Fed Balance Sheet, Deposits, Hotel California & TINA

By Peter Tchir of Academy Securities

This is, broadly speaking, a follow-up to yesterday’s Liquency & Solvidity piece, where we took a hard close look at what the U.S., Europe and Switzerland have done so far in response to pressures on banks.

No surprise here, but while banks borrowed a record $152 billion from the discount window, they “only” borrowed $11.9 billion from the new Bank Term Lending Program (BTLP).

I expect BTLP to get little use, because it is a bit like the Hotel California, you can check out any time you like, but you can never leave.

Using that facility means that you are replacing low cost deposits for roughly market priced funding. A strain on NIM that erodes capital – not ideal. It also means that you have long dated, low dollar price bonds, presumably long enough and in big enough size, that this method of funding is preferable to others. Not a winning combination. The discount window, is temporary and a true “stop gap” measure, so it makes sense banks use that, rather than the new BTLP.

I could be wrong on BTLP, but if I see that increase, I would be selling bank shares, because that really is a facility of last resort, as it is currently designed, and I believe users will experience a Hotel California type of existence.

Which brings us to deposits.

A consortium of banks are going to deposit $30 billion with FRC. This is interesting on many levels, and there are a lot of details that I don’t know, but here are the quick takes:

-

FRC, from various reports, didn’t have many assets eligible for BTLP, which is maybe why they needed an alternative source? So it doesn’t prove my point that BTLP takedown will be low, but it doesn’t refute it either.

-

We don’t know the rate FRC is paying on the deposits. If it is a rate typical of deposits, then it might demonstrate how unappealing it is for banks to have to replace deposits with high cost funds. IF it is a rate that low, then the banks providing the deposits are foregoing significant interest (in addition to in theory taking credit risk, as the point was made that these are “unsecured” deposits). If it is a market rate, then that has some different implications.

-

We don’t know if this provides money to buy new assets, or merely covers deposits that have been removed from FRC. New deposits, at low rates, letting them buy more assets to generate NIM would help generate equity capital for the bank and be interesting.

Lots we don’t know about the deposits and the details will be important to determining the impact. The deposits, in any case, are a new and interesting twist to this period of banking weakness and are a step towards the “private solution” that I think will be needed to really get us over the hump.

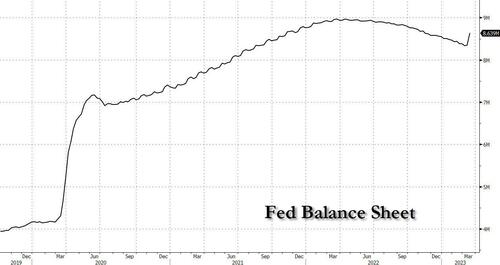

Fed Balance Sheet, FOMC and TINA

The Fed balance sheet has grown, significantly, even with QT continuing.

Rate hike probabilities for the FOMC have dropped from a split between 25 & 50, to a split between 0 and 25. I’m leaning towards zero, but a lot can change between now and then (let’s be honest, with current headlines and low liquidity, things can change between the time I hit send and the time you receive this in your inbox!).

There is some discussion that the Fed could suspend the current balance sheet reduction activity (or maybe it is just me musing on it). I doubt this happens, but they could mention it as a tool, during the press conference, which would be “risk-on”.

So, is it back to TINA (There Is No Alternative)?

-

Yes, the balance sheet has grown, but using the discount window has nothing like the impact large scale asset purchases had.

-

Yes, the Fed is close to being done hiking, but rates are nowhere near zero, so are not the headwind they were.

I think the TINA case is weak at best. Any balance sheet growth is likely to be temporary. There are legitimate concerns that financial conditions will tighten. While the SVB depositors were saved, I’m seeing little evidence of a rush to fund and to spend money (the drumbeat of tech layoffs continues).

This is still a trader’s market and it is time to be cautious on risk broadly after the strength of yesterday.

Tyler Durden

Fri, 03/17/2023 – 09:36

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com