Buying European Real Estate Is A Contrarian Trade

By Michael Msika, Bloomberg Markets Live reporter and strategist

Real estate stocks have shown signs of life in July, giving investors a taste of what the most-shorted sector in Europe could do if the outlook improves even slightly for the industry.

The Stoxx 600 Real Estate index bounced nearly 14% between late June and late July, trimming this year’s decline. Its 4.6% loss year-to-date is still the second-worst after miners among sub-sectors in Europe. But there are signs that peak pessimism may not be far away, and that the stocks may already be pricing in further earnings and credit deterioration, offering a cushion to prices.

“We’re optimistic on real estate for the rest of the year as we see the downside from higher interest rates now priced into book value,” says UBS strategist Gerry Fowler. “Companies like Vonovia have also implemented a lot of self help, which is fantastic when you’re very cheap. The sector is now at the top of our framework scoring after remaining at the bottom earlier this year.”

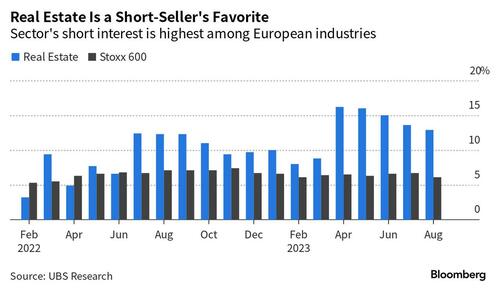

As a highly-levered sector, real estate has been challenged since the end of 2021 as rising interest rates and soaring inflation squeezed consumers and companies. Valuations have dropped dramatically and are now at a 30% discount to the 2023 EPRA net tangible assets as estimated by UBS. Most of all, the sector became a short sellers’ favorite.

“European real estate stands as the most crowded short of all sectors and markets,” says UBS analysts including Charles Boissier, a trend that started in the fourth quarter 2021, and points to potential “short squeezes” ahead. The analysts note that short interest on the sector has been decreasing for four consecutive months now, driven lower by some of the most-shorted names including Aroundtown or Unibail-Rodamco-Westfield.

SBB remain the most-shorted real estate stock, followed by Balder, Fabege, Aroundtown and LEG, “the common theme being their higher-than-average leverage,” the analysts write. They also note Klepierre has seen a rise in short interest in past month, while short interest remains high in Sweden in particular.

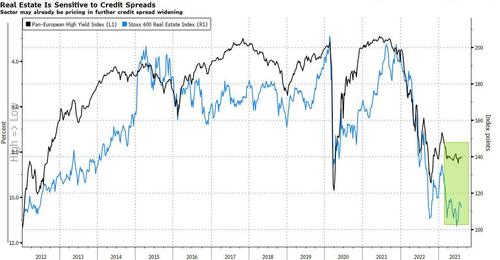

The latest earnings season hasn’t been great for real estate stocks, one of the few sectors tracking negative EPS growth at -4%, and showing a downside surprise of 23%, according to JPMorgan strategists. That said, the majority of companies reporting have beaten estimates, while the sector’s performance seems to have undershot the trend, and stocks could already be pricing a further drop in profits.

To be sure, the sector is still facing challenges, and any bounce could be short-lived. The latest rebound is already showing signs of stalling as equity markets wobble. Retail and office exposure remain a concern for the sector, while the work-from-home trend is a long term headwind for office rents, according to Barclays strategists. Higher rates are pressuring valuations and may lead to some companies’ balance sheets being questioned, with potential capital raises ahead, they add.

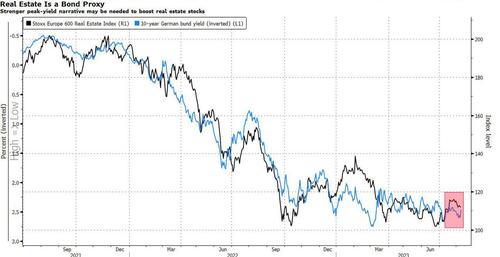

One of the biggest risks is that rates rise on the back of stubborn inflation, and policy rates adjust sharply higher, according to JPMorgan derivatives strategists. Other risks include inflation starting to moderate at a slower pace forcing central banks to hike more, a sharp recession, or a credit crunch, but none of those is their base case. JPMorgan forecasts bond yields to trade lower into year-end and the first half of 2024 in Europe, US and UK, as evidence of disinflation builds and the end of the hiking cycle approaches.

“We believe real estate, expressed through Vonovia, may have the attributes to surprise the market on the upside given our high-conviction view that rates will trade lower, the sector’s high and negative sensitivity to rates, and its poor performance over the last 18 month resulting in rock bottom valuations,” says JPMorgan derivatives strategists led by Davide Silvestrini. “We think a lot is priced in.”

Tyler Durden

Wed, 08/09/2023 – 07:20

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com