ decision in favor of greenback calls, suggesting that the market was positioning for a no-change decision by the central bank. The move for risk reversals suggests that investors are still looking for bullish yen expressions over the medium-term, and especially after Kuroda’s term ends in April

- The Swiss franc extended its advance against to 0.9131 per dollar, the strongest level in a year

- The euro extended an advance against the dollar and bunds reversed opening gains after ECB official Francois Villeroy de Galhau said that guidance from ECB President Christine Lagarde that borrowing costs will continue to be lifted in half-point steps for some time still holds. One trader has placed a large bet using options on German 5-year futures, targeting the yield to rise above 2.40% for maximum profit, up from about 2.13% currently

- The pound rose against the dollar and traders added to wagers on the BOE’s hiking cycle after UK inflation figures showed month-on-month and core readings came in higher than anticipated in December

In rates, Treasuries and JGBs spiked higher overnight after the Bank of Japan kept monetary settings unchanged with no nod to any concession on current policy; 10-year TSY yields fell as much as 8.3bp to 3.465% and were trading at 3.47% last. Gains have been broadly maintained into early US session, with 10-year note futures trading near day’s high. Heavy US economic data slate includes PPI and retail sales, and Treasury auctions 20-year bonds. UK and German government bonds pared earlier advances to trade in the red as Treasury yields were richer by 3bp to 7bp across the curve with gains led by intermediates, flattening 2s10s spread by 4bp on the day; 10-year yields trade around 3.48% with bunds and gilts underperforming by 4bp and 7bp in the sector. Most gains in Treasuries were made during aggressive rally in JGBs after Bank of Japan policy announcement, which left benchmark JGB 10-year richer by around 8bp on the day. US Treasury auctions resume with $12b 20-year bond reopening at 1pm.

In commodities, crude futures rose with WTI adding 1.7% to trade near $81.50. Spot gold rises roughly $4 to trade near $1,913/oz

To the day ahead now, and data releases from the US include December’s PPI, retail sales and industrial production, whilst from the UK we’ll also get the December CPI release. From central banks, we’ll hear from the ECB’s Villeroy, and the Fed’s Bostic, Harker and Logan. Lastly, the Fed will also be releasing their Beige Book.

Market Snapshot

- S&P 500 futures little changed at 4,012.00

- MXAP up 0.5% to 166.79

- MXAPJ up 0.3% to 546.45

- Nikkei up 2.5% to 26,791.12

- Topix up 1.7% to 1,934.93

- Hang Seng Index up 0.5% to 21,678.00

- Shanghai Composite little changed at 3,224.41

- Sensex up 0.6% to 61,049.16

- Australia S&P/ASX 200 little changed at 7,393.36

- Kospi down 0.5% to 2,368.32

- STOXX Europe 600 up 0.1% to 457.14

- German 10Y yield little changed at 2.10%

- Euro up 0.6% to $1.0855

- Brent Futures up 1.1% to $86.89/bbl

- Gold spot up 0.3% to $1,913.84

- U.S. Dollar Index down 0.39% to 101.99

Top Overnight News from Bloomberg

- ECB policymakers are starting to consider a slower pace of interest-rate hikes than President Christine Lagarde indicated in December, according to officials with knowledge of their discussions

- The BOJ standing pat caught some traders by surprise, but is unlikely to douse speculation that it will normalize policy as inflation in Japan accelerates and Governor Haruhiko Kuroda nears the end of his term

- China’s top economic official told an audience of international billionaires and bankers that his country’s economy will likely rebound to its pre-pandemic growth trend this year after coronavirus infections passed their peak

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were positive albeit with price action mostly kept rangebound after the weak lead from Wall Street, while focus overnight centred on the BoJ policy announcement in which the central bank defied the increased speculation for a policy tweak. ASX 200 was flat with strength in the tech and consumer sectors offset by losses in commodity-related stocks. Nikkei 225 was boosted after the BoJ stuck with its ultra-easy policy settings and reaffirmed its dovish guidance. Hang Seng and Shanghai Comp were choppy but with strength in key tech names after China approved licences for 88 new games including titles from Tencent and NetEase in a further sign of an end to its tech crackdown.

Top Asian News

- PBoC injected CNY 133bln via 7-day reverse repos with the rate kept at 2.00% and injects CNY 447bln via 14-day reverse repos with the rate kept at 2.15% for a CNY 515bln net injection.

- China’s NDRC’s said the economic development situation this year is still complicated, external environment is turbulent and pressure is still large, but it is confident and capable of promoting the continuous recovery and overall improvement of China’s economy, according to Reuters.

- Hong Kong is expected to end its COVID mask mandate by March or April, according to sources cited by Ming Pao News.

European bourses are contained overall, Euro Stoxx 50 +0.1%, as the dovish BoJ fails to provide impetus. US futures are similarly steady ahead of earnings, data and Fed speak, ES +0.1%. Within Europe, sectors are mixed with marked outperformance in Tech after updates from Just Eat and ASM International.

Top European News

- ECB’s Villeroy reaffirms that a European recession should be avoided in 2023, will bring inflation back to target around 2024/2025. Lagarde’s 50bp guidance remains valid. Will remain at the terminal rate for as long as is necessary; will go to the terminal by summer, not there yet.

- UK Chancellor Hunt is reportedly planning a “slimmed down” spring budget which will not feature tax cuts within the statement, via The Guardian citing sources which add that there will be tax cuts before the next election, with the autumn statement the most likely point to announce such a change.

- Germany is reportedly to narrowly avoid a 2023 recession, with price-adj. growth of 0.2%, via Reuters citing source/draft of the economic report; Inflation: 2023 6.0%, 2024 2.8%.

- Magnitude 7.0 earthquake strikes off Sulawesi, Indonesia; Tsunami waves are possible for coasts located within 300km of Indonesia’s quake epicentre, Pacific Tsunami Centre says.

- Ukraine Latest: Helicopter Crash Kills 18 People Near Kyiv

- Sweden Boosts Capacity to Send Power South to Ease Supply Crunch

- French Power Crunch This Winter Now Less Likely, Grid Says

- Women Are Macron’s Biggest Critics on Pension Reform

- BASF Drops After €7.3 Billion Russia Writedown Sparks Loss

BOJ

- BoJ kept its policy settings unchanged with rates at -0.10% and YCC maintained to target 10yr JGBs at 0% via unanimous vote, while it kept the yield band and yield target unchanged. BoJ stuck with its forward guidance on interest rates and guidance that it will continue large-scale JGB buying and make nimble responses for each maturity, while it reiterated that it will not hesitate to take additional easing measures as necessary. Furthermore, the BoJ extended the fund operation to support financial lending by one year and the Outlook Report contained cuts to Real GDP growth forecasts and mostly upward revisions to Core CPI estimates, although fiscal 2023 and fiscal 2024 Core CPI forecasts remained below the 2% price goal.

- BoJ Governor Kuroda (post-meeting press conference) says he is not expecting 10yr JGB yields to continue trading with yields above 0.5%, and there is no need to further expand its bond target band; today’s decision is not a change in BoJ’s monetary policy. It is still early days since the adjustment to yield bands made in December, BoJ needs more time to assess impact on market functions. YCC is fully sustainable, widening band has made YCC more sustainable. Important for FX rates to move stably, reflecting fundamentals; he has no specific comments on FX levels, noting that currency policy is the jurisdiction of the government.

FX

- Yen yields gains made on the premise of further BoJ YCT adjustment as the Bank holds fire.

- USD/JPY jumps to 131.57 from the low 128.00 area at one stage, DXY rebounds accordingly to 102.900 before sharp reversal on the back of strength elsewhere in the index.

- Sterling extends on UK pay gains as services and core inflation top consensus, Cable breaches 1.2300 on the way to 1.2360+ peak.

- Euro eyes resistance in the high 1.0800 zone as the Dollar recoils and Kiwi approaches 0.6500 and Aussie takes firmer hold of 0.7000 handle

- PBoC set USD/CNY mid-point at 6.7602 vs exp. 6.7644 (prev. 6.7222)

Fixed Income

- Core benchmarks have picked off the European morning’s lows to near unchanged levels, but remain shy of overnight BoJ-inspired peaks.

- The overnight BoJ derived upside seemingly fizzled out amid ECB’s Villeroy dismissing the dovish source reports and hot UK core CPI.

- Stateside, USTs are holding firmer than their EGB peers ahead of a packed afternoon docket.

Commodities

- Crude benchmarks are bid and have broken out of contained overnight ranges following the latest geopolitical rhetoric, lifting the complex to fresh YTD peaks.

- WTI Feb’23 and Brent Mar’23 are at the top-end of USD 80.55-81.86/bbl and USD 86.13-87.43/bbl parameters, ranges that mark fresh YTD peaks for the complex, though, the benchmarks remain well within late-2022 extremes.

- China’s NDRC warned iron ore trading companies and iron ore futures companies against price gouging and speculation, while it will step up supervision on iron ore’s spot and futures markets, according to Reuters.

- IEA Oil Market Report: Demand set to increase by 1.9mln BPD to a record of 101.7mln BPD.

- Spot gold is essentially unchanged and unable to derive much support from the Dollar’s weakness as the overall tone remains a tentative one post-BoJ.

- Copper prices are bid this morning in the wake of disruption to Glencore’s Antapaccay copper mine in Peru, which is operating at restricted capacity amid anti-government protests, according to Reuters sources.

Geopolitics

- US reportedly sends Ukraine US arms which were stored in Israel, according to NYT.

- Russian Foreign Minister Lavrov says discussions with Ukraine President Zelenskiy are not possible; ready to respond to Western proposals on Ukraine but have not seen any serious proposals; adds, that they will have to take corresponding military measures if Finland/Sweden were to join NATO.

- Ukrainian Minister of Internal Affairs has died in a helicopter crash near Kyiv, according to local journalists.

- Serbian President Vucic says Crimea is Ukraine, and the EU path is the only one for Serbia.

US Event Calendar

- 07:00: Jan. MBA Mortgage Applications 27.9%, prior 1.2%

- 08:30: Dec. Retail Sales Ex Auto and Gas, est. 0%, prior -0.2%

- 08:30: Dec. PPI Final Demand MoM, est. -0.1%, prior 0.3%; YoY, est. 6.8%, prior 7.4%

- PPI Ex Food and Energy MoM, est. 0.1%, prior 0.4%; YoY, est. 5.6%, prior 6.2%

- 08:30: Dec. Retail Sales Advance MoM, est. -0.9%, prior -0.6%

- Retail Sales Ex Auto MoM, est. -0.5%, prior -0.2%

- Retail Sales Control Group, est. -0.3%, prior -0.2%

- 09:15: Dec. Industrial Production MoM, est. -0.1%, prior -0.2%

- 09:15: Dec. Capacity Utilization, est. 79.5%, prior 79.7%

- 09:15: Dec. Manufacturing (SIC) Production, est. -0.2%, prior -0.6%

- 10:00: Nov. Business Inventories, est. 0.4%, prior 0.3%

- 10:00: Jan. NAHB Housing Market Index, est. 31, prior 31

- 14:00: Federal Reserve Releases Beige Book

- 16:00: Nov. Total Net TIC Flows, prior $179.9b

Central Bank speakers

- 09:00: Fed’s Bostic Makes Welcoming Remarks at Academic Conference

- 14:00: Fed’s Harker Discusses the Economic Outlook

- 14:00: Federal Reserve Releases Beige Book

- 17:00: Fed’s Logan Gives Speech in Austin

DB’s Jim Reid concludes the overnight wrap

The big news overnight is that there is no big news overnight as the BoJ met economists expectation that they wouldn’t change anything on YCC today despite increasing market expectation that they would. The policy does seems unsustainable if current conditions persist though as since the last meeting on December 20th, they’ve spent $265bn (a whopping 6% of annual GDP!) buying bonds. Indeed, as George Saravelos pointed out yesterday there are some reports suggesting the BoJ may own more than 100% of some benchmark 10yr bonds. So not only has it bought the entire stock, but it has lent it out to short-sellers who have sold it back to the BoJ. Before the meeting our Japanese economists suggested that he does expect the BoJ to abandon YCC by the end of Q2 this year, but more around forces such as the “shunto” spring wage negotiations, a positive output gap and leadership changes at the bank.

It is clear from the market reaction that although economists expected no change the market was set up for one as the Yen has slumped -2.54% against the dollar, marking its biggest one-day drop since March 2020, trading at $131.42 as I type. Given this, the Nikkei (+2.45%) is leading gains across the region. Meanwhile, yields on 10yr Government Bonds tumbled well below policy cap, declining around -10bps, to trade at 0.40% following the central bank’s decision (they did dip to 0.36% immediately after). US 10yr Treasuries are -6bps lower on the back of the news.

The BOJ did enhance its YCC by expanding its fund-supply market operations by offering funds of up to 10 years against pooled collateral to financial institutions for both fixed- and variable-rate loans. This is hoped to ease pressure on the swaps market and help market function. We will see. The press conference is to come after we go to press, so we’ll see if that changes anything.

In the rest of Asia, equity markets are lower with the KOSPI (-0.69%) being the biggest underperformer followed by Chinese equities with the CSI (-0.22%) and the Hang Seng (-0.11%) both down whilst the Shanghai Composite (-0.03%) is just below flat. In overnight trading, US stock futures are edging higher with contracts on the S&P 500 (+0.12%) and NADAQ 100 (+0.17%) climbing after a weaker start.

Central banks were also driving markets yesterday ahead of the BoJ, with a strong European rally after Bloomberg reported that the ECB might go for a smaller 25bps hike in March following another 50bps move in February. Obviously this is just a report, but if true it would be significant, as it would be a slower pace than President Lagarde implied at the last meeting in December. Indeed, she said that “we should expect to raise interest rates at a 50 basis-point pace for a period of time”, so it would imply that this “period of time” could actually just be one meeting.

The article only said that 25bps in March was “gaining support”, but there were some massive market moves in response to its release. Investors immediately adjusted their expectations for ECB policy over the coming months, with the rate priced in by the June meeting down -9.3bps on the day. That led to a significant rally in sovereign bonds too, with yields on 10yr German bunds down -8.4bps, having fallen from 2.14% just before the report came out to an intraday low of 2.06% immediately after. That was echoed across the continent, with yields on 10yr OATs (-10.1bps) and BTPs (-12.6bps) falling by even larger margins, and it left the spread of 10yr Italian yields over bunds at just 180bps, their tightest level since April.

This buoyancy was seen amongst European equities as well, which continued their run as one of the top-performing assets of 2023. The STOXX 600 (+0.40%) and the DAX (+0.35%) both surged following the Bloomberg report, which brings their YTD gains to +7.43% and +9.07%, respectively. And for the DAX those gains mean the index is now at its highest level since mid-February, just before Russia’s invasion of Ukraine began. Another factor helping to boost sentiment in Europe was the release of the latest ZEW survey from Germany. That saw a massive upside surprise in the expectations component for January, which came in at an 11-month high of 16.9 (vs. -15.0 expected), thus adding to the growing body of evidence on the brightening outlook in Europe.

Over in the US, the picture wasn’t quite as rosy as investors came back from holiday. Indeed, the S&P 500 (-0.20%) ended a run of 4 consecutive gains after weak earnings releases dampened risk appetite, with Goldman Sachs (-6.44%) as the second-worst performer in the entire S&P 500 after their earnings missed expectations. On the other hand, fellow major US bank Morgan Stanley (+5.91%) was the second-best performing S&P 500 member as the company beat expectations and pushed a rosier guidance than its peers. The best performer was Tesla (7.43%) which continues to have a rollercoaster time of it. Around this we also had the latest Empire State manufacturing survey for January, which fell to a new low for this cycle at -32.9 (vs. -8.6 expected). And apart from April and May 2020 at the height of the pandemic, that’s now the lowest reading for the survey since Q1 2009.

For US Treasuries there was also a relative underperformance with Europe, with the 10yr yield up +4.4bps to 3.547%. This has reversed overnight on the BoJ news mentioned at the top. The Fed’s next meeting just two weeks from now we start to come firmly into view now, where investors are placing a very high weight on a downshift in the pace of rate hikes to 25bps. It also comes as further posturing takes place ahead of US debt ceiling negotiations. Yesterday, House Speaker McCarthy called on Senate Democrats and the White House to discuss conditions on raising the debt ceiling such as changes to major entitlement programs and discretionary spending, while White House Press Secretary Jean-Pierre remained adamant that the Biden Administration would not be negotiating over the debt ceiling. Treasury Secretary Yellen told lawmakers late last week that the government would need to start using “extraordinary measures” by the end of this week in order to avoid running out of cash.

Elsewhere, UK gilts lagged slightly behind the rest of Europe with the 10yr yield “only” down -6.0bps. That followed UK labour market data that showed nominal wage running at +6.4% over the three months ending-November (vs. +6.2% expected). In turn, that led investors to raise the prospects of another 50bps hike from the BoE in February, with the hike priced in up +1.8bps on the day to 44.6bps.

In other news, oil prices continued their steady advance over recent days, with Brent crude (+1.73%) nearly closing above $86/bbl for the first time this year. That uptick in energy prices was seen more broadly as well, with European natural gas futures (+7.71%) coming off their 16-month low to close at €59.35 per megawatt-hour.

Lastly, at Davos yesterday, European Commission President von der Leyen said in a speech that in order “to keep European industry attractive, there is a need to be competitive with offers and incentives that are currently available outside the European Union”. That follows EU criticism of the recent Inflation Reduction Act in the US, which they consider to unfairly subsidise US firms. Our own European economists put out a note yesterday on the issue (link here) where they write the US legislation is probably more of an additional competitiveness shock to the EU, which could reinforce the energy crisis and the fear that high energy costs could linger for years. They also look at how the US policies might negatively impact the EU over different time horizons.

To the day ahead now, and data releases from the US include December’s PPI, retail sales and industrial production, whilst from the UK we’ll also get the December CPI release. From central banks, we’ll hear from the ECB’s Villeroy, and the Fed’s Bostic, Harker and Logan. Lastly, the Fed will also be releasing their Beige Book.

Tyler Durden

Wed, 01/18/2023 – 08:03

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com