Why 0DTE Is So Important, And Why The VIX Is Now Meaningless

By Peter Tchir of Academy Securities

Why Do I Keep Thinking 0DTE stands for Zero Dark Thirty?

There is a lot to talk about this week:

-

How we nailed the inflation story and got the Powell presser more or less right, but got the market reaction completely wrong. The rally on Thursday caught me completely by surprise (though in hindsight, it shouldn’t have – which brings in 0DTE). And, to be perfectly honest, who would have thought that with Treasuries down, earnings misses, and less than stellar guidance the previous night from some tech heavyweights stocks might close in the green? They did briefly, before fading into the close.

-

We published a detailed report on the U.S. debt profile – link here and the Fed’s holdings of U.S. Treasuries. This was to give people a sense of how long it takes for higher rates to really increase our average cost of debt, and to provide a sense of the losses that Congress should expect from the Fed’s QE holdings. More on background than an actionable item, but as debt ceiling concerns are likely to mount, it is good to be armed with some facts and figures.

-

We finished Friday with what was a Stunning Jobs Report. The word “stunning” was carefully chosen (at least by T-Report standards) because it can mean impressive (which the report was), but it can also “cause astonishment or disbelief” which this report managed to do as well! The ADP report was one of the worst reports in some time (though the methodology change could matter), while the NFP report was one of the best in the past year. However, there will always be “buts” when we have such bizarre ways of calculating this data and incorporating revisions. The Household number, which was strong, was almost entirely due to stacking the revisions into the January number and I’m told by people who dug into it that the real number was more like 80k. I haven’t seen the “response” rate, but that has been an issue plaguing many of these surveys. The response rate has been low, leading many to question if there is a “selection bias” that leads to inflated numbers. In any case, the Fed looks at this data and it should sharpen their “hawkish tongues” as they get back on the media and speaking circuit.

-

A Chinese Spy balloon? Please see Friday’s SITREP (and update) for thoughts and comments from several members of Academy’s Geopolitical Intelligence Group. Academy continues to see a rift in U.S./China relations, but I certainly didn’t have “balloon delays Blinken visit” on my bingo card. We do intend to publish World War v3.1 (the battle over chips) early this week, but there were just too many more pressing issues on which to focus.

With all of that said, this weekend’s T-Report will focus on 0DTE or Zero Day to Expiration options. Zero Dark Thirty sounds “cooler” and is military “slang” for half an hour past midnight specifically or a time in the night where operations can be conducted under the cover of darkness – which again, seems to bring me back to 0DTE.

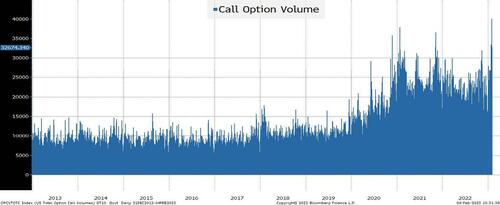

The Rise of 0DTE (first discussed by Zero Hedge last November in “What’s Behind The Explosion In 0DTE Option Trading“, and only now is everyone catching up)

“The Rise of 0DTE” sounds like a “Terminator” sequel, and in some ways it might well be!

Over the past two years we (as market participants) have been forced to understand some heretofore unknown phenomena in order to navigate markets: Meme stocks, Wall Street Bets, and Weekly Gamma Squeezes, to name a few.

We’ve highlighted the growth of trading in short maturity options for a few months now. It started in the past year and has accelerated. It has gone from a blip on our radar screen, to something that was pinging consistently, and now to something that is capturing our full attention.

Randall Forsyth summed up the current zeitgeist well in “Zero-Day Options Fuels Latest Frenzy in the Wall Street Casino”.

Very short-dated options are much more akin to “gambling” than investing. On Thursday, option volumes were dominated by options expiring on the 2nd (true 0-day options) and those expiring on the 3rd (originally longer-dated options that were set to expire on Friday). Friday’s pattern was similar to the vast majority of the most active options expiring that day.

I admit, I pull up MOSO (on Bloomberg) to follow the most active options during the day. It is a bit like watching a horse race. There is SPY Feb 2 410 in the lead. TSLA Feb 3 190 is running a close second. TSLA Feb 3 190 then takes the lead, but up pops TSLA Feb 3 200 from the back of the field. SPY Feb 2 415 is making a charge, but whoa, what happened here, TSLA Feb 3 200 is now the front runner. However, look at this field. Of the 20 top contenders, only one is a put and only one is longer than Friday maturity (an ARKK Feb 17 Call, presumably because ARKK doesn’t have a shorter dated option).

Thursday saw the heaviest call option trading ever recorded (see “Today Was The Largest Option Volume Session Of All Time”)! The relatively tiny premiums involved in 0DTE allowed massive notional lots be traded. It is the ultimate way to leverage your “portfolio”.

Put option volumes also ticked up and were relatively balanced with calls on Friday – which may be why the “rip” into the European close faded throughout most of the day. This could be an important feature of 0DTE options trading that differs from the “meme stock” crowd (which tends to be a “long only” trade).

Forget VIX

The VIX calculations use S&P 500 option contracts with more than 23 days and less than 37 days left to maturity. So, none of the 0DTE options trading impacts VIX.

You can stare at VIX all you want, but you are unlikely to get much useful information. Speculators, vol sellers, covered call sellers, and hedges have all moved their money from the more expensive options (included in the VIX options) to less expensive options. Some option purists will scream bloody murder that the daily option implied volatility is way more expensive than it is in the longer-dated options, but they are being too smart for their own good as this is about leveraged dollars, not trading implied versus realized volatility.

It may still be valid to look to VIX for a signal, but if those options that go into it are not the “trading vehicle of choice” then how should we expect a timely “early warning” signal? I don’t think that we can. VIX has been drifting lower and lower on my daily “market checklist” and risks dropping off of the screen entirely. I get far more information pulling up the MOSO screen compared to knowing where VIX is.

Ironically, VIX 0DTE calls were being bought on Friday during certain parts of the day (so there is still correlation), but I think that it will be a coincidental indicator at best and more likely a lagging indicator for any larger moves.

Why It Matters

So far, I’ve done little to explain why I think that it is so important. When we used to write about the “Gamma Squeeze” we focused on stocks and ETFs where early in the week you would see weekly option volumes tick up. You’d get large activity in a strike price that seemed unreachable (certainly in a week). Then you would see buying activity in the stock and options across the board. That would start driving the price higher causing more buying until (lo and behold) that previously “unreachable” strike is now in the money.

The 0DTE options trading has some advantages:

- It is less reliant on single stocks, which I think lets more people participate in the game.

- The low dollar price of these options lets even smaller players control more notional.

- You can do it every day! Literally every day is set up to try to gap things higher (or lower). I think lower is also a feature more likely to appear in 0DTE trading than even in the “traditional” gamma squeezes.

But I still haven’t explained “why it matters”, so let’s try to do that here.

I will use SPY (S&P 500 ETF) because that seems to be a fan favorite in the 0DTE space.

Let’s say SPY opens at $412 on Monday (it closed $412.35 on Friday).

I buy a SPY 420 Feb 6 Call. It should cost a few cents, let’s say 10 cents. The SPY Feb 6 415C closed Friday at $0.60 and the 420 is a full percentage point more out of the money than the 415.

I could buy that from an existing options holder, from an options market maker (who may delta hedge it), from someone writing a covered call, or from someone selling it “naked” to get some premium.

The “delta” or the amount of SPY represented by a 420 call expiring that day when the stock is at 412 is minimal no matter what volatility assumption you use.

So, I’m buying this option as a lottery ticket. Presumably most others are as well. At some point, there will be sellers that didn’t hold the options. Let’s look at their behavior:

- Market Maker. They sell the option and buy 2% of the notional of the stock (the “delta”). That’s not the “correct” amount, but close enough. At this stage they sold the option and created a tiny amount of buying interest in the stock.

- Covered Call Writer. They sell the option and they’d be okay if SPY gets called away at 420 (they tend to focus more on single names, but let’s simplify for now).

- Naked Call Writer. The proverbial “picking up nickels in front of a steamroller”. They are going to collect some premium income on these “crazy” trades people are willing to spend money on.

Now, lets say we get “good” news and suddenly SPY is at 416. This will have impacted everyone in the 415 Calls in the same way we will demonstrate on the 420 and that may well be why the news got us to 416 in the first place, but this is getting complex and circular (because it is).

SPY jumps to 416.

- Market Maker. Has been buying stock on the way up. Maybe 1% out of the money is a 20% delta, so they had to increase their stock holding from 2% to 20% of the notional (would have added pressure).

- Covered Call Writer. Starts wondering if they really wanted to let go of the stock at 420 because things feel so good.

- Naked Call Writer. Little nervous here. Do they buy some calls? Buy some stock? Sit on their hands? Definitely a wildcard.

This complex interplay of gamma and 0DTE options across a number of strikes and a number of similar stocks/indices gets SPY to 422.

- Market Maker. Would have been buying more and the delta is likely much higher than 50% or they would be buying all the way up and would have to start buying more for every tick higher. This adds real buying pressure.

- Covered Call Writer. Do some buy the stock or try to buy back the call because they regret not holding it? It wouldn’t take many people doing this to put further price pressure on the stock because the bulls would be fully in charge of the price action.

- Naked Call Writer. PAIN. Many will cover or be forced to cover as not everyone can sit there accepting that selling something for 10 cents might cost them $5 or more (currently costing them $2).

Like everything else in trading, this doesn’t work in isolation.

Positioning plays a crucial role in helping this sort of strategy work. You don’t need to “share the idea” because it is so visible that it attracts attention, but sharing the ideas and “profitability” helps (my social media stream is getting clogged up with “turn $500 into $100,000” with 0DTE). Thursday was ripe picking for this strategy for many reasons and it worked!

Puts Can Work as Well

This strategy can work (and has been working) in either direction and there were some high put activity days. 0DTE trading tends to amplify moves in “both directions”.

On Friday, it seemed like many got sucked into the “this only goes up” mantra (which almost worked), but 0DTE is different than meme stocks in that respect.

Windshield Wipers

I’m thinking of 0DTE as a “windshield wiper” strategy.

- It can push higher and if something cracks, it can drive it a lot higher.

- If nothing cracks, then they can push it lower. If something cracks, then they can drive it much lower.

This is a game of high leverage where you spend 50 cents knowing that you will lose on a bunch, but you can hit a few $5 tickets and be an overall winner.

What Stops It?

More prudent options sellers. The weekly gamma squeezes seemed to stop working once market makers decided what realistic vol was. Then they doubled that to be safe, doubled it again to be extra safe, and then doubled it one more time for good measure. Suddenly squeezes didn’t work as well.

We are far from that occurring since I suspect a lot of today’s readers will dismiss the focus on 0DTE as the “ravings of a madman”.

It won’t be the first time, but I suspect that within weeks this will be the biggest topic of conversation out there (helped by the fact that we can stop talking about the Fed for a few weeks and the debt ceiling issue is still a bit distant). It is occupying 90% of my conversations and not just because I bring it up.

I do not think that this is an “up” only strategy, so be careful next week. The one lesson (even for those who don’t really believe that 0DTE is important) is that it helps drive stocks higher. That, I think, is not the correct lesson, though it certainly was true on Thursday!

Bottom Line

For me (and I haven’t been positioning aggressively) it means running smaller risk and covering when it is going against you, or at least waiting longer to add to losing positions as the 0DTE option trading will extenuate moves!

On the bright side, it was fun to think about something other than central bank policy, if only for a few hours!

Tyler Durden

Sun, 02/05/2023 – 15:00

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com