Visualizing Gold Price And US Debt (1970-2023)

Gold has long been considered a store of value and a hedge against economic uncertainty.

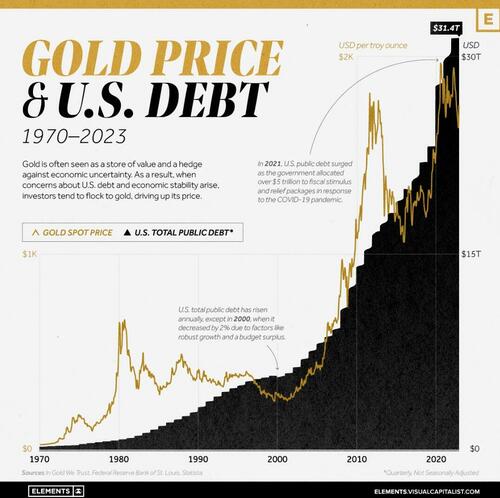

Over the past five decades, its price has been closely intertwined with concerns surrounding the growing U.S. public debt.

In the graphic below, Visual Capitalist’s Bruno Venditti, using data from In Gold We Trust and the Federal Reserve Bank of St. Louis, explores the relationship between gold price and the U.S. national debt.

A $31T Government Debt

The U.S. national debt is the amount of money the federal government has borrowed to cover the outstanding balance of expenses incurred over time.

Every fiscal year, if spending exceeds revenue, the federal government borrows money by selling marketable securities such as Treasury bonds, bills, notes, floating rate notes, and Treasury inflation-protected securities (TIPS) to cover the deficit.

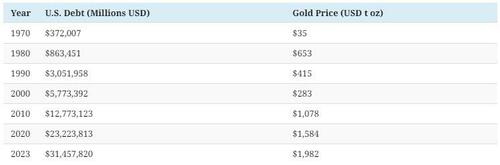

The American public debt has risen annually since 1970, except in 2000, when it decreased by 2% due to factors like robust growth and a budget surplus.

Over the last few decades, the national debt has grown from around $370 million in 1970 to an all-time high of $31.4 trillion in 2023, recently sparking the debate in Congress to increase the debt ceiling to avoid a potential default.

The number is even higher if considering federal unfunded liabilities. Those are future financial obligations that the government has committed to but lacks sufficient funds to fully cover, such as Social Security and Medicare. Taking those into consideration, the current present value of the fiscal imbalance is $244.8 trillion, almost 10 times the current U.S. GDP.

U.S. Debt’s Implication on Gold Prices

A rising US debt often leads to concerns about inflation. When a government accumulates a significant amount of debt, it may resort to measures such as printing more money or increasing government spending, potentially leading to inflationary pressures. In such situations, investors may turn to gold as a hedge against inflation.

In addition, as the federal debt levels rise, investors may become wary of the stability of financial markets and seek safe-haven assets such as gold.

Although the price of gold tends to rise as U.S. debt increases, numerous other factors can also influence the market, including market sentiment, central bank policies, and global economic conditions.

Tyler Durden

Wed, 07/05/2023 – 04:15

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com