China Has A Simple Solution To Its Soaring Youth Unemployment

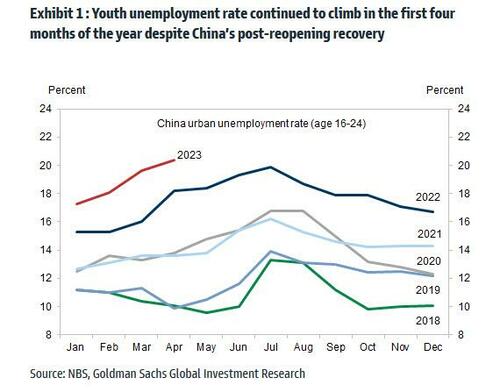

Something bad is brewing inside the Chinese economy: while most conventional indicators are showing a sharp slowdown to the country’s GDP growth rate, including disappointing retail sales, fixed investment and industrial output, forcing the PBOC last week to ease monetary conditions if nowhere nearly enough to spark a bounce in the economy, a far more troubling indicator has just hit an all time high – the unemployment rate for China’s youth (those aged 16-24), has more than doubled in the past 4 years, surging to a record 20.8% in May (and anecdotal evidence suggests youth unemployment rate could be even higher than the official estimate), up from the single digits pre-Covid.

And if there is one thing Beijing wants no part of, it is tens of millions of young Chinese sitting idle, doing and earning nothing as they watch their big city pals sport the latest gadget du jour, and getting angry – if not regime changey – thoughts.

But why has China’s youth unemployment soared as much as it has?

According to a recent note from Goldman’s China strategist Maggie Wei (full note available to professional subs), Chinese youth unemployment rates tend to be higher than overall unemployment rates as this group appear particularly vulnerable to economic downcycles, likely due to a lack of experience.

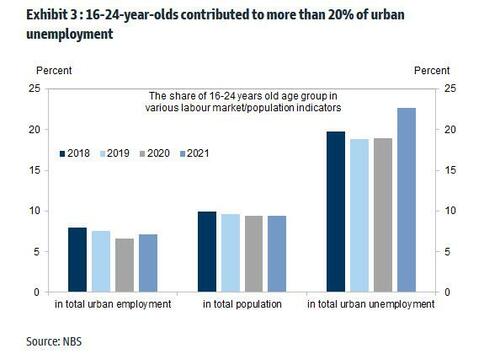

But before we get into the reasons for the jump, first some facts. According to China’s NBS, there are are around 96 million 16-24year-olds in the urban areas; 32 million 16-24 year-olds in the urban labor force (the rest are mainly still studying), 26 million 16-24 year-olds in urban employment (7% of urban employment), and roughly 6 million 16-24 year-olds unemployed (23% of urban unemployed persons). In other words, there are about 3 million additional unemployed 16-24 year-olds now relative to pre-Covid.

The youth population is an important driver for overall consumption: the 15-24 year-old group accounted for 17% of total consumption (2010 data, based on household surveys and academic research). This age group tends to spend more on culture and education, residence (for example paying rents), transportation and communication.

So, again, why is youth unemployment so high?

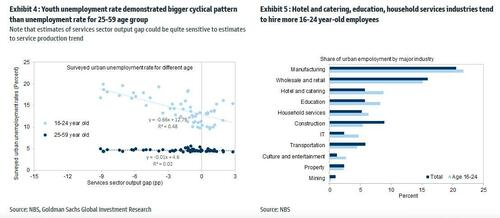

As the youth accounted for close to 20% of consumption, increasing their employment and restoring their consumption power appear important to consumption recovery post reopening.

As noted above, youth tend to be particularly vulnerable during economic downcycles, probably due to a lack of work experience. Goldman’s analysis suggests that, compared with older workers, the 16-24 age group unemployment rate is more sensitive to fluctuations in the service activity growth. The next chart shows the correlation between unemployment rate and the 3-month lag of output gaps in the services sector for 16-24 age group and the 25-59 age group separately. For each 1pp increase in services sector output gap, youth unemployment rate would rise by 0.6pp, while the unemployment rate for the 25-59 year-olds might be little changed. NBS data on employment suggest services sectors such as hotel and catering, education, and IT industries tend to hire more young employees compared with other sectors.

The services sector shows significant output gaps since last year as Covid outbreaks and related control measures weighed on services activities. Output gap in the services sector narrowed materially in Q1 this year from -7pp in December 2022 to -1.2pp in April 2023, on the back of reopening boost to the economy. This would imply 3pp lower youth unemployment rate in Q2 this year. While the improvement in service activity growth implies rising demand for young workers, this increase in demand could be more than offset by strong supply seasonality. As we enter the graduation season, youth unemployment rate could rise by 3-4% and peak in summertime (usually in July or August) before starting to decline from end of Q3, if we look at the seasonal pattern in 2018 and 2019 (prior to Covid). As a result, we might see youth unemployment continuing its upward trend in the next few months.

Are there structural reasons behind China’s elevated youth unemployment rate

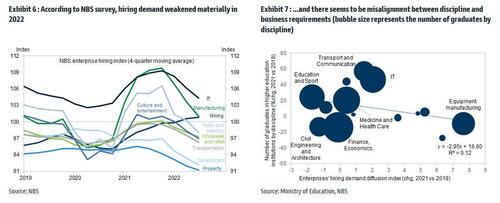

While the above analysis suggests the youth unemployment rate is cyclical and is set to decline as service activity growth improves, there may be other structural headwinds contributing to the high youth unemployment rate. In particular, mismatches between skillset graduates acquired from their higher education and skillset required by employers in industry with booming labor demand might have caused frictions in the labor market and therefore contributed to high youth unemployment rate.

In the chart below, GS plots the number of graduates by discipline and hiring demand by industry, according to NBS’s data. There appears to be misalignment between discipline and business requirement, though graduates could choose jobs that are not directly relevant to their discipline. For example, the number of graduates in education/sports discipline grew by more than 20% in 2021 relative to 2018, while hiring demand of education industry as a whole weakened materially during the same period. Meanwhile, regulation changes in recent years towards IT, education, and property sector might have contributed to the weakening of labor demand in these sectors.

What are the policy solutions?

Here, the answer is two-fold, with the distinction being drawn between the politically correct (if largely irrelevant), and that which is less socially acceptable, yet bears far more profound consequences for the real world.

Starting with the former, Goldman writes that China’s youth unemployment suggest promoting services activity growth to offset the recent surge. “A complete closure of service sector output gap from current level could reduce youth unemployment rate by up to 7% according to the bank’s estimate, although this could overestimate the potential improvement if some of the weakness in sectors such as education and information technology may have become structural on regulatory tightening.”

Blah Blah Blah: China is the world’s most advanced authoritarian economy (although under Biden, the US has been doing everything in its power to dethrone China): if it had an on-off switch to flip as per Goldman’s reco, it would have done so long ago instead of opening up its economic omnipotence to global skepticism and criticism, something which further weakens Beijing’s control at a time when the economy is clearly stalling.

Instead, a more practical and realistic solution comes from Jeffrey Landsberg over at Commodore Research, who writes that in recent months he has often received questions from clients regarding if and when to expect a war will break out between China and Taiwan. In response, Landsberg writes that “it is very difficult to make such a prediction, but lately a depressing thought has been stuck in our mind: War Creates A Lot Of Unemployment For A Country’s Youth.”

Commodore further notes that “it is becoming increasingly uncomfortable that the world’s concerns of a coming war in Taiwan are intensifying at the very same time that China’s youth unemployment is surging.” And while caveating its prediction, the firm cautions that “the record level of China’s youth unemployment, concerns over Taiwan, and countless Ukrainian and Russian youth already engaged in a European land war all continue to weigh heavily on our mind.”

There’s more: Commodore also writes that “it remains clear to us that the United States and many other nations (excluding China) have already long been in a recession.”

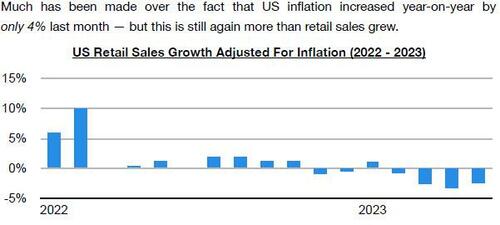

Consensus is only that a recession could come, but in our view a recession has been long underway. The following data is from the United States, but data from many other countries — including much of Europe etc. — all show the same reality: consumer and industrial sectors in the United States and elsewhere are all showing recession. Six out of the last seven months (including every month this year) have seen US retail sales growth come in less than inflation. This is a rare development that only occurs in recession. US consumers are purchasing less actual goods than they did a year ago.

Furthermore, while November is when US purchases of actual goods started to contract on a year-on-year basis, December marked when US manufacturing started to contract.

As Commodore concludes: “the United States (and many other nations) have long been a recession. China is faring better, however, but its

youth unemployment, housing market, and chance of war all remain concerning.”

What was left unspoken, but what is most concerning, is that when the world’s interests all align in the direction of war, a war is usually not far behind. Because while a China-Taiwan war would be a bloody, if quick solution to the problem of soaring youth unemployment, with all of its inherent systemic destabilization, we will also remind readers that the last time US debt/GDP was at the current level – and, worse, was forecast to grow exponentially higher – all else equal…

… was at the end of World War II. As such, it becomes instrumental for the current regime – and by that we mean either manifestation of the uniparty that is in control – to prevent “all else being equal”, which by extension means a radical US debt and economic restructuring similar to that observed in the aftermath of the great war.

All of which is to say that we now live in a world where both the US and China are tacitly looking for a war outcome. It won’t take long before they get it.

Tyler Durden

Mon, 06/19/2023 – 17:05

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com