Large Bank Loan Volumes Slump Despite Fed Reporting Massive Deposit Inflows

Money-market funds saw inflows and banks’ usage of the Fed’s emergency BTFP facility hit a new high this week, so what malarkey does The Fed have in store when it tries to explain what happened to bank deposits.

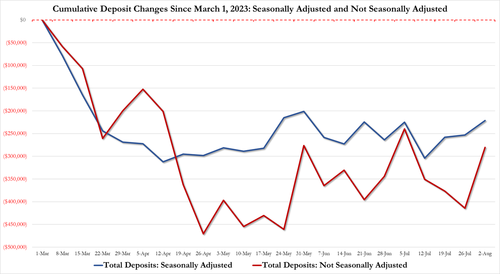

Seasonally-adjusted, total deposits rose by $17.6 billion last week (the 3rd straight week on SA inflows)…

Source: Bloomberg

And for once, non-seasonally-adjusted deposits rose too (by a huge $121 billion!)

Source: Bloomberg

The divergence between money-market fund assets and bank deposits remains extreme…

Source: Bloomberg

On a non-seasonally-adjusted basis, Large banks saw $81BN inflows and Small banks $53BN inflows (while Foreign banks suffered a $12BN deposit outflow)…

Source: Bloomberg

The big surge in NSA (out of nowhere) magically recoupled it with the cumulative SA deposit outflows…

Domestically (removing foreign deposit flows), banks saw a massive $134BN inflow (NSA), which was whittled down to a $31.5BN inflow (SA)…

Source: Bloomberg

On the other side of the ledger the story gets murkier with large bank loan volumes tumbling almost $10 billion as small bank lending accelerated…

Source: Bloomberg

Make of it what you will – but ‘baffle em with bullshit’ comes to mind on this dataset.

Tyler Durden

Fri, 08/11/2023 – 16:40

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com