Key Events This Week: It’s All About Earnings As Macro Calendar Eases

Looking at the key events this week, today will see the US debt ceiling rise up the agenda again since House Speaker Kevin McCarthy is giving a speech at the New York Stock Exchange that’s expected to cover the Republicans’ position on the issue. As a reminder, the US is expected to come up against the debt ceiling again this summer (or even sooner), and the Republicans have said they want concessions like spending cuts in return for passing an increase. Since the Republicans now have a majority in the House of Representatives, at least some of them will need to be on board to pass an increase. The situation has several echoes to the last major fight over the debt ceiling in 2011, when there was also a Democratic president negotiating with a Republican majority in the House. Although an agreement was eventually reached, that episode coincided with a noticeable slump in the S&P 500 alongside a sharp decline in consumer confidence.

In the meantime, there are a few highlights ahead on the data side. Tomorrow sees the release of China’s Q1 GDP growth, where DB economists are expecting an above-consensus print of +4.5% year-on-year. Then on Friday we’ll get the April flash PMIs from around the world, which will offer an initial indication of how the global economy has been performing into Q2. Otherwise, inflation will remain in the spotlight, with this week seeing the March CPI releases from Japan and the UK. In Japan, economists expect core-core inflation excluding fresh food and energy to tick up slightly to 3.6%, up from 3.5% the previous month. And in the UK, inflation is anticipated to decline to 9.7%, down from 10.4% in February.

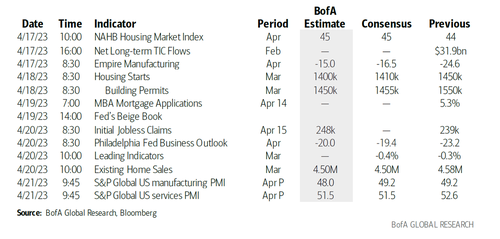

Here is a summary of the key US events:

The final big highlight this week will be earnings season, which is increasingly ramping up now as 59 companies in the S&P 500 will be reporting. Some of the financials will be of particular interest given the market turmoil last month, and we’ll get results from Bank of America, Morgan Stanley, Goldman Sachs and Charles Schwab this week. Elsewhere, some of the highlights will include Tesla, Netflix, IBM and Johnson & Johnson.

In its preview of the week ahead, Rabobank writes that the market will focus mostly on US earnings season “because if these go down, the implication will be that unemployment must soon rise, and then US rates fall, and then P/E ratios are not the issue they are soon to be otherwise, apparently.” Hence, will the tone be that good news is bad news and bad news is good news? Or will it be good news is good news, and there is no recession fear? It’s hard to project the collective mind of a market focused on the here and now, the never-never, and quarterly returns, rather than unfolding geopolitical reality.

However, in data terms, this is what the global calendar looks like:

- Monday: New Zealand food price inflation for March opened the week, coming in at +0.8% m-o-m. This follows on from a 1.5% gain in February, which saw annual food price inflation hit its highest level since 1989. It’s likely that further food inflation lays ahead, as the longer-run effects of Cyclone Gabrielle continue to be felt in the coming months. No change in China’s 1-year MTLR rate is expected from 2.75% today. Later, the Empire Manufacturing index for April will be released in the US. Expectations are -18, a substantial improvement over March’s -24.6. A beat would confirm a trend of improvement following last week’s strong industrial production data.

- Tuesday: The minutes of the RBA’s April policy meeting will be first up. This may provide further insight into Governor Lowe’s comments a fortnight ago that the pause doesn’t necessarily mean the RBA has finished hiking. Stronger than expected jobs figures released last week certainly lend some weight to the idea that the RBA isn’t done yet, as does the building momentum in house prices across Aussie capital cities. Afterwards we will see Q1 GDP data for China. This is expected at 3.9% y-o-y, well up on the previous read of 2.9% and accelerating toward China’s 5% target for 2023. Later in the day we have a speech from the Fed’s Bowman, as well as the ZEW survey in Germany: improved readings for both the current situation and future expectations are anticipated here. CPI data in Canada follows, with consensus of a fall from 5.2% y-o-y in February to 4.3% in March.

- Wednesday: The headline releases will be the Fed’s Beige Book, along with UK CPI data, seen falling from 10.4% y-o-y in February to 9.8% in March. There will also be quite a few central bank speakers on the day: Lane, de Cos, and Schnabel will be in action for the ECB, while the BoE’s Mann will also be speaking.

- Thursday: NZ Q1 CPI is the first cab off the rank, where markets will be looking for confirmation that inflation peaked in Q4, but a reading higher than the expected y-o-y figure of 7% will present a conundrum for the RBNZ, who are also dealing with rapidly contracting GDP. Across the ditch in Australia, we get the NAB Business Survey. This is one of the four data points that Governor Lowe nominated as being of particular interest to the RBA ahead of the April policy meeting, so will likely still be a market mover this month. Later in the day we will hear from the ECB’s Lagarde, Schnabel, Holzmann, and Guindos, while on the other side of the Atlantic, the Fed’s Goolsbee, Williams, Waller, Mester, and Bowman will all be speaking. We will also get the latest weekly jobless claims data for the USA (+240k expected).

- Friday: Japanese CPI figures are due, followed by April PMIs for the Eurozone, US, and UK. We will also see UK retail sales figures for March, expected to have declined by 3.0% y-o-y. That sounds really grim until you compare it with the 3.5% y-o-y fall in February. The Conference Board’s leading index also drops (-0.7% expected, down from -0.3% prior) before comments from the Fed’s Cook and Bostic close out the week.

Finally, courtesy of DB, here is a day-by-day Calendar of Events with a focus on the US

Monday April 17

- Data: US April NAHB housing market index, Empire manufacturing, Canada February wholesale trade sales

- Central banks: BoE’s Cunliffe speaks

- Earnings: Charles Schwab, State Street

Tuesday April 18

- Data: US April New York Fed services business activity, March housing starts, building permits, China Q1 GDP, March industrial production, retail sales, property investment, UK March payrolled employees monthly change, February employment change, average weekly earnings, Italy February trade balance, Germany and Eurozone April ZEW survey, Eurozone February trade balance, Canada March CPI

- Central banks: Fed’s Bowman speaks

- Earnings: Johnson & Johnson, Bank of America, Netflix, Lockheed Martin, Goldman Sachs, Prologis, Intuitive Surgical, BNY Mellon, United Airlines, Western Alliance Bancorp

Wednesday April 19

- Data: UK March CPI, PPI, RPI, February house price index, Japan February capacity utilization, Italy February current account balance, EU27 March new car registrations, ECB February current account, Eurozone February construction output, Canada March industrial product and raw materials price index, housing starts

- Central banks: Fed’s Beige Book, Fed’s Goolsbee speaks, ECB’s Schnabel and deCos speak, BoE’s Mann speaks

- Earnings: Tesla, ASML, Abbott, Morgan Stanley, IBM, Lam Research, Heineken, US Bancorp, Baker Hughes, Citizens Financial, Alcoa

Thursday April 20

- Data: US April Philadelphia Fed business outlook, March leading index, existing home sales, initial jobless claims, Japan March trade balance, February Tertiary industry index, Germany March PPI, France April manufacturing confidence, March retail sales, Eurozone April consumer confidence

- Central banks: Fed’s Williams, Waller, Mester, Bowman and Bostic speak, ECB March meeting account, ECB’s Visco and Holzmann speak

- Earnings: TSMC, AT&T, Union Pacific, American Express, Blackstone, CSX, Truist, Volvo

Friday April 21

- Data: US, UK, Japan, Germany, France and Eurozone April flash PMIs, UK April GfK consumer confidence, March retail sales, Japan March CPI, Canada February retail sales

- Central banks: Fed’s Cook speaks

- Earnings: P&G, SAP, HCA Healthcare, Schlumberger, Freeport-McMoRan

Source: DB, Rabobank, BofA

Tyler Durden

Mon, 04/17/2023 – 08:39

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com