Morgan Stanley: “Maybe This Time Is Different”

By Seth Carpenter, Global Chief Economist at Morgan Stanley

As markets look to the future, the standard practice is to assume that cycles are cycles, and taking history as a guide, anyone shouting, “This time is different” is met with skepticism. But of course, we have all lived through Covid now, and that fact alone sets this cycle apart from others. So, it is worth asking, “What is different this time and what is not?”

The Covid pandemic distinguishes this cycle from any post-WWII business cycle. Demand collapsed in a highly correlated way. Nearly every economic data series now has a very clear statistical break, marking the first difference relative to other cycles.

The key characteristic of this cycle is volatility in supply and demand, and how shocks evolved across different sectors. The initial collapse in demand for both goods and services was followed by a resurgence of demand for goods against a sclerotic supply chain. The decoupling of demand for goods from demand for services had not been seen in previous cycles. The initial collapse in demand led to disinflation, but the surge in demand for goods in particular led goods inflation to decouple from services inflation.

Subsequently, services demand recovered as the economy reopened, but the reopening was rife with frictions, as a large swath of the labor market reinvented itself or was displaced for a period of time. While the collapse in demand was highly correlated, the recovery was not. One consequence of this rather uncorrelated cycle is that inflation has been noisy. Today, we see that inflation for goods has retreated notably, but services inflation remains robust, even after an aggressive tightening cycle.

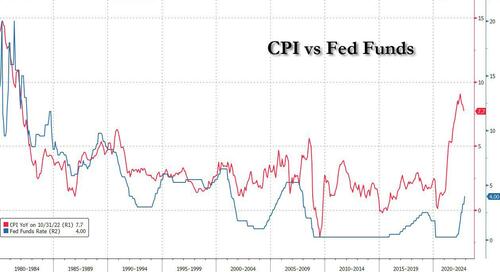

With inflation running higher than at any point since the 1970s, we have another key difference. The Federal Reserve (and other DM central banks) is hiking rates to bring inflation down.

This hiking cycle is the first since the 1970s with that motivation. Put differently, in most previous cycles, hiking rates went along with strong growth, and when growth and earnings showed signs of slowing, policy retreated. This time, the Fed is intentionally raising rates to slow growth substantially below the potential growth rate of the economy and plans to keep them high while the economy slumps. This central bank strategy is clearly a key difference relative to other cycles.

So, where does this discussion leave us? Why is it important to highlight the differences in this cycle? We have had a “soft landing” view for the US for a long time. The pushback has consistently been that previous cycles have not had soft landings, so it is not reasonable to forecast one now. We were comfortable that there were enough differences in the cycle to produce a different outcome. The market narrative has shifted toward us, and now the question arises whether we are actually seeing enough slowing or even a re-acceleration.

So far, we do not think that there is sufficient evidence to change our fundamental view of a slowing economy. And, going back to the Fed’s strategy of intentionally slowing the economy below potential to squeeze inflation out, a “no landing” scenario does not really make sense to us.

But the data for January do reflect underlying strength. The seasonally adjusted non-farm payrolls were strong, reflecting much less of a contraction in jobs than is typical for a January. This labor hoarding dynamic is a key part of why we have been in favor of a soft landing. In past cycles, when there has been a slowdown, there have been waves of layoffs.

This time, we see that pattern in tech, but not across the rest of the economy. So, maybe this time is different.

Tyler Durden

Sun, 02/26/2023 – 15:00

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com