Just Weeks After “Capitulating” On Stocks, Retail Buyers Are Back With A Vengeance

It was only two weeks ago when, with the S&P about to break out to new 2023 highs, we noted that Bank of America ‘s client flows desk had declared retail capitulation (in the case of BofA, “retail” means High Net Worth individual investors), but it wasn’t just the rich that were dumping: a parallel analysis by Vanda Research found that all across the retail sector – including those Millennials armed with a few hundred bucks to spare and a Robinhood account – enthusiasm for buying stocks had shrunk and “retail investors are not chasing the rally.”

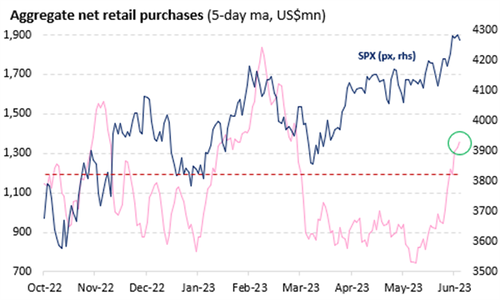

Well fast forward to today, when with the S&P blasting off above its previous range of 3,800-4,200 and about to take out the August 2022 highs, it didn’t take long for retail to make a dramatic U-turn and flood right back into the book.

According to the latest note from Vanda Research, which at the end of May was about to declare the end of retail’s infatuation with chasing stocks, “with an average flow into US markets of US$ 1.36bn/day over the past week, retail traders are officially back in the mix after a 3-month lull.”

According to Vanda trade flows researcher Marco Iachini , “better-than-consensus economic data and the resolution of the debt ceiling were among key macro drivers of this rebound in participation, but AI’s push is what decisively boosted animal spirits in recent weeks.” He also notes that “despite bears’ warnings of froth, we continue to see relatively benign market dynamics, leading us to believe that retail’s uptick in buying can extend over the coming weeks and, in turn, support equity markets’ grind higher.“

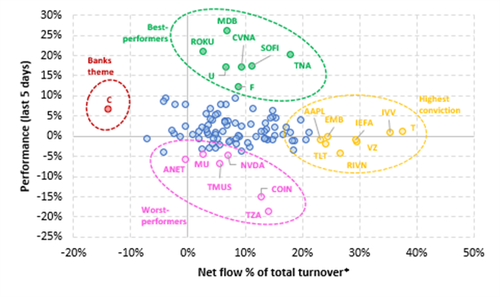

Looking at the most heavily traded names offers insights into the main retail themes of the past week, and the Vanda scatterplot below provides a better understanding of retail sentiment in the past week.

- First, blue-chip securities that experienced the strongest retail buying bias (yellow) did not necessarily outperform. Although, with one exception (i.e., RIVN), these names constitute classic long-term retail portfolio targets such as AAPL, TLT, IVV, T, and VZ, indicating that while retail traders are re-engaging with equity markets, they’re doing it through a long-term lens.

- Second, some of the top semi names experienced some profit-taking (pink) but also displayed a rather balanced bid-offer profile.

- Thirdly, investors are taking advantage of the uptick in banking stocks to rotate out of these positions (more on this later).

- And last, some of the ever-loved small-cap tech names were among the best-performing securities this past week (green), likely contributing to improved retail sentiment.

Focusing on small caps, elevated net purchases as a share of total turnover in leveraged small-cap ETFs TZA (bear) and TNA (bull) was noteworthy. It’s as though retail crowds have a polarized view of the space, as both ETFs saw significantly more buying than selling (to Vanda, this is an additional sign of balance, rather than froth, within the market).

Source: Bloomberg, VandaTrack

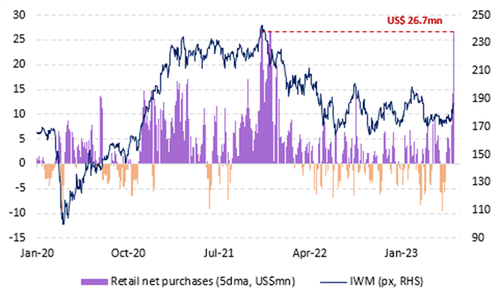

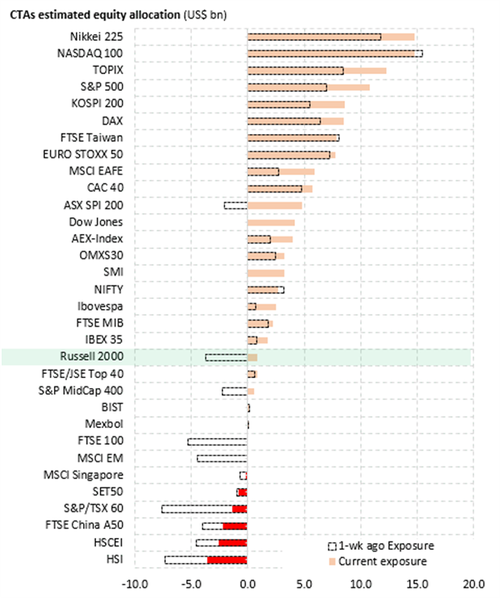

While more speculative retail small-cap bulls and bears contended in the leverage ETFs space, others helped trigger a short-squeeze in the Russell 2000. Weekly flows into IWM, which tracks the Russell 2000 index, have jumped to the highest since Nov ’21.

With systematic investors holding a short futures position in the index heading into last week (second chart), the drastic uptick in retail buying likely helped fuel a short squeeze. Nevertheless, flows in this segment of the equity market have been fairly volatile in the past year and a half, and so it will take more than just a short squeeze for buying to sustain at these levels, especially as retail investors have only just started to rebuild conviction in the markets.

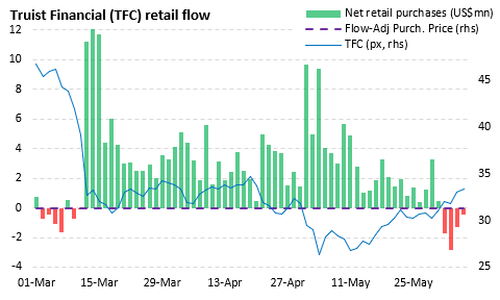

Meanwhile, even as they show renewed interest in small caps, individual traders are wasting no time getting out of regional banks’ stocks. Case in point, price and flow action in Truist Financial (TFC) over the past week. With TFC shares having recently surpassed retail’s average purchase price since March (US$ ~31.35), net flows have turned negative, suggesting that retail investors are seizing this opportunity to exit these positions to rotate into tech and small-cap stocks.

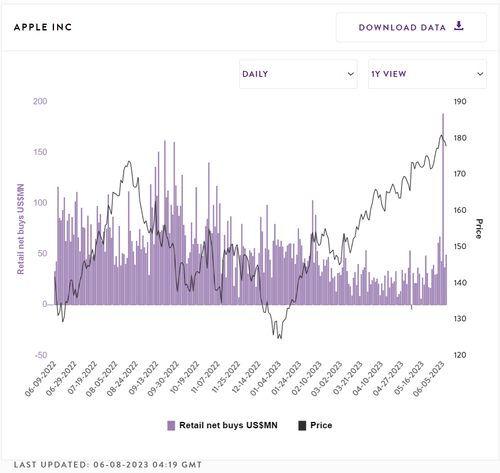

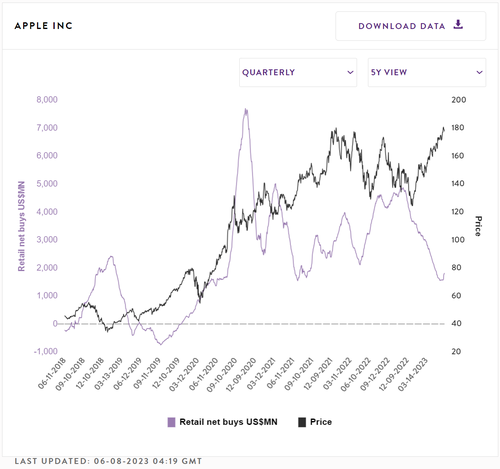

Turning to some core retail positions, if institutional investors were buying the Apple rumor and selling the news, they sure did not tell retail investors. On Monday, as Apple held its Worldwide Developers Conference, individual traders registered the largest 1-day net flow into the company’s shares since Dec ’21 at US$ +190mn. Given Apple’s size and presence across virtually any passive and active fund in the investment landscape, Vanda would not put too much meaning onto a single day of retail inflows.

Additionally, as the next chart shows, it is worth noting that the starting point for Monday’s spike in purchases is relatively low.

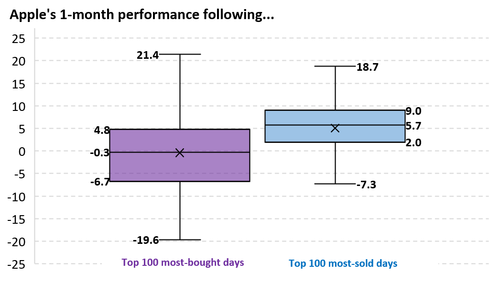

However, analyzing the daily retail flows in APPL reveals an interesting pattern. It tends to be more profitable, with a significantly higher success rate (80% vs. 50%), to purchase the stock when retail traders are selling it, rather than when they are buying it at an unprecedented rate; therefore, buyers beware.

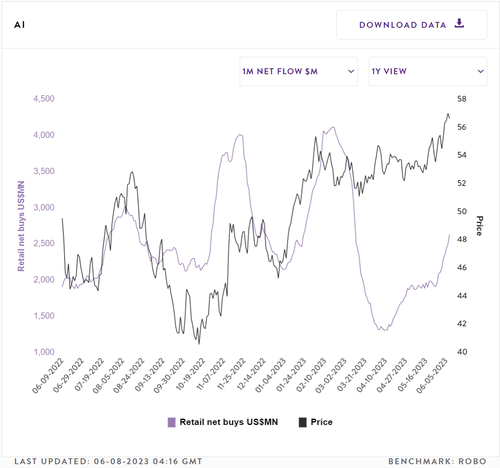

Last but not least, AI names should continue to see further retail buying in the coming weeks. In yet another indication that stocks are not seeing worrying levels of retail froth, Vanda notes that one-month flows into AI names have only just crossed levels that would have typically been associated with “low” retail buying in the past year.

Tyler Durden

Mon, 06/12/2023 – 05:45

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com