What Are The Risks To Oil Markets From Recent Developments In Russia

The dramatic events over the weekend in Russia were – at least to the commodity traders – a stark reminder of the importance of grasping the risks to Russia oil supply associated with potential domestic upheaval. To address those, and other questions, Goldman’s commodity team discusses the history of supply shocks, the risks to oil infrastructure, and the potential effects on oil prices in Q&A format.

First, some big picture observations:

-

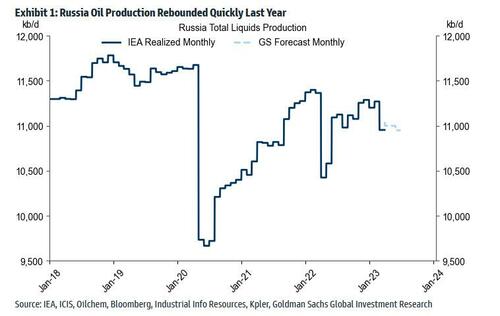

Russian oil output rebounded quickly last summer after a brief drop during the spring. A broader review suggests that persistent and substantial shocks to oil supply have historically arisen because of significant domestic civil unrest or because of the destruction of key oil infrastructure in a military conflict.

-

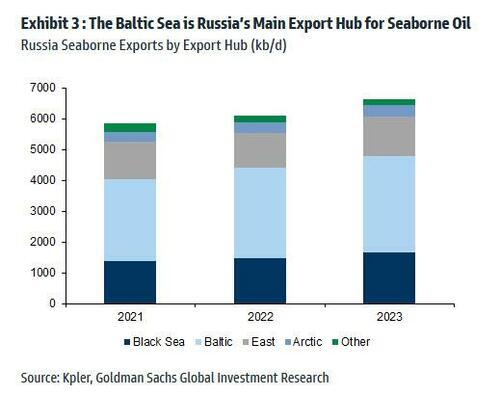

While there is no disruption to oil flows at present, it is worth noting that the Baltic Sea and the Black Sea are Russia’s major export hubs for seaborne oil, and that the Wagner group also has some presence around oil facilities in Libya.

-

While Goldman does not expect a very large impact on oil prices from this weekend’s failed coup, markets may price a moderately higher probability that domestic volatility in Russia leads to supply disruptions or has a sizable negative impact on oil supply at some point in the future. That said, the impact may be limited because oil markets are often focused on spot fundamentals, which have not changed, and because any hits to financial risk sentiment or to oil demand from increased uncertainty may provide an offset.

Below, we excerpt the full details from the bank’s Q&A:

The History of Supply Shocks

Q1. Why did Russia production briefly drop in 2022?

Russian total liquids production dropped by around 1mb/d at its trough in April-May 2022 relative to its 2022Q1 peak of 11.4mb/d. Russian production was initially limited by reduced purchases by mostly Western buyers, amid the initial uncertainty following the invasion. The combination of falling exports, and limited domestic storage capacity quickly resulted in abrupt shut-ins at the production well-heads.

Q2. Why did Russian production rebound quickly last summer to nearly pre-war levels?

Production rebounded sharply by June 2022 as alternative vessels were quickly sourced from the global ‘dark’ and ‘grey’ fleet, that were not reliant on Western financial and logistical services. Eventually, the G7’s price caps on oil permitted any vessel to facilitate Russian oil flows if the cargo was priced below the caps. The key point is that the 2022 disruption was ultimately political in nature, and Western governments had the ability to take actions to reduce disruptions, which they did.

Q3. Which geo-political circumstances have historically led to large and persistent oil supply disruptions?

Exhibit 2 shows five major and persistent historical supply shocks. Goldman includes the large 5½mb/d drop in Russia oil production from a peak of 11½mb/d in 1987 to a bottom of just 6mb/d in 1996 following the dissolution of the Soviet Union. It also shows the four major “exogenous supply shocks” identified by University of Michigan economist Lutz Kilian: the Iranian revolution of 1978-1979, the Iran-Iraq war of 1980-1988, the Gulf war of 1990-1991, and Venezuela’s civil unrest of 2002-2003.

In all five cases, the oil supply shock arose because of significant civil violence/unrest in the producing country, or because military conflict led to the destruction of oil facilities. A large and persistent supply shock typically requires that one party wants to sustainably reduce domestic oil activity/revenues. In the case of domestic civil violence, this party is typically the domestic challenger to the incumbent, while it typically is the foreign opponent in the case of the military cross-border conflict.

Q4. What are the implications for the probability of large and persistent decline in Russia supply?

History suggests that the probability of a significant and persistent decline in Russia oil supply is closely related to the probability of a major domestic civil conflict (e.g. involving other domestic opponents to the war) or a major military conflict (e.g. with Ukraine), leading to the destruction of oil infrastructure. The fact that Putin invoked what happened during the Russian Revolution of 1917 in his address Saturday suggests that the perceived probability of significant domestic upheaval at some point has likely risen.

Oil Infrastructure risks

Q5. Where is Russia’s key oil infrastructure?

As Exhibit 3 shows, Russia exports its seaborne oil from three main hubs (2023 YTD volumes, mb/d): the Baltic Sea (3.15), the Black Sea (1.65, excluding the Caspian Pipeline Consortium), and the East (1.3). Russia’s main oil producing regions are concentrated in Central/Eastern Russia.

Q6. Which Russian oil infrastructure may face a relatively more elevated risk? And what data are you watching?

There is no disruption to oil flows at present, and Goldman does not expect any domestic disruption to oil flows. Since the rebellion was initiated around Rostov-on-Don in the South, by the Sea of Azov, which filters into the Black Sea, oil infrastructure in the region may face a relatively higher risk of disruption or blockade. The two main Black Sea export ports of Novorossiysk and Tuapse are 200-250 miles to the South of Rostov, and are fed by pipelines that are closer to Rostov.

Q7. Are there any potential repercussions for oil producers outside of Russia?

The Wagner group has established a presence in Libya since 2019, entrenched in and around oil facilities, although some resources have more recently been diverted to Ukraine. The Wagner group appears aligned with Khalifa Haftar’s LNA, (per Bloomberg) the opposing force to the internationally-recognized government in Tripoli (the GNA). The LNA controls the majority of well export ports in the East, and well-head production feeding the Western ports.

The Wagner group therefore possesses a capability to disrupt oil production, although the incentives to do so seem unclear should revenue depend on these flows. Nevertheless, this weekend, the LNA-aligned Eastern parliament threatened a blockade of exports over revenue disagreements. Blockades have occurred multiple times in the last five years – most recently in 2022H1 – with the potential to block almost all of Libya’s c.1.1 mb/d production.

Effects on oil prices

Q8. How do you think about the potential upward pressure on oil prices from increased risk of lower supply?

Markets may price a moderately higher probability that domestic volatility in Russia:

- leads to near-term supply disruptions (which could put some upward pressure on timespreads) or

- has a sizable negative impact on oil supply at some point in the future (which could put some upward pressure on long-dated oil prices)

To estimate the mechanical price effect of the former effect, one can use a timespreads pricing framework, which starts from the empirically estimated relationship between OECD commercial stocks 1-4 months ahead and Brent timespreads. By making the additional simplifying assumption that there are only two outcomes, namely no disruption and a disruption of a given size X, this mechanical boost to oil prices would roughly equal the product of:

- the rise in the probability dP of a disruption over the next few months (where dP<1)

- the size X of the disruption (where X is in mb/d)

- the number of months M a significant disruption would last

- $1/bbl (this coefficient is based on our timespreads framework)

Of course, OPEC has a sizable ability to offset disruptions.

Q9. Beyond the (moderately) higher risk of lower Russia supply, are there any other channels through which these developments may affect oil prices?

While the higher risk of lower supply at some point may put some upward pressure on prices, the impact on oil prices will be limited. For one thing, oil markets are often focused on spot fundamentals, which have not changed, and three other effects may provide an offset. First, markets may discount the increased risk of Russia supply disruptions because its OPEC+ partners/Saudi Arabia might dial down some of the voluntary cuts in response to any large supply drop. Second, increased uncertainty may weigh on oil demand in Russia (and possibly also outside of Russia), and on sentiment in asset markets. Three, the increased uncertainty about the political situation in Russia may increase the perceived probability of a tail scenario, where escalating tensions between Russia and Saudi Arabia lead to sharply higher core OPEC output.

Q10. You published last week a piece on the long-run implications for oil prices from Russia’s invasion of Ukraine, and from the 2022 energy crisis. What were the take-aways, and do the developments over the weekend alter these conclusions?

The 2022H1 rally was largely driven by fears of major Russia disruptions, and that much of the subsequent selloff reflected the powerful responses of policy (e.g. record SPR releases, higher interest rates) and of the market (e.g. higher US shale supply) to higher prices.

Goldman identified three potentially bearish long-run implications from the 2022 energy crisis:

- the energy firms’ shift from ESG to energy security and the associated pick-up in oil investment (although it remained almost 40% lower last year than in 2014)

- the potential shift in power from producers to consumers if the oil price cap—designed to keep barrels on the market while dwindling Russian revenues-became a blueprint for future sanctions

- the 2022 jump in investment in clean energy (+15% year-on-year) and EVs (+60%), and its negative effect on long-run oil demand

It is of course too early to confidently identify any long-run effects from the most recent developments. That said, at the margin, the surprising geopolitical developments over the last couple of days likely illustrate the uncertain nature of the current geopolitical global environment. This elevated uncertainty may further support the shift in focus to energy security.

More in the full goldman note available to pro subscribers.

Tyler Durden

Mon, 06/26/2023 – 14:40

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com