Where The World’s Ultra Wealthy Reside

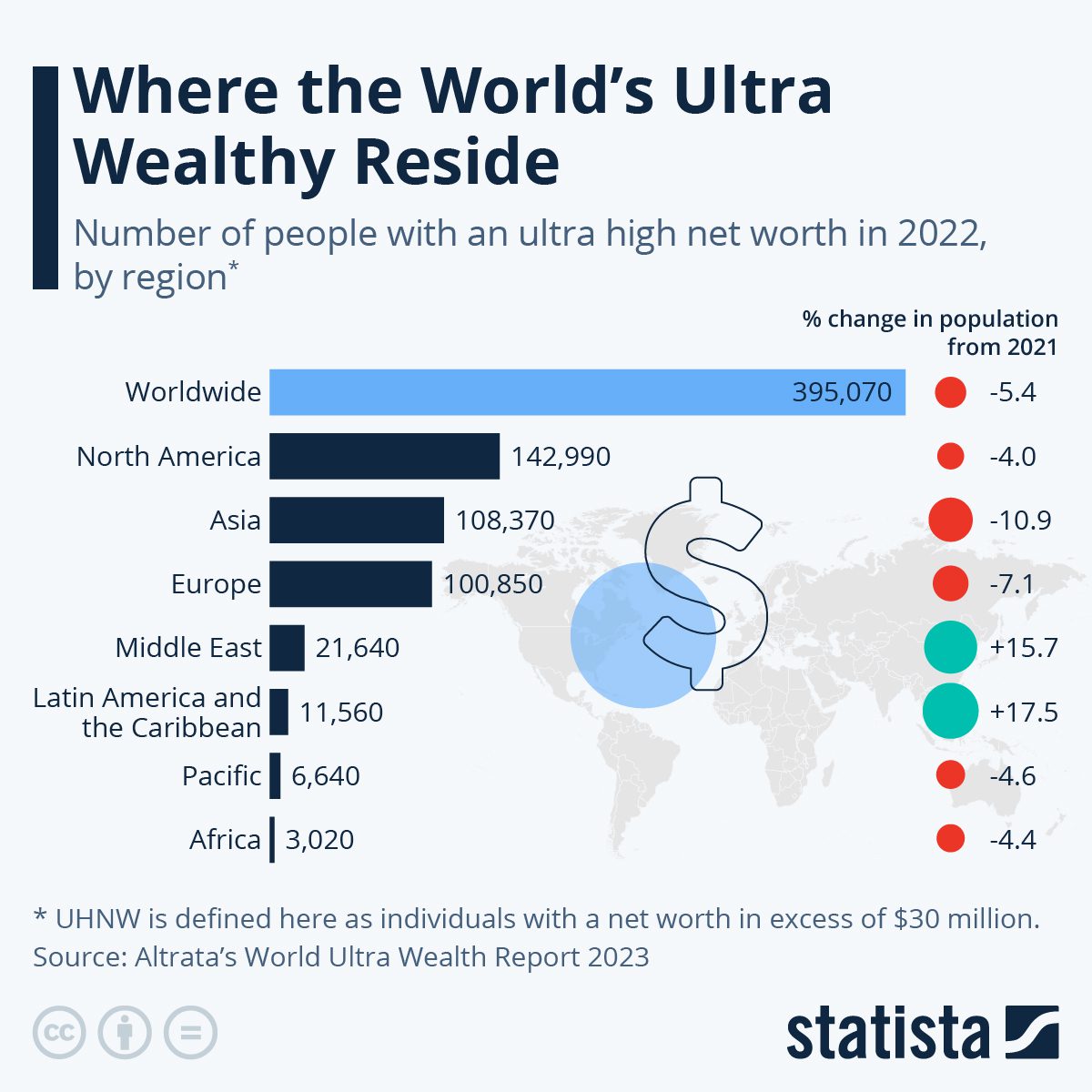

There were a total of 395,070 ultra wealthy individuals worldwide last year, according to Altrata’s World Ultra Wealth 2023 report.

This was a 5.4 percent drop from one year before and the first downturn since 2018.

Following record highs in recent years, combined net worth similarly fell by 5.5 percent to $45.4 trillion.

While North America is still the world region with the highest number of ultra wealthy people at 142,990 individuals, Asia follows in second place with 108,370 and Europe in third place with 100,850.

As Statista’s Anna Fleck shows in the following chart, Asia’s ultra rich population fell by 10.9 percent in 2022, marking the biggest proportional year-on-year decline of any region worldwide.

Reasons cited by analysts include the impacts of China’s strict Covid policies as well as the fallout from the war in Ukraine, which, they write, impacted exports and consumption, disrupted regional supply chains and depressed stocks, especially in tech-heavy markets such as South Korea and Taiwan.

You will find more infographics at Statista

Europe also recorded a fairly significant fall in its number of ultra wealthy people in this time frame (-7.1 percent to 100,850 people).

The ten countries with the highest numbers of ultra wealthy people, who each have a net worth in excess of $30 million, include: the United States (129,665), China (47,190), Germany (19,590), Japan (14,940), United Kingdom (14,005), Canada (13,320), Hong Kong (12,615), France (11,980), Italy (8,930) and India (8,880).

Of these, India was the only country to record an increase in its ultra wealthy population year-on-year (+3.2 percent), while all others saw declines.

Hong Kong and Japan saw the greatest negative percent change in their ultra wealthy populations, at -23% and -21.9 percent, respectively.

Tyler Durden

Wed, 09/13/2023 – 05:45

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com