Why Macro Is Broken

By Russell Clark, author of the Capital Flows and Asset Markets substack

Unusually among financial focused substack writers, I use substack as a sort of conversation with myself. The conversation that I have been having with myself is, to put it bluntly, why did my process which worked so well suddenly turn in a crappy value destructive way of managing money?

For new subscribers, you can read about the original process here. To summarise, very quickly, I would start with macro – looking at NIIP, current accounts, M2 etc looking for problems or opportunities, then once macro told me where to look, I would look at the corporate data (micro) to find opportunities either long or short, and then finally when technicals (market) confirmed would place the trade. This process was developed over the 2000 to 2011 period, an era that contained many market crises, from the dot com bust, the Argentinian devaluation, the GFC, Eurocrisis among others.

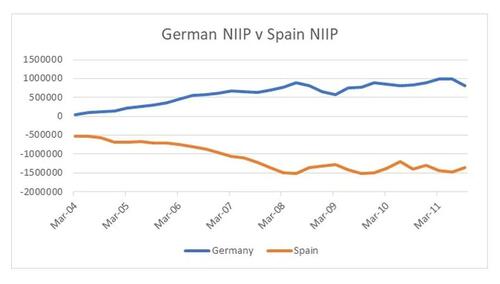

What I observed at this time, was that the managers who never came back where the ones who got currencies wrong. A typical equity manager will assume currency trends will continue in the same direction forever, and when they changed, typically all hell broke lose. So for me, “capital flows drive asset markets” and so I wanted to avoid market where capital could flow out of. A negative net international investment position (NIIP) was to be avoided. It has (had?) a great track record of predicting changes in currency trends and crises. For example, before any of has heard about Target 2 balances, the NIIP of Spain and Germany was telling you that trouble was brewing.

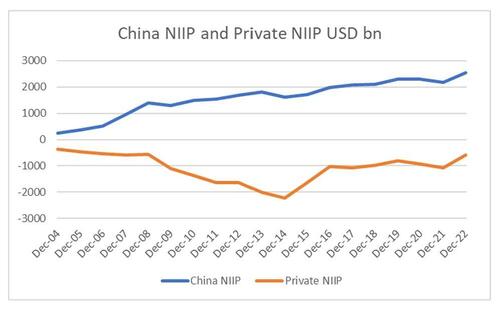

My glory days, which lets put from 2011 to 2016, I had taken the above observation and modified to look at private NIIP. This made it more useful in Asia, where governments had large foreign reserves, but the private sector could be heavily leveraged. Using this made me very bearish on China, well before it became mainstream.

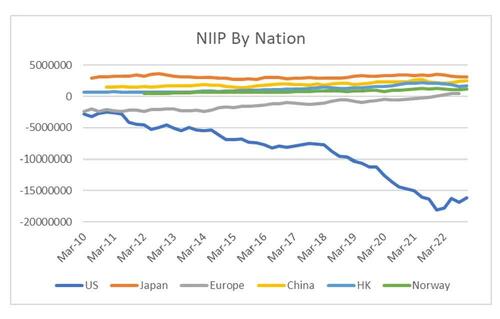

The problem is that this analysis has been saying that I should be bearish on the US and US dollar since 2016. Contrary to my expectation, US NIIP has gotten more and more negative, and being bearish on the US has been a career ending trade.

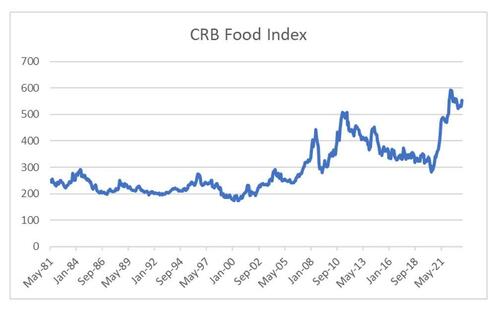

I think most investors reaction to this is to say, well this does not work anymore, lets ignore it. Or say that central banks now control markets, so don’t worry about it, or the world is doomed and this is further evidence to prove it. That is not my style. My style is to look at it, and then look at it again, and trying different styles of analysis, until something works and I can make sense of it. Over the 20 months or so I have been writing this, my first guess was that food inflation would break this down. The idea was that we have been in a food deflation market since 2010. Food inflation did indeed come in 2022, but as we can see, US equities and US dollar continues to power on (after a hiccup in 2022).

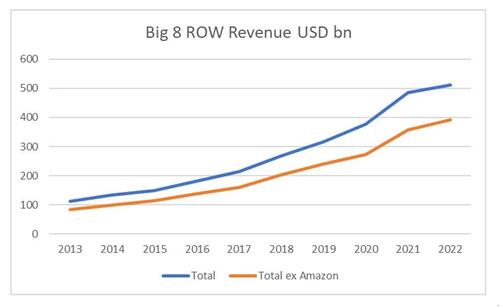

There have been a range of other financial structurers that I have found that I thought could create the kind of bear market that would correct the US NIIP imbalance. Clearinghouses was one – which I have written on extensively. Autocallables and volatility markets were another – again I have written extensively on this too. Yet despite a range of events that I thought would correct the NIIP imbalance, US dollar and US equities have continued to trade really well. So the last few posts have been looking at NIIP more closely, and in particular the US to see what is going on. The first observation I found is that US service exports do not look like they are either been reported or repatriated. Looking at my own life, I use US corporates for more things than ever. And you can see that in the rest of the world revenue numbers for large successful US corporates (I have tried my best just to get service revenue). Big 8 is Apple (service revenue), Microsoft, Google, Facebook, Netflix, Amazon, Visa and Mastercard.

When I add in things like private equity revenue, and other tech companies like Adobe, Salesforce etc, you could easily see US service exports should have grown by US 1 trillion over the last ten years. When we look at the US service trade balance, there is no growth at all. What there should be is an extra USD 80bn of monthly service flows to the US, and 80bn away from the rest of the world. When I do that, I find no strong reason to think the US dollar should fall. In this case the macro data does not match up with the corporate data. I am pretty sure the macro data is wrong.

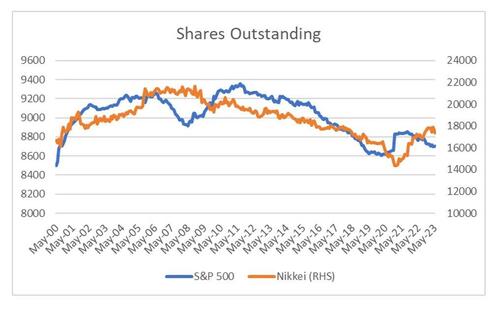

What this tells me is that big US service based multinationals do NOT repatriate their capital back to the US. Instead they set up subsidiaries, where they keep the cash. This makes sense – and we know Apple was a very aggressive user of tax minimisation strategies, paying no tax on European revenues for years. However, US shareholders have been keen to see that cash returned to them in the most shareholder friendly way possible, which has been share buybacks. And so we have seen share buybacks become the dominant driver of equity markets. Interestingly we are seeing Japan beginning to follow, and its equity market is also doing very well. When I look at asset flows into the US as not being driven by risk adverse Japanese life insurers, who would bring their money back at the drop of a hat, but think about flows as large tech companies repatriating capital via tax efficient share buy backs (often borrowing in the US to buy back shares) we can see that there is little reason to expect those NIIP capital flows to reverse. One corporate embark on share buybacks, absent a crisis, they rarely seem to stop. They are secular flows, not cyclical. This is why I say that macro is broken.

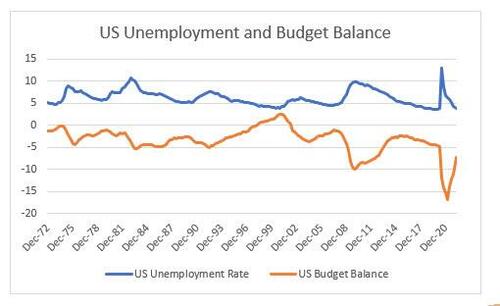

So now we know why Macro is broken. First, important macro data, such as trade balances and current account data is increasingly irrelevant. More and more of the economy is service driven, but those flows are keep in some tax remote corporate enclave. It also explains why despite record asset prices, Federal Government budgets and not balanced – because most of the boom is in untaxed assets and revenues. Historically speaking, at this level of unemployment, the US government should be running either a budget surplus, or a small deficit.

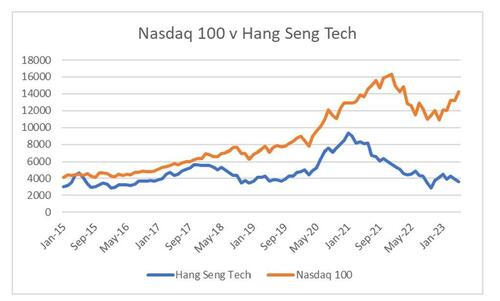

So when does it end? When the politics turns against US multinationals. China saw where Alibaba, Tencent etc were going, with ever increasing power, and turned decisively against them. Plainly the US has been more on the softly softly approach to US tech companies (US elections are expensive – making it very difficult to get US corporates offside).

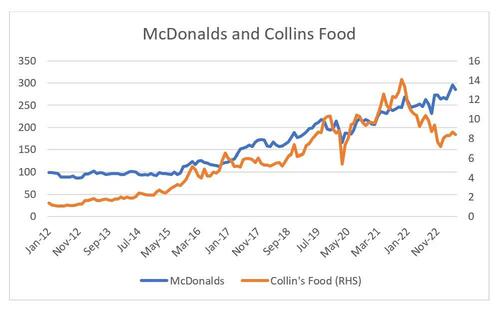

The other thing that should be said about this is this is not a tech only thing. I have thought McDonalds could be a good short, but it a perfect example of using offshore cashflow to buy back shares, and its share prices has completely diverged from listed subsidiaries.

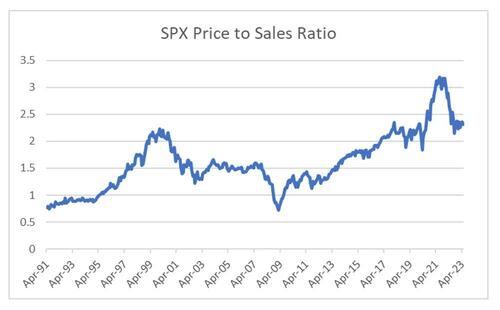

US corporates been the dominant buyer of equities also means that the US market will probably remain expensive. Price to sales is still at dot-com levels. But what is very different about the dot com era is that us corporates sold equity at that price level. As far as the data says here, S&P 500 corporates are buying equity here.

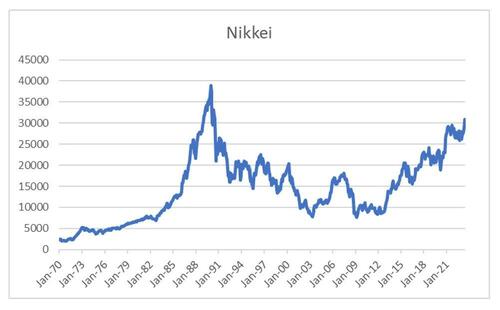

Is there some precedent for this type of set up? Well yes. In the 1970s and 1980s, Japanese corporates came in dominated a whole range of industries, which ensured huge amounts of capital flowed back to Japan. At the time Japanese corporates also bought shares in related companies (cross-holdings), which meant that rather than a free market, the share price was determined by corporates with a strong interest in pushing up the value. After the bubble burst, policy makers sought for corporates to unload these cross shareholdings, which depressed valuations, but in recent years, as shown above, share buy backs have taken hold in Japan again. Once again the Nikkei has become a booming market.

People often confuse free market policies with capitalism. This is incorrect. Capitalists hate free markets. Capitalist prefer monopolies and the ability to set the value of companies through share buybacks.

I have no idea when US politics will turn free market again. I plan to take a look at Japan using adjusted macro data – its buy back model may well have more room to run.

Tyler Durden

Wed, 06/21/2023 – 07:30

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com