PBOC’s “Unrounded” MLF Operation May Put Floor Under China Rate

By Helen Sun, Bloomberg markets live reporter and strategist

The PBOC injected a net 199b yuan of medium-term loans Wednesday, 1b yuan shy of the market expectation. This is the second month in a row it decided not to provide liquidity in a round number (was 779b in January), signaling its cautious stance against excessive liquidity in the financial system.

This will probably put a floor under China’s rate swaps and money-market rates, barring any surprises on the economic recovery.

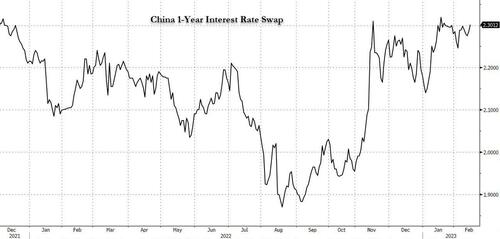

Today, the cost of 1-year interest-rate swaps climbed to a two-week high, nearing the recent peak reached in November 2022, and will probably stay elevated.

The central bank gauges lenders’ needs for such funds ahead of its operations, and in the statement today it said demand from financial institutions has been “sufficiently met.” In another sign of its cautiousness, the PBOC has been draining funds for three consecutive days in the daily reverse repo operations, pulling a combined 844b yuan after injecting a net 1t yuan that helped to bring the overnight funding cost off a two-year high.

Tyler Durden

Wed, 02/15/2023 – 17:45

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com