Netflix Jumps After Q4 Subscriber Growth Soars, CEO Hastings Retiring

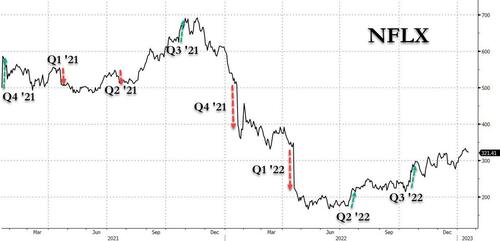

Recent earnings reports from streaming giant Netflix had been a veritable horrorshow… until last quarter: the stock soared to an all time high two years ago when Netflix reported a blowout subscriber beat and projected it would soon be cash flow positive – if only briefly before again reversing and then tumbling seven quarters ago when Netflix again disappointed after it reported a huge subscriber miss and giving dismal guidance, leading to the second quarter when Netflix slumped again after the company missed estimates and guided lower. This again reversed five quarters ago when Netflix soared after it blew away expectations and guided to a blowout Q4, only to plummet one year ago when the company’s stock crashed after NFLX reported a dismal subscriber miss for Q4 and gave horrific guidance for the current quarter. Then three quarters ago, the stock absolutely imploded, plummeting 20% in seconds after the company reported the loss of 2 million subs in Q2 and forecast catastrophic earnings. Then two quarters ago, when there was almost no more muscle to cut, the stock finally jumped after reporting a smaller than expected subscriber loss. The upside trend continued last quarter when NFLX again surged when the company reported solid subscriber growth for Q3 with a forecast that topped expectations.

In short, after the shares tumbled on 4 of the past 8 earnings releases – and obviously surged on the other 4 – it’s been a dizzying rollercoaster, with the shares losing almost 50% of their value since the start of 2022 – one of the most oversold tech stocks of the past year – yet up almost 100% from its June 2022 lows.

Heading into today’s earnings, Citigroup analyst Jason Bazinet said the focus will be on fourth-quarter subscribers, the forecast for first-quarter revenue, the profit outlook, and any commentary regarding the new cheaper ad-supported tier that started during the quarter. In a note to clients, he said the ad-supported tier was only offered in 12 markets and “likely had a slow start” but will help lift the shares over time. In a sign of how seriously Netflix is taking the advertising opportunity, the company said Wednesday it is expanding its relationship with Nielsen, the long-time leader in TV ratings. Coincidentally, Nielsen reported its latest streaming data on Thursday morning. Netflix had a 7.5% share of the overall time people spent watching TV in December, larger than all other streamers but YouTube. Netflix remains the dominant player by other measures, though, accounting for seven of the 10 most-watched shows on streaming in mid-December.

Meanwhile, Wells Fargo analyst Steven Cahall said Netflix’s comments about cracking down on password sharing will be the big focus of today’s earnings call. “As the Street better understands password sharing we see it as upside to revenue growth estimates,” he said in a note to clients Wednesday.

Bloomberg Intelligence analyst Geetha Ranganathan had a bullish take, saying that things are finally falling in place for Netflix, as a solid content slate that included hits like Wednesday and Glass Onion could help it easily meet and possibly exceed guidance for 4.5 million more subscribers in the fourth quarter: “Though investors will be looking for color on the adoption of its ad-supported tier, which debuted in November, we expect this to be a slow build that will eventually boost average revenue per user and revenue through 2023, especially when combined with a crackdown on password sharing.”

Analysts at MoffettNathanson had a more bearish view warning that Netflix has “hit subscriber maturity” in the US, Canada and Western Europe, and it now faces “a number of strategic challenges that cloud future earnings and cash-flow growth prospects.” Among them, they said, are creating an option with ads that creates an attractive price point for consumers to sign up without creating “a high degree of spin-down behavior,” meaning subscribers switching from high price ad-free tiers to lower ad-included price tiers.

So with all that in mind, here are the details from the fourth quarter letter with news hitting moments before the results that CEO Reed Hastings gives up the CEO title:

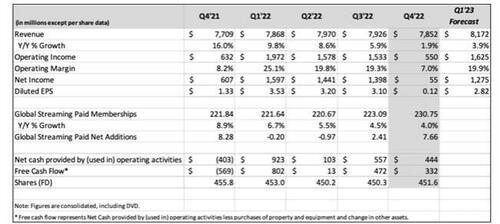

- Q3 Revenue $7.85 billion, +1.9% y/y, in line with the estimate $7.86 billion

- Q3 EPS 12c vs. $1.33 y/y, missing the estimate 42c

But it is the blowout number of subs that everyone is focusing on, to wit:

- Streaming paid net change +7.66 million, down modestly -7.5% y/y, but smashing the estimate +4.5 million

- UCAN streaming paid net change +910,000, -24% y/y, beating the estimate +553,653

- EMEA streaming paid net change +3.20 million, -9.6% y/y, beating the estimate +1.3 million

- LATAM streaming paid net change +1.76 million, +81% y/y, beating the estimate +727,190

- APAC streaming paid net change +1.80 million, -30% y/y, beating the estimate +1.9 million

- Streaming paid memberships 230.75 million, +4% y/y, beating the estimate 227.3 million

- Operating margin 7% vs. 8.2% y/y, beating the estimate 4.45%

- Operating income $550 million, -13% y/y, beating the estimate $393.2 million

- Free cash flow $332 million vs. negative $569 million y/y, below the estimate of negative $199.2 million

The good news: after two quarter of subscriber declines, the company is now seeing two consecutive quarters of sharp subscriber growth.

Looking ahead, Netflix no longer predicts its subscriber growth for future quarters instead focusing purely on financial metrics which for Q1 are largely in line with consensus:

- Q1 revenue $8.17 billion, in line with estimate of $8.17 billion

- EPS $2.82, missing the estimate $2.99

- Operating margin 19.9%, missing the estimate 21.7%

- Free Cash Flow $3BN for 2023, beating the estimate of $2.41BN

But besides Q4 earnings, the company also reported material news that the company’s founder, Reed Hastings, is stepping down as chief executive of Netflix, in a shake-up at the top of one of the most powerful studios in Hollywood. Hastings, who launched Netflix in 1997 as a DVD-by-mail service, wrote in a blog post that he has been increasingly delegating management in recent years. Now is “the right time to complete my succession”, he added. He will stay on as the company’s executive chairman.

“Our board has been discussing succession planning for many years (even founders need to evolve!)”, Hastings, 62, wrote. “I’m so proud of our first 25 years, and so excited about our next quarter of a century”.

To replace Hastings, chief operating officer Greg Peters has been promoted as co-chief executive with Ted Sarandos, who was in charge of programming during Netflix’s massive investment period and promoted in 2020 to co-chief executive alongside Hastings.

The change comes as Netflix has lost more than a third of its market value in the past year, after revealing its decade-long growth spurt had come to an end. Sarandos and Peters will be charged with regaining momentum and leading Netflix through a more austere era for the entertainment industry.

The stock initially dumped as much as 4% on news of the Hasting resignation, before spiking asmuch as 8% and settling about 4% higher at last check.

Developing.

Tyler Durden

Thu, 01/19/2023 – 16:15

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com