For Treasuries, It’s Deja Vu All Over Again Before Long Weekend

By Ven Ram, Bloomberg markets live reporter and strategist

The market’s recent re-pricing of the Federal Reserve’s rate trajectory is nothing short of dramatic. Investors will find it challenging to price Friday’s slate of data going into the long weekend while being fully mindful of the risks centered in Washington.

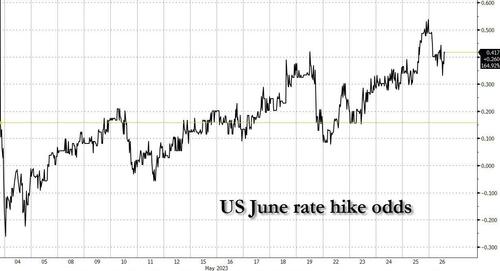

Just after the Fed raised rates earlier this month, the markets were assigning a more-than-50% chance of a rate cut in July and fully factoring in a reduction by September. After some hawkish jawboning from James Bullard as well as Neel Kashkari and Thursday’s better-than-forecast 1Q GDP numbers, interest-rate traders see the Fed raising rates yet again in July. Talk about the markets turning on a dime.

Will Chair Jerome Powell, who all but signaled that the Fed would stay on hold when it meets next month, be persuaded otherwise if today’s PCE data turn out to higher than the markets estimate? And will consumers’ expectations of inflation in the University of Michigan survey jump yet again, putting paid to the school of thought that inflation is oh-so-2022?

The minutes of the Fed’s May review showed an interesting split in opinion among members. But if Powell has made up his mind, will we see his best persuasive powers at work in June to ensure we — rather magically — get a consensus decision as we have seen all through this cycle except once?

Amid all this, we are inching closer and closer to the X-date in Washington, the Treasury’s cash balance has fallen below $50 billion and there is still no sign of a deal. With Friday being a crucial deadline for traders, how will Treasuries close the week if there is no agreement in sight by the close of trading? After all, no one wants to go into a long weekend and leave one’s P&L to the whims of fortune until you can offload your positions on Tuesday.

As recently as in March, traders dreaded going into the weekend what with the endless torrent of headlines speculating the fate of mid-size banks. If baseball legend Yogi Berra were alive, he would have quipped: it’s deja vu all over again!

Tyler Durden

Fri, 05/26/2023 – 08:26

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com