1-Year Inflation Expectations Tumble At Fastest Pace On Record

So much has changed in just a few days: one week ago people cared about boring stuff like seasonally adjusted payrolls (a product of White House administration propaganda as much as actual data) and the readjusted Consumer Price Index (also a product of White House administration propaganda as much as actual data). Well, nothing like a bank crisis to clear one’s head of goal-seeked data that would make Beijing blush. And also – apparently – there is nothing like a bank crisis to send inflation expectations plummeting.

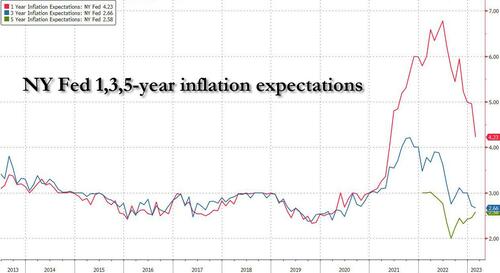

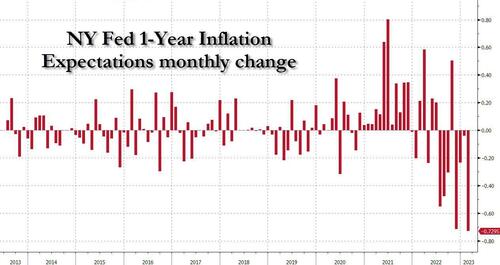

Earlier today, in breach of today’s data vacuum, the NY Fed published its latest Survey of Consumer Expectations, which showed that inflation expectations collapsed at the 1-year horizon, plunging by 0.8% to 4.2%, the lowest since May 2021…

… and the biggest monthly drop on record for the series! One can only imagine what the read would have been if the poll had taken place after the collapse of SIVB and SBNY.

At the same time, 3Yr inflation expectations remained unchanged, and slightly increased at the long-term horizon.

Most importantly, expectations about year-ahead price increases for core staples such as gas, food, cost of rent, college education, and medical care all declined as follows:

- Gas down 0.4% (to 4.7%),

- Food down 1.7% (to 7.3%),

- Medical care down 0.3% (to 9.4%),

- College education down 1.2% (to 8.1%),

- Rent down 0.2% (to 9.4%).

Needless to say, this number will only go down the worst the banking crisis gets.

And like that… inflation is gone.

This was the first of a run of key readings on inflation (CPI and PPI are due tomorrow and Wednesday), consumer spending and sentiment that could determine whether the U.S. central bank presses on with interest rate hikes or pauses to measure the fallout from bank failures that prompted it to take emergency action.

On the other side, labor market expectations improved, with unemployment expectations and perceived job loss risk decreasing and job finding expectations increasing, but expect this to crater in the March survey after several hundreds thousand people are let go as a consequences of the fast spreading bank crisis contagion.

There was more bizarre optimism as expectations for voluntary job quits reached the highest level since the start of the pandemic. Households’ perceptions and expectations for current and future financial situations both improved.

Some more details from the report:

- Median home price growth expectations increased by 0.3 percentage point to 1.4% in February, remaining far below the 12-month trailing average of 3.4%. The increase was more pronounced among respondents with annual household incomes above $100k and for those who live in the Northeast Census region.

- Median one-year-ahead expected earnings growth remained unchanged at 3.0% in February. The series has been moving between a narrow range of 2.8% to 3.0% since September 2021.

- Mean unemployment expectations—or the mean probability that the U.S. unemployment rate will be higher one year from now—declined by 1.8 percentage point to 39.4%. The decline was most pronounced for respondents with a college education and those with annual household incomes above $100k.

- The mean perceived probability of losing one’s job in the next 12 months decreased by 0.2 percentage point to 11.8%. The mean probability of leaving one’s job voluntarily in the next 12 months increased by 1.7 percentage point to 20.8%, the highest reading of the series since February 2020.

- The mean perceived probability of finding a job (if one’s current job was lost) increased by 0.3 percentage point to 57.9% in February.

- Median expected growth in household income decreased by 0.1 percentage point to 3.2%.

- Median household spending growth expectations decreased to 5.6% in February from 5.7% in January. This is the fourth consecutive decline in the series.

- Perceptions of credit access compared to a year ago deteriorated in February, with the share of households reporting it is easier to obtain credit than one year ago declining. However, respondents were slightly more optimistic about future credit availability, with the share of households expecting it will be harder to obtain credit a year from now also declining.

- The average perceived probability of missing a minimum debt payment over the next three months declined by 1.5 percentage point to 10.6% in February. The decline was most pronounced for respondents with no more than a high school education.

- The median expectation regarding a year-ahead change in taxes (at current income level) decreased by 0.1 percentage point to 4.3%.

- Median year-ahead expected growth in government debt remained unchanged at 10.2%.

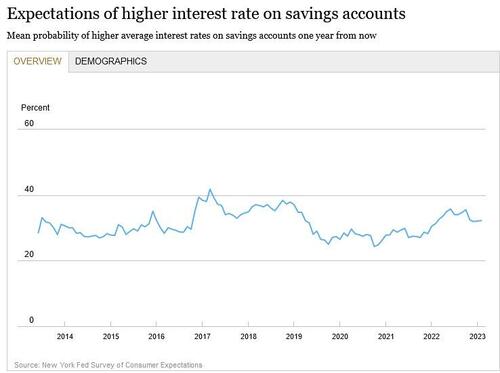

- The mean perceived probability that the average interest rate on saving accounts will be higher in 12 months increased by 0.1 percentage point to 32.2%.

- Perceptions about households’ current financial situations improved in February with fewer respondents reporting being worse off than a year ago. Year-ahead expectations about households’ financial situations also improved, with fewer respondents expecting to be worse off a year from now.

One of the more notable expectations was that 32% of consumers expect higher rates on savings accounts. Well, we have some bad news…

Finally, the mean perceived probability that U.S. stock prices will be higher 12 months from now increased by 0.7 percentage point to 36.4%. Good luck with that.

Full report here.

Tyler Durden

Mon, 03/13/2023 – 14:20

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com