It Hurts When You Have To Chase the Market Rally

By Michael Msika, Bloomberg Markets Live strategist and reporter

A surge in equity markets when most investors are still underweight stocks is causing pain. No wonder that the fear of missing out on the rally is gaining traction, prompting those watching from the sidelines to buy into any dips.

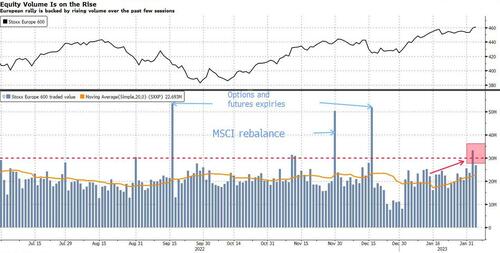

Receding inflation, increasing talk of a peak in bond yields and a resilient economy suggest a soft landing can be achieved after all. Traders are decidedly glass half-full and equity volumes are picking up.

Even outrageously strong US job data Friday — fodder for hawkish Federal Reserve policymakers — had no impact on European stock prices. The Stoxx 600 entered a bull market and London’s FTSE 100 hit a record high.

“Central banks not pushing back on dovish market expectations have turbocharged the Goldilocks mood, despite rather uninspiring fourth-quarter earnings,” says Barclays strategist Emmanuel Cau. While a majority of investors have been reluctant to chase the rally and remain under-exposed to equities, that’s something he says may change given the positive momentum.

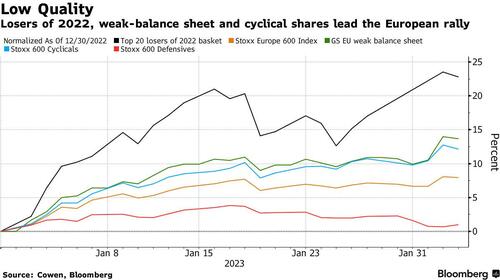

Some may question the quality of the sharp upturn, given that it’s being led by names that were last year’s biggest losers and by beaten-down cyclicals. Part of the bounce could be short covering and investors chasing cheap valuations, with these stocks still 55% lower on average since the start of 2022.

“What I do think short term is that those skeptical asset managers who stayed put during the rally won’t be able to stay passive much longer, which could lead to a swift rise followed by even heftier profit taking, given the technical levels we are going to reach,” says Mikael Jacoby, head of continental European sales trading at Oddo Securities. A lack of big surprises from ECB policymakers this week meant “good news,” he adds.

The rally already looks stretched by many measures, and the big question is where the inflection point could be. More than 90% of Euro Stoxx 50 components are trading above their 200-day moving average — the highest reading since April 2021 — and while it didn’t indicate a strong reversal back then, the market still took a breather.

Down the line, strategists at BofA believe monetary tightening will take its toll on the economy and on markets. US-based Michael Hartnett says first-quarter highs for the S&P 500 are “likely before Valentine’s Day,” while his European counterpart Sebastian Raedler sees stocks as “unlikely to avoid a drawdown” as the recession materializes.

The first victims of a reversal could be cyclical stocks. These economically sensitive shares have outperformed defensives aggressively in the past month and are close to erasing the losses they suffered after Russian invaded Ukraine, leaving them already priced for further economic expansion.

If the rather underwhelming, though not catastrophic, earnings season hasn’t fazed investors, analysts have quietly kept on cutting estimates. The proportion of companies beating EPS projections has dropped significantly this quarter, in both Europe and the US.

“We doubt that the current stabilization in European macro data will transition into a meaningful economic recovery this year, given the lagged impact from higher rates and rising energy costs,” says Morgan Stanley strategist Graham Secker. He notes that it takes two years for the effect of rate hikes to show up in trailing EPS. “Our top-down EPS forecast for -10% this year still looks very plausible to us.”

Tyler Durden

Mon, 02/06/2023 – 12:47

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com