Hartnett: “The Next Great Bull Markets Starts After The Next Recession, When The Fed Is Forced To Bail Out The US”

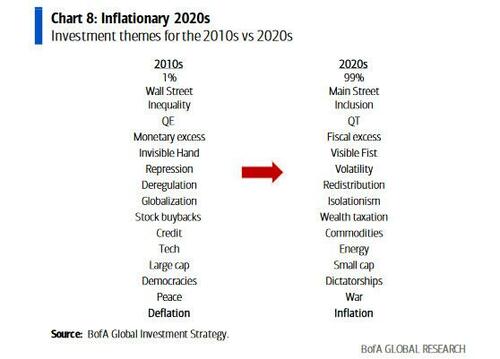

In his latest Flow Show note (available to pro subs here), BofA CIO and the most accurate Wall Street strategist of the past several years, Michael Hartnett, looks at the year anniversary of the Ukraine war and makes the following observations: “war = inflationary de-globalization theme = higher rates”; no surprise than that theme “winners” of the past year are: energy 29% (XLE), manufacturing re-shoring 21% (AIRR), defence/aerospace 14% (PPA), natural resources 14% (IGE), and the “losers”: Bitcoin -39%, innovation -34% (ARKK), bonds -23% (TLT), oil dependency -19% (Taiwan/Korea).

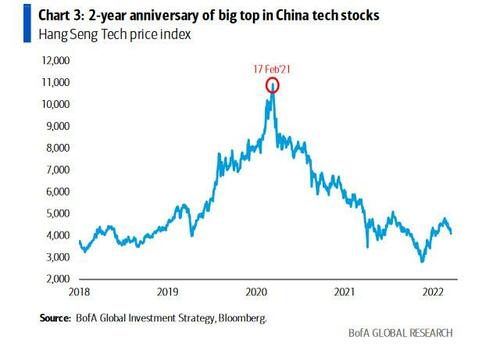

But while that anniversary will dominate the airwaves this weekend, traders will be quick to remind us that today is also the 2-year anniversary of the secular peak in China tech which as Hartnett writes was the “1st QE bubble to pop, HSTECH was 11k, now 4k, in classic post-bubble trading range.

Since then a lot has changed and the following anecdote from Hartnett in neighboring Japan captures it best: “biggest 5% wage hike at Honda in 30-years as BoJ emergency buying bonds to maintain failed YCC regime – a humiliating end to QE-era… Meanwhile Tesla prioritizing battery-cell production in US not Germany due to protectionist tax breaks in Biden Inflation Reduction Act” which again brings us to “war, protectionism, de-globalization…higher inflation, higher rates.“

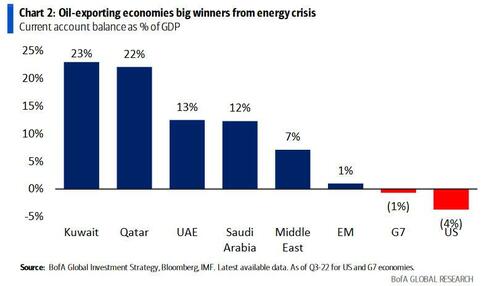

And higher debt, of course, but mostly in “developed countries” – the best government balance sheets in world are now those belonging to oil-exporting Gulf economies which according to the BofA strategist are the “biggest winners from war, transition to net zero, energy crisis; current account surplus of Gulf Cooperation Council (GCC) is 15% GDP today vs 4% for US and -1% for G7…hence launch of 1st Middle East US$ Bond ETF (ticker TGCC, yielding 5.4%).”

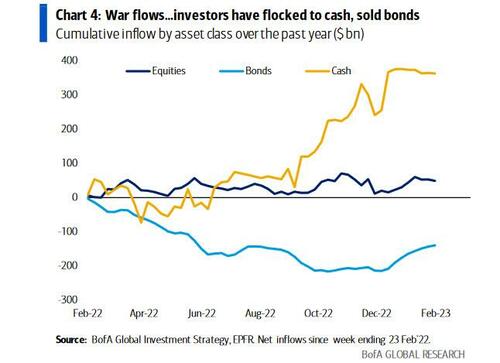

The impact of the war has also been felt in asset flows, where cash has been the biggest beneficiary: as hartnett shows in the chart below, since Feb’22. flows have been $354bn to cash (largely thanks to sharply higher interest rates), $40bn to equities, $12bn from gold, $135bn from bonds.

As for flows in the latest week, here we have seen some notable risk-off largely due to the continued selling in stocks: $4.9bn to bonds, $0.7bn from gold, $3.8bn from cash, $7.0bn from equities. Here are the flows to know:

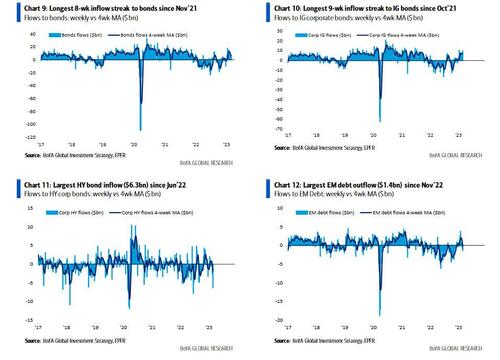

- Bond inflows $4.9bn, longest 8-week inflow streak since Nov’21 (Chart 9);

- IG inflows $9.9bn, longest 9-week inflow streak since Oct’21 (Chart 10);

- HY outflows $6.3bn, largest since Jun’22 (Chart 11);

- EM debt outflow $1.4bn, largest since Nov’22 (Chart 12);

- US equity outflows $9.0bn, 3rd straight week of outflows;

- Outflows resume to financials ($0.5bn), after 4 consecutive weeks of inflows;

- Outflows resume from US growth ($1.6bn) after 2 straight weeks of inflows.

But what about the one thing everyone wants to know: what does Hartnett think stocks do next. Here, nothing has changed from last week when as a reminder, Hartnett predicted that “the S&P will swoon to 3,800 by March 8″ after the market it failed to rise above 4,200 just as Hartnett had also predicted earlier.

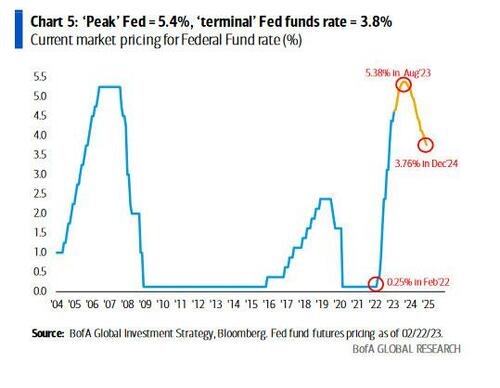

Today, Hartnett picks up on this forecast and repeats that this “3.8K by 3/8” prediction is mostly driven by tighter global financial conditions, as the “Jan “no landing” data will be followed by Feb “no landing‘ data (released early March)” which will propel yields up >4% = SPX <3.8k, a repeat of what he said last week, when he laid out his expectations that resilient growth in the first half of the year will coincide with higher interest rates and lead to a sharper economic slowdown in the second half.

Meanwhile, in just a few short weeks, the Dec’24 Fed funds rate expectations were 2.9% before the blowout (and laughably seasonally adjusted) Jan payrolls, and are now 3.8%.

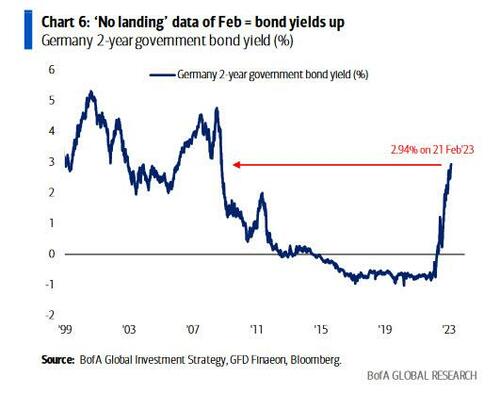

At the same time, German 2-yields have risen to 14-year highs, and today rose above 3%.

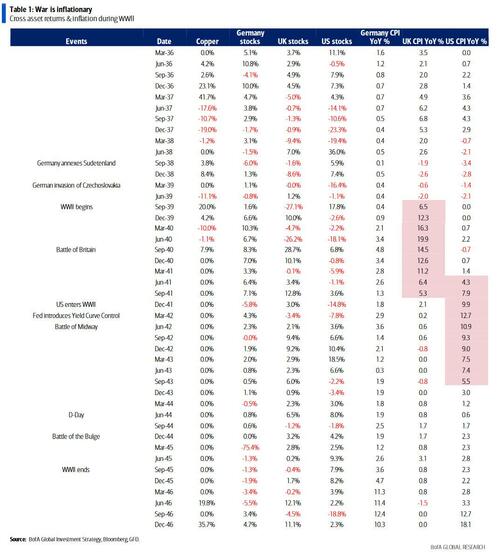

The bottom line (in case he didn’t repeat it enough times already today): “war is inflationary and causes higher bond yields (see WW2 asset prices).”

Unlike last week, Hartnett concludes not with his downbeat – if accurate – truism that Fed tightening cycles always “break” something…

… but that bigger picture means there really is no other alternative. Recall one week ago we showed the CBO’s long-term US debt/GDP forecast which can only be described as “game over.”

The CBO just published the single best ad for precious metals and cryptos.

In case there is confusion, this is the “game over” forecast. pic.twitter.com/dc7descDnm

— zerohedge (@zerohedge) February 15, 2023

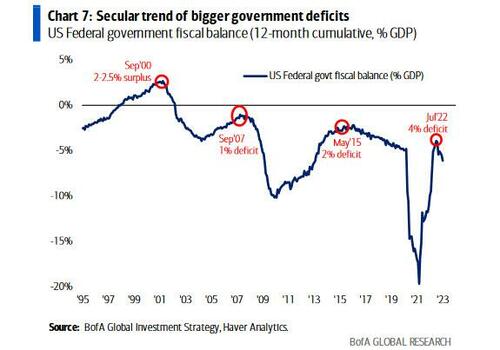

Hartnett agrees, and writes that while fiscal stimulus panic (energy price caps/rebates, bailouts, nationalization) was successful in averting recession in early-2020s; the offset is that deficits are rising again: UK Jan’23 fiscal deficit up to 5.2% of GDP, due to higher energy subsidies; EU energy bailouts > $750bn past 12 months; US Federal deficit up to 6.1% of GDP (was 3.9% of GDP Jul ’22) due to fiscal infrastructure spend; at peak of 2000 expansion, US ran fiscal surplus, peak of 2007 expansion deficit was 1% of GDP, peak of last expansion deficit was 2.5% of GDP, in latest one deficit was 4% of GDP…

…clear secular deterioration.

Hartnett’s punchline is also his “endgame” trade recommendation – go all in the next big recession, when the Fed goes all-in “Japan”, and is forced to launch yield curve control (YCC) the same way it did during World War 2, to keep the dollar reserve status, and the western financial system from disintergrating:

“US government debt to rise >$21tn next 10 years = $5.2bn every day, $218mn every hour… the great irony of inflationary 2020s will be in next recession Fed forced to resort to YCC to bail out US government…and that’s when the next great bull market in risk begins.”

Somewhere Zoltan Pozsar is smiling.

More in the full Hartnett Flow Show available to pro subs here.

Tyler Durden

Fri, 02/24/2023 – 18:00

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com