Inflation Resurgence Will Reignite The Value Trade

By Simon White, Bloomberg Markets Live reporter and strategist

The realization that elevated inflation will linger a lot longer than initially expected should continue to boost value stocks, while disadvantaging the growth segment.

The disinflationary trend is likely to peter out faster than anticipated. It was always destined to end in disappointment for those clinging to the notion of transitory inflation, but I expected the downtrend to last a bit longer, and for CPI to bottom at a lower level than it is likely to trough at before returning to its upwards bias.

Global cyclical inflation pressures, which have hitherto driven headline inflation in the US lower, are likely to turn back up soon, as easing in China finally begins to get traction, and reinforce domestically-driven inflation which has barely budged from its highs.

There are several factors likely to entrench inflation. One is well-discussed, wages, which will keep services CPI elevated and sticky. Less talked about is the influence of profit margins. 2021 saw one of the fastest and sharpest rises in profit margins, as companies took advantage of tight supply and an indomitable surge in demand after the pandemic.

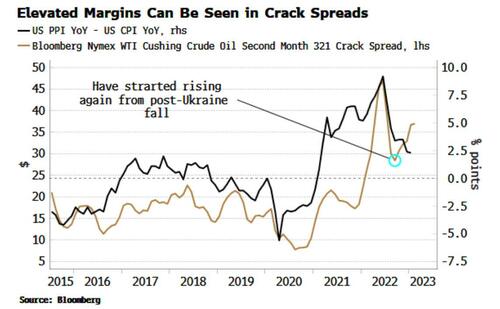

Even as margins fall as demand eases back, they are likely to remain high, helping ingrain inflation. As an example, crack spreads (the difference between gas/petrol and oil prices) show a positive relationship with PPI versus CPI (a proxy for profit margins). The fact they have started rising again, after the fall from the Ukraine-war highs, is a sign that margins may remain sticky.

Stubborn inflation may be a wake-up call for longer-term bond yields, which have thus far remained relatively contained, in the belief that inflation will soon return to trend and stay there.

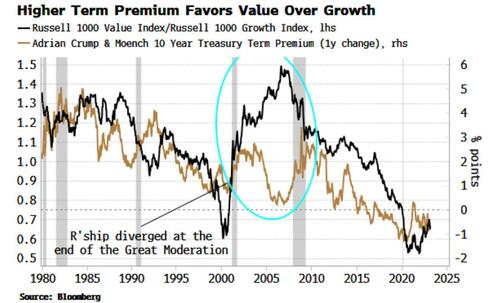

Term premium, essentially the compensation bond holders require for inflation risks, has stayed relatively low, but if there is a realization that elevated inflation is going to be with us for a while yet, term premium could begin to rise. As the chart below shows, this would tend to benefit value relative to growth stocks.

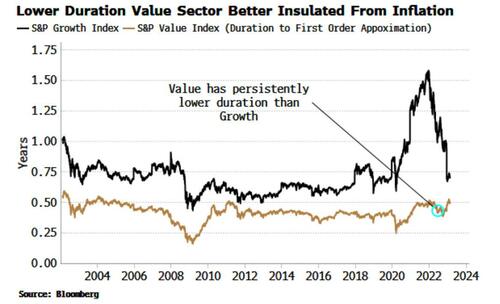

In inflationary environments, holding lower-duration assets is preferable. Value stocks are generally lower duration than growth stocks, meaning they should weather inflation better.

The US stock market overall continues to look overvalued, despite a protracted bear market. Rekindled inflation would point towards value as a factor to focus on for outperformance.

Tyler Durden

Wed, 03/01/2023 – 07:20

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com