Investors Say They Want Companies To Save Cash, But They’re More Than Happy To Reward Those Buying Back Stock

By Sagarika Jaisinghani and Michael Msika, Bloomberg Markets Live reporters and strategists

Meta, Big Oil Lead $160 Billion Buyback Revival

Investors may say they want companies to save cash rather than repurchase stock, but they’re more than happy to reward the increasing number doing otherwise.

Bumper buyback announcements worth more than $160 billion from the likes of Meta Platforms Inc., BNP Paribas SA and Equinor ASA have brought enthusiastic responses this earnings season. Those that suspended programs — such as Carlsberg A/S and British American Tobacco Plc — or shied away from setting out new plans have been punished. Both in the US and Europe, buyback announcers have outperformed benchmark indexes by 6 percentage points in the past year.

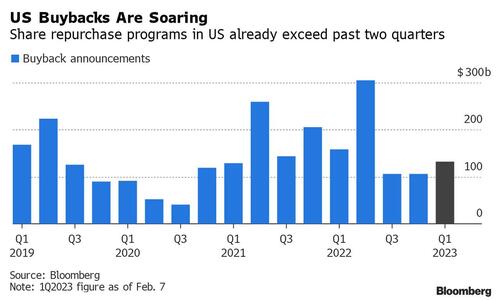

After slowing down last year as firms braced for a bleaker economic outlook, stock repurchase plans have roared back in 2023, led by energy firms such as Chevron Corp. and Exxon Corp. as soaring oil prices brought cash flooding in. That’s despite 53% of the participants in Bank of America Corp.’s latest fund manager survey saying they’d rather see corporates shoring up balance sheets, and less than a fifth opting for higher shareholder returns.

Not even a new US tax on buybacks or calls for further levies by President Joe Biden have acted as a deterrent, and at $132 billion in January in the US, repurchase plans notched the best ever start to a year.

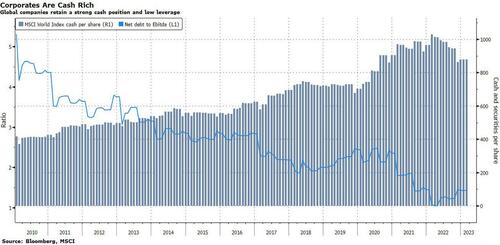

Companies with still large post-pandemic cash balances are returning increasing amounts to investors as they face “relatively limited investment opportunities in light of a worsening economic backdrop and rising uncertainty,” said Marija Veitmane, senior multi-asset strategist at State Street Global Markets.

In Europe, this year is shaping up to be one of the best ever for buybacks, with announcements totaling about $30 billion so far. Along with energy firms, banks have been leading the way as higher interest rates have provided a boost to their income. Goldman Sachs Group Inc. strategist Sharon Bell said she expects repurchases to be one of the main drivers of stock demand in the UK in 2023.

With the economic climate still so uncertain, companies have cause to prefer returning cash via buybacks, given they’re much easier to suspend or reduce than dividends. Moreover, buybacks produced capital gains but no immediate tax bills until this year, when a 1% excise tax went into effect in the US. In his State of the Union address this week, Biden called for quadrupling the levy.

One argument against buybacks is that companies would be better off investing the cash into research & development, ensuring they maintain a competitive advantage over the longer term. But as interest rates remain high, “shorter-duration equities” are more attractive, “perhaps at the expense of those hoping to tie up capital for longer-time horizons,” said Ross Mayfield, investment strategy analyst at Robert W. Baird & Co.

That’s not to say companies announcing buyback plans this season have ignored R&D investments. BP Plc on Tuesday hiked its dividend and extended buybacks, but also pledged to accelerate investments in both low-carbon energy and fossil fuels. Its stock jumped 8% to the highest since November 2019.

“It’s not an either/or situation for buybacks versus capital expenditure and a majority of companies are continuing to invest as appropriate in R&D,” said Brian Ferguson, a portfolio manager at Newton Investment Management.

To be sure, not everyone is sold on the benefits of stock repurchases.

“Buybacks create incremental demand for shares, pushing them higher and enriching executives with stock options or underlying shares,” said Michael Green, portfolio manager and chief strategist at Simplify Asset Management. “Whether they are a good deal for long-term shareholders is debatable.”

BAT shares tumbled by the most in nearly two years after the firm’s decision to end a share buyback program disappointed some investors.

Tyler Durden

Fri, 02/10/2023 – 10:55

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com