End Of Rate Hikes Won’t Be All Clear For Equities

By Michael Msika, Bloomberg Markets Live reporter and strategist

Investors are trying to navigate the end of the rate-hiking cycle in the most cautious way possible, waiting for a green light to go risk-on, but that may take time to materialize.

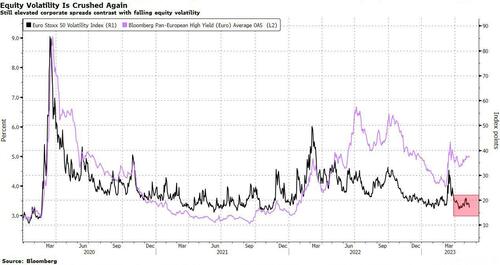

The stock market is extending a consolidation phase that could drag on. Volatility on the Euro Stoxx 50 is being crushed again, trading at less than 18 on the Vstoxx Index and back below its 10-year average. Investors are torn between expectations of a dovish turn from the Fed later this year and the uncertain macro-economic outlook. Swap markets are already pricing in more than 75 basis points of cuts in 2023 after last week’s economic reports, even though strategists warn that may be premature. Meanwhile, the ECB isn’t done hiking yet.

“Wide swings of the market in both directions, positive or negative, are quite possible,” says DWS strategist Marcus Poppe. “This is also clearly reflected in the behavior of market participants: many feel uneasy and prefer to remain at the sidelines.”

Generally, investors are cautious and the earnings season has been revealing in terms of how defensively they are positioned. Some 68% of companies in Europe have posted beats so far, with cyclicals delivering the bulk of them, according to Barclays strategists. Yet, stock reaction was muted. Despite earnings resilience, cyclicals have been unable to reverse their underperformance of the last few months, as investors continue to monitor deterioration in manufacturing data.

“Historically, European equities move sideways to slightly up after the last Fed rate hike,” says Citi strategist Beata Manthey. “Defensives outperform cyclicals, both in Europe and globally. Within the European market, health care, utilities, and tech have fared best after US policy rates peak, while commodity sectors lag.”

The strategists note that European stocks might even underperform US peers, given the divergence in monetary policy, and warn a Fed pivot is likely to come later than the market expects, with a first cut seen in early 2024. They recommend a defensive allocation, geared toward health care, staples and tech.

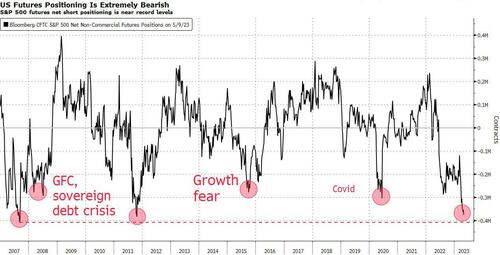

To be sure, positioning is now so cautious and weighted toward shorts that investors should be wary of markets having the potential to break out to the upside, according to Societe Generale strategist Arthur van Slooten. Net shorts on S&P 500 contracts are striking, reaching the same extreme levels as in 2011.

The strategist says positioning is so extreme that the lack of confirmation of a recession scenario could result in a quick and drastic reversal of positions, that would potentially help send equities higher.

For now, many asset allocators prefer bonds to stocks, as they are better equipped to navigate the recession and the current interest-rate environment.

“We are neutral on European stocks as waning global growth, a lack of EPS downgrades, and a rate-hiking cycle that lags that of the US could pressure cyclical and value-oriented European indices,” says Pimco portfolio manager Erin Browne. “We believe the overall resilience seen in equity markets in 2023 would diminish in a downturn. Earnings expectations appear too high, and valuations too rich.”

Tyler Durden

Mon, 05/15/2023 – 11:05

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com