FDIC Weighs Squeezing Big Banks To Plug $23 BIllion Hole From Small Bank Failure Costs

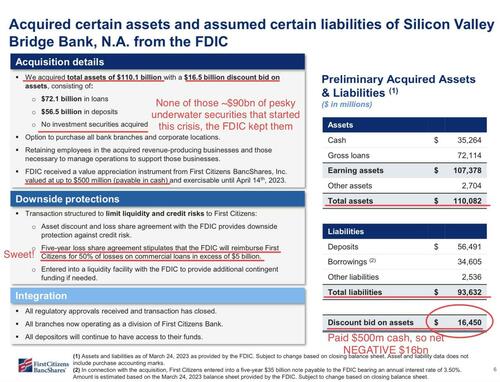

Yesterday, we explained that the reason why the stock price of First-Citizens Bank & Trust exploded on Monday after the FDIC revealed that it would “acquire” much of the now failed Silicon Valley Bank, is because in exchange for paying $500 million to the FDIC, the Raleigh, N.C. bank would get $16.5 billion in clean assets, and would also get a taxpayer backstop for future losses to boot.

But while the transaction was immediately accretive to First-Citizens, which doubled its market cap moments after the news hit…

… the question is who would end up footing the bill. The logical answer, of course, is “US taxpayers”… unless of course the FDIC found someone else to front the massive costs that have emerged as a result of the ongoing bank failures.

Well, moments ago Bloomberg reported that the FDIC may have found someone to “volunteer” and pick up most of the tab: that someone are the very same large, megabanks that have directly benefited from the ongoing crisis of confidence shaking their small, regional peers.

According to Bloomberg, the Federal Deposit Insurance Corp, which is facing almost $23 billion in costs from recent bank failures, is “considering steering a larger-than-usual portion of that burden to the nation’s biggest banks.”

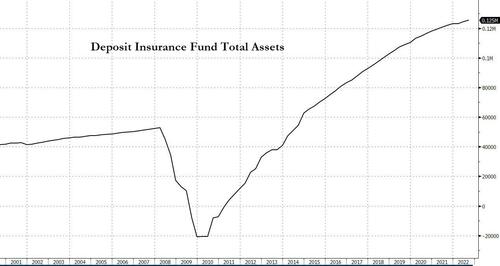

The agency has said it plans to propose a so-called special assessment on the industry in May to shore up a $128 billion deposit insurance fund that’s set to take major hits after the recent collapses of Silicon Valley Bank and Signature Bank, and whose purpose is to “insure” the roughly $10 trillion in guaranteed deposits (those under $250,000) yet which is a small fraction of that total amount.

The regulator — under political pressure to spare small banks now that politicians and the Fed have decimated small banks with both their actions and inactivity — has noted it has latitude in how it sets those fees. Behind the scenes, Bloomberg reports, officials are looking to limit the strain on community lenders by shifting an outsize portion of the expense toward much larger institutions, according to people with knowledge of the discussions. That would add to what already may be multibillion-dollar tabs apiece for the likes of JPMorgan Chase, Bank of America and Wells Fargo.

Talks for setting the size and timing of the assessment are in early stages. Leaning heavily on big banks is seen as the most politically palatable solution, some of the people said, asking not to be named describing private deliberations.

To be sure, the contentious question of how to spread the cost of SVB’s and Signature’s failures is already a hot topic in Washington, where lawmakers have pressed FDIC Chairman Martin Gruenberg, Treasury Secretary Janet Yellen and Federal Reserve Chair Jerome Powell over who will shoulder the burden — especially after an unusual decision to backstop all of those banks’ deposits while refusing to backstop all uninsured deposits across other banks, thus keeping the bank run dormant. The extraordinary measure saved legions of tech startups and wealthy customers whose balances far exceeded the FDIC’s typical $250,000 limit on coverage, and sparked a backlash against VC “billionaire bros” who were the latest beneficiaries of depositor bailouts.

The news initially hit the KBW Bank ETF, but as traders assessed the broader implications of the report, they may concluded that more capital from the big banks to offset the pain caused by small banks may end up boosting confidence in the broader banking sector, and with some 40 minutes to go until he close, the KBWB ETF rose to session highs amid fresh optimism that the acute phase of the bank crisis is now in the rearview mirror.

Tyler Durden

Wed, 03/29/2023 – 15:24

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com