Fed Hikes 25bps As Expected, Signals Pause; Warns Of ‘Tighter Credit Standards’

Since March 22 (the last FOMC statement, which included the dot-plot and economic projections), markets have been ‘just a little bit turbo’ but amid all that vol, bonds and stocks are modestly higher while the dollar has tumbled and alternative currencies (bitcoin and gold) have outperformed…

Source: Bloomberg

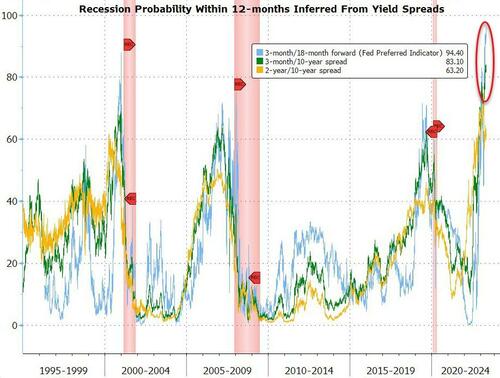

However, The Fed’s preferred recession rate-spread indicator (3-month/18-month forward) is now flashing red implying a 94% probability of a recession within the next year

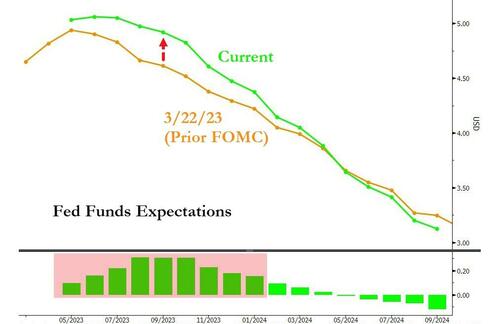

Interestingly, the market’s expected rate trajectory of The Fed has shifted somewhat hawkishly, mainly due to the plunge in rate-hike odds that occurred on the day of the FOMC meeting…

Source: Bloomberg

Rate-hike expectations have drifted higher since the last FOMC…

Source: Bloomberg

Today’s 25bp hike is a lock from the market’s perspective, but what is really the focus today is any hints that The Fed is done (and the market for now, is convinced they will be with just 5% odds of a 25bp hike in June).

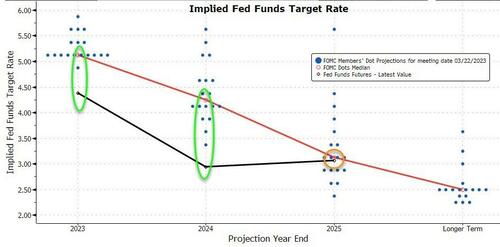

But, the market remains massively dovishly divergent from The Fed‘s dotplot rate expectations for this year and next…

As we noted earlier, a single sentence in the FOMC statement will change everything everything today and all eyes will also be on whether there are any dissents.

-

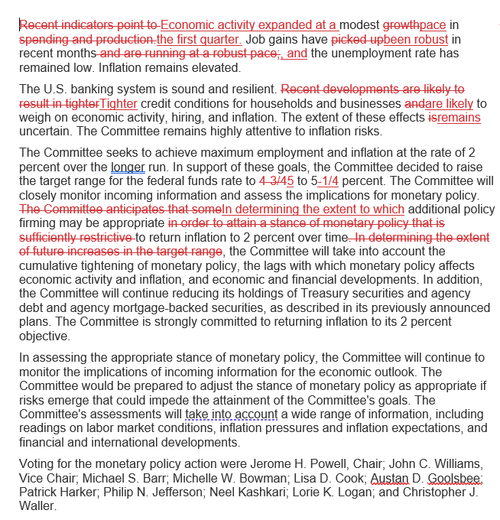

Federal Open Market Committee raises benchmark rate by 25 basis points, as forecast, to target range of 5%-5.25%;

-

FOMC omits prior language saying “some additional policy firming” may be warranted, suggesting Fed could pause at the next meeting

-

FOMC will take into account various factors “in determining the extent to which additional policy firming may be appropriate”

Additionally, The Fed highlights the impact of the banking crisis:

FOMC says tighter credit standards likely to weigh on inflation, economy

QT continues:

The Fed maintains plan to shrink balance sheet each month by as much as $60 billion for Treasuries and $35 billion for mortgage-backed securities.

And the vote was unanimous.

Finally, read the full red-line below:

Tyler Durden

Wed, 05/03/2023 – 14:05

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com