It’s “Buy The Rumor” Time For Chinese Markets

By Ye Xie, Bloomberg markets reporter and analyst

The surprising rate cuts by the People’s Bank of China on Tuesday signaled that policy makers have shifted to stimulus mode after watching the economy languish over the past few months. The magnitude of the potential stimulus package remains to be seen. But as far as the market is concerned, the window of buying the rumor has opened — at least before reality sets in again.

Two days before President Xi Jinping’s 70th birthday, the PBOC delivered a gift to investors by unexpectedly lowering the seven-day reverse repurchase rate and the standing lending facility rate. As Bloomberg economist David Qu noted, it’s almost guaranteed that the central bank will follow up by cutting the key rate on the medium-term lending facility on Thursday.

The direct impact of a 10-bp rate cut is minimal, potentially lifting GDP this year by only 0.1 percentage points. More importantly, it’s not the cost of money that is ailing the economy. It’s the lack of demand for money, as private firms and households are pessimistic about the business and income outlook.

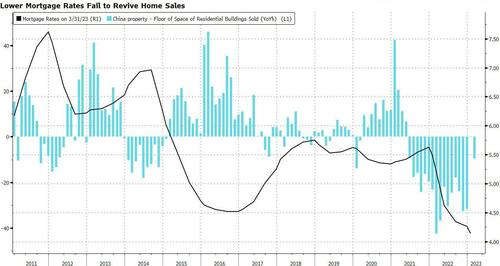

That point is highlighted by credit data released late Tuesday. Both total social financing and new bank loans missed already low expectations. Corporate bond issuance took a hit amid renewed concern about local-government financing vehicles, while household borrowing remains sluggish, reflecting low demand for mortgages.

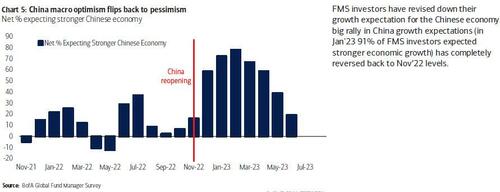

It’s not surprising, then, that investor sentiment is depressed. Bank of America’s global fund-manager survey showed that investors’ expectations on the Chinese economy have drooped to the lowest level since the reopening from the pandemic late last year.

And shorting Chinese equities is considered the second-most crowded trade after “Long Big Tech.” In addition, 13% of investors surveyed considered the Chinese housing market to be the most likely source of global credit risk.

The good news is that Beijing seems to be ready for action. Bloomberg reported that policy makers are considering a broad package of stimulus measures, including supporting the real-estate market.

Strategists at Clocktower Group are turning bullish:

The bottom line is that we expect the material constraints from a burgeoning deflationary spiral to soon outweigh Beijing’s preference to remain patient, implying a potential stimulus announcement around the July politburo meeting. As such, Chinese risk assets are likely very close to, if not have already reached, the bottom in the near-term, especially given the overwhelming pessimism currently priced in the market.

Keep in mind, though, that Beijing is facing significant constraints. Unless the government is willing to unwind some of Xi’s signature policies, including the notion that “housing is not for speculation,” and de-risk local government debt, there’s a good case to be made that any stimulus is likely to be moderate.

When rumor — or “little articles” as Chinese investors call them — is driving market expectations and imaginations, the sky is the limit. The bad news is that when the actual policy initiatives are announced, the market may shift to sell-the-fact mode again.

Tyler Durden

Tue, 06/13/2023 – 23:03

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com