“Premiums Are Going Nuts Everywhere”: Plunging US Supply Sends Oil Prices Around The World Soaring

Buyers of physical oil across the planet are experiencing an acute supply shortage and are facing some of the highest premiums for supplies they’ve seen in months as plunging stocks at the largest US crude storage hub send shockwaves cross markets from Asia to Europe and the Middle East.

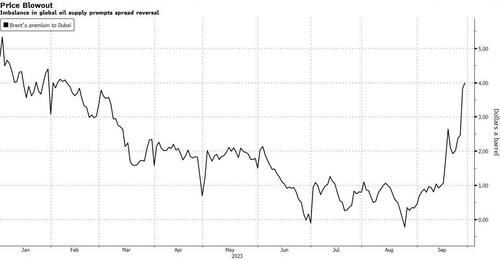

As Bloomberg reports, US crude cargoes on offer in Asia are being offered at the costliest premium this year. The spread between Brent and Middle East oil has jumped to the highest since February while the premium for near-term US supply is close to the highest since July 2022.

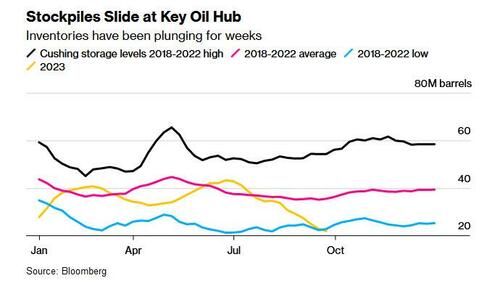

Behind the soaring premiums is Cushing, Oklahoma, the delivery point for benchmark US crude futures, which helps to set the price of oil across the Americas and beyond. As we have noted in recent weeks, inventories at the hub are now sitting just above seasonal lows last seen in 2014, and are effectively at the level known as “tank bottoms” below which inventories are for the most part unusable.

Cushing Tank bottoms pic.twitter.com/z8Rr20mR5B

— zerohedge (@zerohedge) September 27, 2023

Stockpiles at Cushing, Oklahoma tumbled below 22 million barrels last week, the lowest since July 2022, and have dropped for seven straight weeks, reaching the lowest level at this time of the year since at least 2018. At these levels, many traders consider inventories to already be at the lowest levels that allow tanks to function normally.

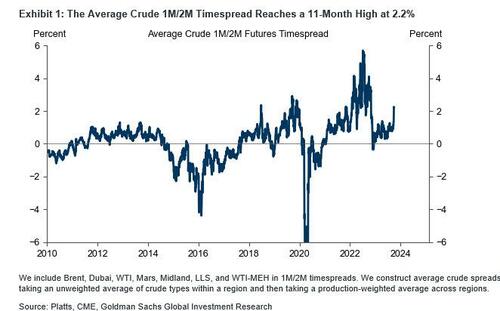

The situation is forcing some traders to pay up big for last-minute supplies at Cushing. The prompt futures spread, which closely tracks supply and demand at the site, surged above $2 a barrel on Wednesday, the highest since July 2022.

Meanwhile, the US refinery maintenance season is getting underway, which will prevent the storage hub from draining to absolute lows. Still, exports remain a wild card for balances, given that demand for American oil is high amid OPEC+ supply curbs, meaning domestic users will likely have to pay up to keep barrels in the US.

Operationally, pulling oil out of tanks when levels fall below the so-called “suction line” is difficult and expensive, and the quality of crude can be compromised by the presence of water and sediment. For now, traders are expecting stockpiles to halt their decline by October and possibly start building up again, depending on how exports shape up. Indeed, this week’s drawdown was less than 1 million barrels — the first time that’s happened since early August.

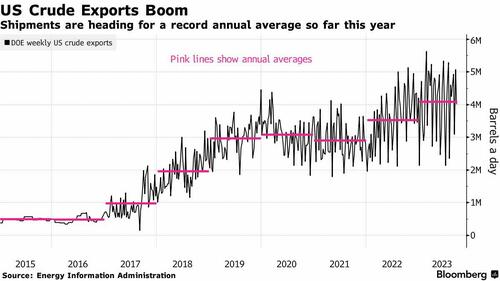

Cushing’s role in global oil markets has also diminished in recent years since the US lifted an export ban. Most barrels now flow straight from the prolific oilfields in Texas’ Permian Basin to the coast, where they are shipped to overseas buyers.

“Cushing can stay at minimum operating operating levels for an extended period of time,” said Scott Shelton, an energy specialist at ICAP. “It’s now a transit point to the US Gulf Coast and a supply point for Cushing-based refiners.”

The latest surge in US crude spreads also fueled a jump in Brent spreads, with the prompt spread climbing above $2 as well, to the widest in a year.

All that’s happening just as the world was already facing a tight supply situation with Saudi Arabia and Russia cutting output. In recent months, the US had helped fill a void left in the market, routinely sending more than 4 million barrels every day to sate global appetite. Between overseas shipments and strong domestic demand, stockpiles quickly declined in the US. Now there’s a question of whether those flows will continue.

“We’re running out of oil – you can see how low storage is at Cushing,” said Gary Ross, a veteran oil consultant turned hedge fund manager at Black Gold Investors LLC. “If we’re running out at Cushing, then we’re running out in Europe, because it relies on US exports. If the US exports less, then where is Europe going to get its oil from?”

As supplies collapse, cargoes of WTI Midland crude for January delivery to Asia are being offered for sale at premiums of $9 a barrel above benchmark Dubai oil, according to traders who buy and sell the grade. That would be the highest premium seen this year, data compiled by Bloomberg show. Actual trading will likely start next week, giving more clarity on how much stronger the market for US barrels has gotten.

Abu Dhabi’s Murban crude also surged against Dubai on the ICE Futures Abu Dhabi exchange. Although spot cargoes of Middle Eastern crude will only begin trading in the coming weeks, the premium of the grade — often compared with WTI Midland — increased to the highest since February/

In the futures market, the surge is already apparent. The tightness in US supplies narrowed the gap between US crude and international benchmark Brent to under $3 a barrel, the smallest since May last year. Meanwhile, the spread between Brent and Middle East’s Dubai marker — also known as Brent-Dubai EFS — has skyrocketed

While there’s been a lot of angst over the shrinking US inventories, there are yet to be any concrete signs of a slowdown in American exports.

“Waterborne exports in October are still likely to come in close to 4 million barrels a day,” said Matt Smith, oil analyst at Kpler. “The lagged impact of the tightening Brent-WTI spread means we may not see the full impact until November’s loadings.”

For November and beyond, it’s still likely exports will hover around the 4 million barrels a day level, Smith said, citing strong domestic shale production.

Traders also point to inventories being fairly robust in the Gulf Coast region as a sign that US exports could continue to remain strong for a few weeks. At the same time, heavy seasonal refinery maintenance work in the US alongside turnarounds in Europe should also offer a cushion and free up some supplies.

Already, prices for WTI in Midland and WTI at Houston are weakening relative to prices at Cushing. If that continues, it could re-open the arbitrage window to ship crude profitably to Asia. It should also help to send more barrels to Cushing.

Still, there are signs that some European refiners are having to pay up for immediate supplies.

Angola’s Sonangol sold four cargoes as much as $1.50 a barrel above offer prices over the past week, with three of the shipments likely going to Europe. Those cargoes would usually be destined for Asia — the atypical trade pattern reflects some of the market’s sharp swings this week.

“The premiums are going nuts everywhere,” Ross said. “The Saudis have tightened this market up dramatically.” Almost as if Saudi Crown Prince MBS doesn’t care much for Joe Biden’s sole election “strategy” of keeping gas prices low – fist bumps notwithstanding…

… especially now that the US SPR is half-empty and any continued drainage would lead to catastrophic collapse at the salt caverns that hold US emergency inventories, sending oil prices to new record highs.

Tyler Durden

Sat, 09/30/2023 – 16:45

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com