Fed Balance Sheet Shrinks For 3rd Straight Week, Bank Bailout Facility Usage Eases

After last week saw The Fed’s balance sheet shrink significantly back from its bank-bailout resurgence, all eyes will be back on H.4.1. report this evening to see if things have continued to ‘improve’ or re-worsened amid regional bank shares unable to bounce above post-SVB lows ahead of earnings.

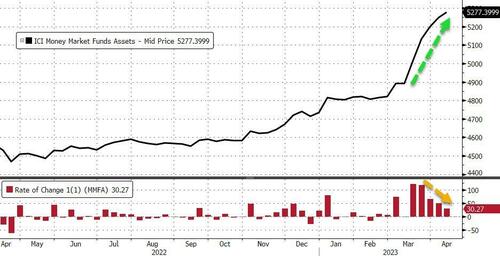

This week’s $30.27 billion inflow means that over the last five weeks, we have seen over $380 billion flow into money market funds which is the largest ever inflow outside of the COVID lockdown panic…

Source: Bloomberg

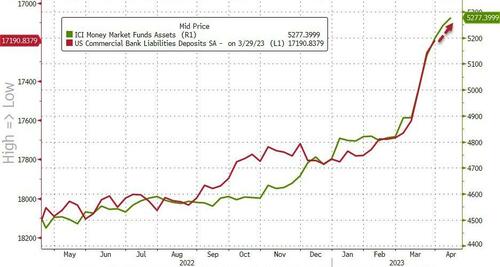

That pushed assets to a record $5.277 trillion, well above the $4.8 trillion pandemic peak, suggesting that US commercial bank deposits continued to fall…

Source: Bloomberg

The silver lining there is that the rate of flow into MM funds is slowing and thus, potentially, the pace of deposit outflows is also slowing.

Though not wanting to piss all over those hopeful fireworks, we note that reverse repo continues to rise…

Source: Bloomberg

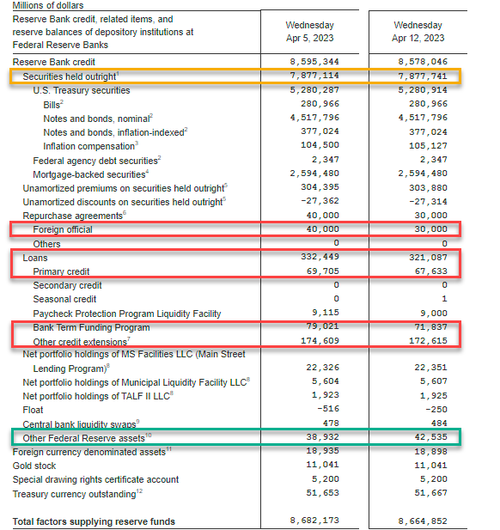

The most anticipated financial update of the week – the infamous H.4.1. showed the world’s most important balance sheet shrank for the 3rd straight week last week, by $17.59 billion, dramatically less than last week’s $73.558 billion tumble – the biggest weekly decline in The Fed’s balance sheet since July 2020…

Source: Bloomberg

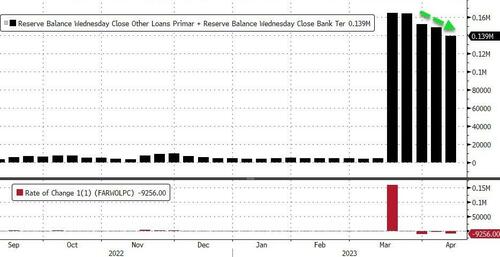

Looking at the actual reserve components that were provided by the Fed, we find that Fed backstopped facility borrowings fell modestly from $149 billion to $139 billion (still massively higher than the $4.5 billion pre-SVB)…

Source: Bloomberg

…but the composition shifted, as usage of the Discount Window dropped by $2.1 billion to $67.6 billion (upper pane below) along with a $8.2 billion decrease in usage of the Fed’s brand new Bank Term Funding Program, or BTFP, to $71.8 billion (middle pane) from $79.0 billion last week. Meanwhile, other credit extensions – consisting of Fed loans to bridge banks established by the FDIC to resolve SVB and Signature Bank – fell very modestly from $175BN to $173BN (lower pane)…

Source: Bloomberg

There was zero QT this week (which was last week’s big downside driver of the Fed balance sheet) but we do note that ‘Other Fed Assets’ rose by $3.6 billion…

The continued rise in MM inflows suggest bank deposit flight continues and the smaller shrink of The Fed’s balance sheet suggests this is far from over yet. The silver lining is that emergency usage facilities eased modestly (but remain extremely high relative to pre-SVB).

Tyler Durden

Thu, 04/13/2023 – 16:41

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com