China AI Stocks Plunge As State Media Warns Of “Valuation Bubble”

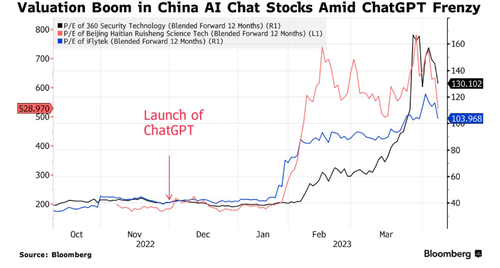

Since the launch of OpenAI’s ChatGPT in late 2022, stocks of artificial intelligence firms worldwide have experienced a substantial increase in market capitalization. Now the Chinese appear to be warning about bubble risks in AI stocks, as one state-owned newspaper warned the AI sector has “signs of a valuation bubble,” according to Bloomberg.

Economic Daily pointed out that Chinese shares related to AI firms “climbed from more than 16 billion yuan to more than 85 billion yuan” in months following the release of ChatGPT. The newspaper said, “capital is enthusiastic about ChatGPT,” but “it should pay attention to avoiding bubbles.”

“At present, ChatGPT is still in the initial stage of application scenarios and commercialization exploration. Some companies have not made too many breakthroughs in related technologies, and even many companies are in a state of loss in performance, but their stock prices have risen by leaps and bounds,” the paper said.

Providing details about stretched valuations, it said:

“At present, there are already signs of valuation bubbles in the ChatGPT concept sector. As of April 6, the price-earnings ratio of the entire sector has reached 136 times.”

The paper then urged regulators to “strengthen the monitoring and crackdown on hot spots and speculation concepts.”

As a result of the bubble-bursting commentary from the newspaper, Chinese AI firms, such as CloudWalk Technology Co. crashed by 20%, Beijing Haitian Ruisheng Science Technology Ltd. plunged by 15%, and 360 Security Technology Inc. dropped by 10%.

AI stocks trading in premarket in New York seemed unphased by Economic Daily’s commentary about taming the bubble.

While AI has been the hottest trend in many stocks over the last several months, valuations might be hard to justify due to the immediate financial impact of this new technology on companies and the tightening of monetary conditions via the Federal Reserve.

Tyler Durden

Mon, 04/10/2023 – 06:55

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com