China People’s Congress Reveals Conservative GDP Target Of Just 5% For 2023

The 2023 National People’s Congress started today (March 5th; our preview is here). Outgoing Premier Li Keqiang delivered the Government Work Report (GWR) (his last), which outlined key economic targets for this year. Here are the highlights:

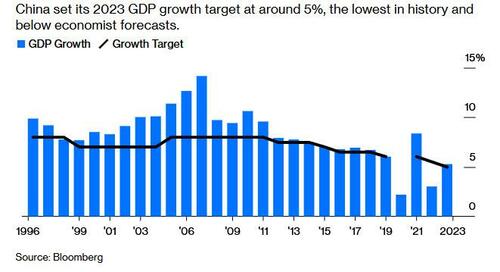

- Policymakers aim to achieve “around 5%” GDP growth target in 2023, the lowest in history and less ambitious than the “above 5%” or “5%-5.5%” discussed by most investors (for more see “China’s 5% GDP Target Signals Crackdowns Are Not Over“).

- Over the last several months China had shown signs of a healthy rebound, with economists polled by Bloomberg raising their forecasts, seeing a 5.3% expansion this year, versus 4.8% in early January. Even top officials were reportedly surprised by the economy’s resilience.

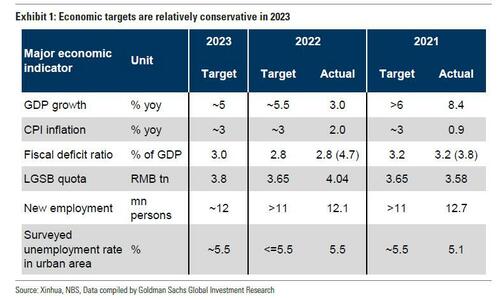

- Fiscal targets (both the 3% official on-budget deficit ratio and the RMB 3.8 trillion local government special bond issuance quota) also appeared slightly more conservative vs expectations. This set of economic targets is consistent with expectations that the broad cyclical policy stance would normalize this year from the very expansionary stance in 2022, although the pace could be gradual and likely hinges on the progress of consumption recovery.

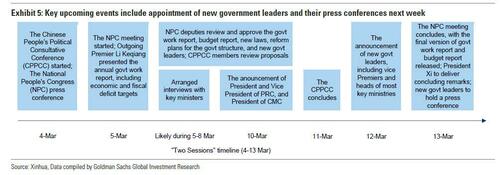

Economic targets are more important than policy tone in today’s GWR because this year is the year for the reshuffling of government leaders. The official targets likely reflected new leaders’ expectations on the economy. The press conference to be held by new government leaders on 13 March may convey more forward-looking policy clues.

Below we drill down into the key highlights from the Two Sessions, courtesy of Goldman’s Maggie Wei and Hui Shan.

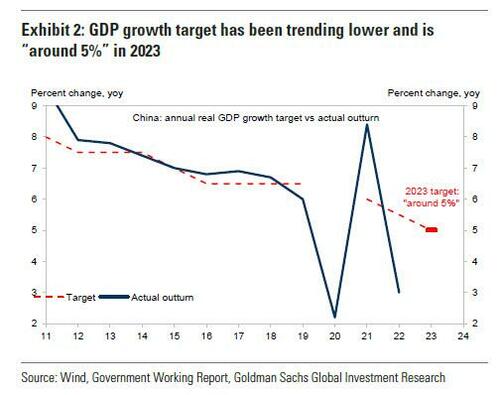

1. The GDP growth target is “around 5%” this year, lower than the “around 5.5%” target in 2022, in line with Goldman’s expectation but slightly less ambitious than the “above 5%” or “5%-5.5%” discussed by some investors. This target implies in practice that any GDP growth rate above 4.5% is probably acceptable. Considering the low base of growth (real GDP growth only at 3% yoy in 2022), the growth target this year is not challenging. For its part, Goldman continues to expect 5.5% GDP growth in 2023 on the back of a rebound in household consumption after reopening. The fact that policymakers missed the “around 5.5%” growth target in 2022 might be one consideration behind the relatively unambitious growth target this year. Consistent with the statement following the Central Economic Work Conference, the GWR further added that policymakers aimed to achieve both quality and quantity improvement of the economy this year. The CPI inflation target (more like a ceiling in practice) is set at “around 3%” for 2023, and Goldman does not think it would be challenging as the bank expects only a moderate increase in CPI inflation this year after reopening.

2. The official on-budget fiscal deficit target in 2022 will be 3.0% of GDP, higher than 2.8% in 2022. Local government special bond full year quota is Rmb 3.8 trillion, higher than 3.65 trillion in 2022. The augmented fiscal deficit indicator is a more comprehensive gauge of the broad fiscal policy stance as policymakers have other quasi-fiscal tools to support the economy. Goldman expects the augmented fiscal deficit ratio to narrow by 1.5pp this year, from 12.4% of GDP last year, as the pressures on policymakers to achieve the growth target this year would be smaller than last year, and growth drivers are set to shift from government-led investment last year to private consumption this year.

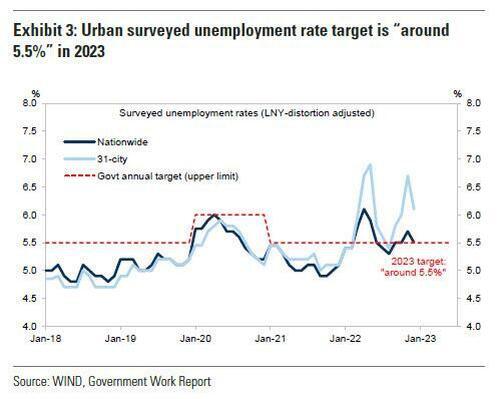

3. The government set the new urban job creation target to be “around 12 million”, and surveyed unemployment rate target to be “around 5.5%”, in comparison with “more than 11mn” new urban job creation and “below 5.5%” surveyed unemployment rate in 2022. These targets are usually not binding and have been pretty easy to achieve – in 2022, despite the 3% headline GDP growth and a very weak services sector (which tended to be more labor intensive than the industrial sector), new urban job creation was 12mn and urban survey unemployment rate was 5.5% as of 2022 year-end, largely in line with government’s targets.

4. The statement around property policy followed recent policy communications – the GWR restated policymakers would help new urban residents and younger generations with their property purchases and also focus on reining in property-related risks. However, the conservative broad policy stance “housing is for living in, not for speculation” was deleted in the “2023 policy suggestions” section of the GWR, and only mentioned as “past achievements” in the report. This might imply more property easing to come, though one should watch whether the new government leaders mention this conservative stance later on March 13th, when they hold press conferences after the conclusion of the Two Sessions.

5. The monetary policy tone in the report is the same as the Q4 2022 PBOC monetary policy report. The GWR reiterated to maintain M2/TSF growth roughly in line with nominal GDP growth and enhance monetary policy’s support to the real economy. In a recent PBOC press conference, when asked whether PBOC would cut interest rates or RRR further, PBOC governor Yi Gang commented that real interest rates were at appropriate levels while lowering RRR to provide long-term liquidity “is still an effective policy tool“, which has left the door open for further RRR cuts when needed, but implied an interest rate cut would be less likely. Goldman forecasts unchanged RRR and policy interest rates this year, given the unambitious growth target and the likelihood of strong growth rebound after reopening.

6. Energy intensity: the GWR this year does not set a specific target but stated that energy intensity should continue to decline. In a separate report by the NDRC, policymakers aimed to “reduce energy intensity by 2pp this year and in practice, try to achieve better results“. The lack of a numeric target in the GWR implies policymakers might want to avoid a situation like late 2021 when production was suspended with power shortages in light of the strict energy intensity reduction target as the economy rebounded.

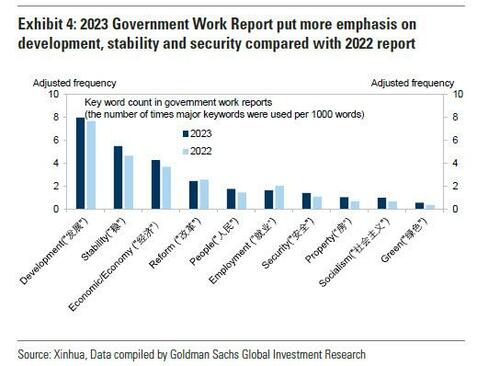

7. As this year is the year for the reshuffling of government leaders, this year’s work report focused more on reviewing past achievements (around 80% of the full length of the report), vs in previous years when the premier usually spent 40% of the full length of the report reviewing the past year but around 60% of the report on policy outlook for the new year.

Economic targets are more important than policy tone of the report as these targets were likely discussed and decided by the new party leaders after the 20th Party Congress. Upcoming key things to watch in the next few days include the fiscal budget report, discussions on the Party and government institutional reforms, and appointment of the new government leaders and new government leaders’ press conference.

Tyler Durden

Sun, 03/05/2023 – 14:00

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com