The Yield Curve Would Invert By A Record 450bps If The Fed Hikes To 8%

By Michael Every of Rabobank

Duh, Kapital

Balloons blow, and capital won’t flow. ‘US Makes Case That Chinese Balloon was Part of a Spying Program’, says Bloomberg, and “The Chinese spy balloon shot down Saturday included western components with English-language writing on them.” ‘US Aims to Curtail Financial Ties With China’, says the New York Times, with the White House preparing rules to restrict US dollars from flowing there. An inverse CFIUS would stop US investment in areas related to technologies like AI; or with dual civilian-military uses, which is a longer list; or balloons.

Markets are not going to like that because it’s anti-Marx. I don’t mean the CCP, though that is also true, but rather Karl’s quote that: “The bourgeoisie has through its exploitation of the world market given a cosmopolitan character to production and consumption in every country. To the great chagrin of Reactionists, it has drawn from under the feet of industry the national ground on which it stood. All old-established national industries have been destroyed or are daily being destroyed…. In place of the old local and national seclusion and self-sufficiency, we have intercourse in every direction, universal inter-dependence of nations.”

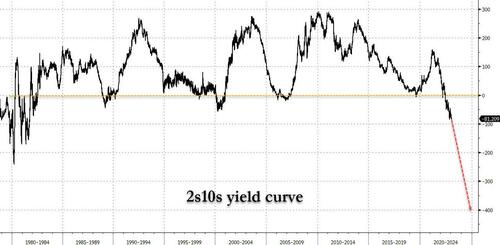

Talking of capital flows, yesterday US yields rose again and the 2s -10s yield curve spread widened to most since the early 1980s, at one point reaching 86bps – and that is with the 2-year yield still 100bps lower than the 5.50% terminal rate that our Fed watcher Philip Marey now has penciled in for this year. However, things can get worse. Philip sees the risk of a US wage-price spiral becoming embedded, as does Fed Chair Powell in talking about a “structural” shift in the labor market. That leads Philip to flag that Fed Funds might have to go to 6% – and today Bloomberg quotes one analyst saying 8% rates are needed to bring US inflation down to 2% again. (If 5.50% was science-fiction a year ago, 8% was *bad* science-fiction, like ‘Plan 9 From Outer Space’.)

The deepening US curve inversion shows the market refuses to see the same risks of a wage-price spiral: the long end would hypothetically by 450bps inverted if it didn’t move and the Fed did to 8%.

In doing so the market is adopting a Marxist view that capital has so much power vis-à-vis labour that wages can’t get out of control. For a long time that has been a really accurate call. However, there is building evidence of a Covid effect on OECD labour markets, and others: Thailand recently floated using prisoners in the under-staffed tourist sector, giving a whole new meaning to ‘Let me take your bag, Sir.’ Moreover, we might be seeing labor hoarding because firms realize having no labor makes their capital worthless. If sustained, that would undermine Marx’s claim that capitalists maintain a “reserve army of labor”, i.e., high unemployment to ensure wage demands never rise.

Of course, one can push back against this, as a Marxist dialectician must, to say that central banks don’t understand the political-economy or Marx, which is ironically an argument for an inverted yield curve, because they risk over-tightening.

However, the long-end view that the bourgeoise elderly are retiring, so asset prices must be high, so yields must be low, clashed with an inverted US demographic pyramid even pre-Covid. A retirement wave now means fewer workers; so wage pressures; so inflation pressures; so higher rates for longer; and so lower asset prices; unless one is focused on the bourgeoise elderly – “OK, Marxist Boomer.”

Moreover, it seems an odd dichotomy to conceive that capitalists are ruthless, short-term, amoral exploiters (so low wages), yet capital markets are thoughtful, rational, and forward-looking (so low yields). Enron, Madoff, and Bankman-Fried are obvious retorts, as is the fact that Wall Street thinks about end-quarter returns and remuneration, not Marx. On that basis, the capital market is as willing to be ruthless, short-term, amoral, and exploitative: and what it wants is lower rates, to allow a broader re-risking, end-quarter returns, and remuneration.

Just as a reserve army of labor is created by capitalists to ensure wages cannot rise much, a reserve army of liquidity flows from capital markets to the long end of the yield curve to ensure yields cannot rise much either. That forces the Fed to keep doing more on rates to compensate for the easing of financial conditions the market is creating. If that then leads to a Fed policy error, recession, and the mass mobilization of a reserve army of labour, then it’s just collateral damage to end-quarter returns; and the market will have created it, rather than having predicted it. Perhaps they are Leninists, not Marxists, willing to give history a violent push in the right direction. Yes, this again supports an inverted curve – just not for the kind of intellectual reasons one thinks.

Of course, capital markets can be forced back – the Fed’s Williams recently underlined that rates are not just moving vastly higher than capital thought a year ago, but will stay higher for longer. But such talk is cheap, as is the long-end cost of borrowing in real terms. Far more effective is the kind of blunt instrument we see the Biden administration about to use vis-à-vis China.

Importantly, all this theorizing will reach a point of praxis soon. What will tip the market scales one way or the other will be wage growth. If there really is no more reserve army of labor, we are going to see wage growth stay high. If there is a reserve army of labor, we won’t. It’s not just a case of ‘duh, Kapital’, but ‘duh, Labor’.

We will find out what the BOJ has to say about both shortly too, as next week (11am local time on February 14) will see the nomination of the next Governor. Do we get a hawk or a dove? Does that imply a market-wrenching shift in BOJ policy? Again, praxis looms.

The RBA quarterly Statement on Monetary Policy today also saw the Bank raise its forecasts for core inflation, now 6.25% y-o-y in the year to end-June, up from 5.5%, but then falling back to 4.25% by December (because reasons). Wages are expected to rise 4% y-o-y by June and peak at 4.25% too, despite a white-hot labour market, despite 1/3 of firms surveyed by the RBA hiking wages by over 5% in Q4 (because reasons). Those forecasts are based on the RBA overnight cash rate peaking at 3.75% this year then declining to 3% by mid-2025, both of which are open to question at this stage. Aussie GDP growth is now seen at 1.6% in 2023 and 1.4% in 2024, against population growth of 1.5%, which implies a lot of net immigration, and a slight decline in GDP per capita. Overall, the SoMP was taken as hawkish – but trying to decipher its inherent contradictions, as the RBA tries not to spook housing while talking tough, is a challenge even for a Marxist.

Today saw Chinese CPI and PPI too: the former was 2.1% y-o-y, up from 1.8%, but as expected, and the latter was -0.8% y-o-y, weaker than then -0.5% expected. Lots of challenges for Marxists there too, even if different ones from the West.

Meanwhile, global commodity traders Trafigura are facing losses of $577m after nickel shipments were found to be fraudulent. That’s painful for them, and for markets expecting cheap nickel as a key input for ongoing green transitions, especially as it comes after the LME’s scandal over nickel trading. That means higher inflation as part of that transition. Of course, higher US rates for longer would help push commodity prices lower for everyone, as well as asset markets in general; and ‘nickel and dimes’ also points out the problems inherent in trying to move away from dollars to commodities as currency as a point of geopolitical praxis. You think fiat is doddy? Try non-existent nickel and copper!

Tyler Durden

Fri, 02/10/2023 – 09:20

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com