Kodak Halted 9 Times As Stock Explodes Higher Amid Flood Of Retail Buying

Tyler Durden

Wed, 07/29/2020 – 10:37

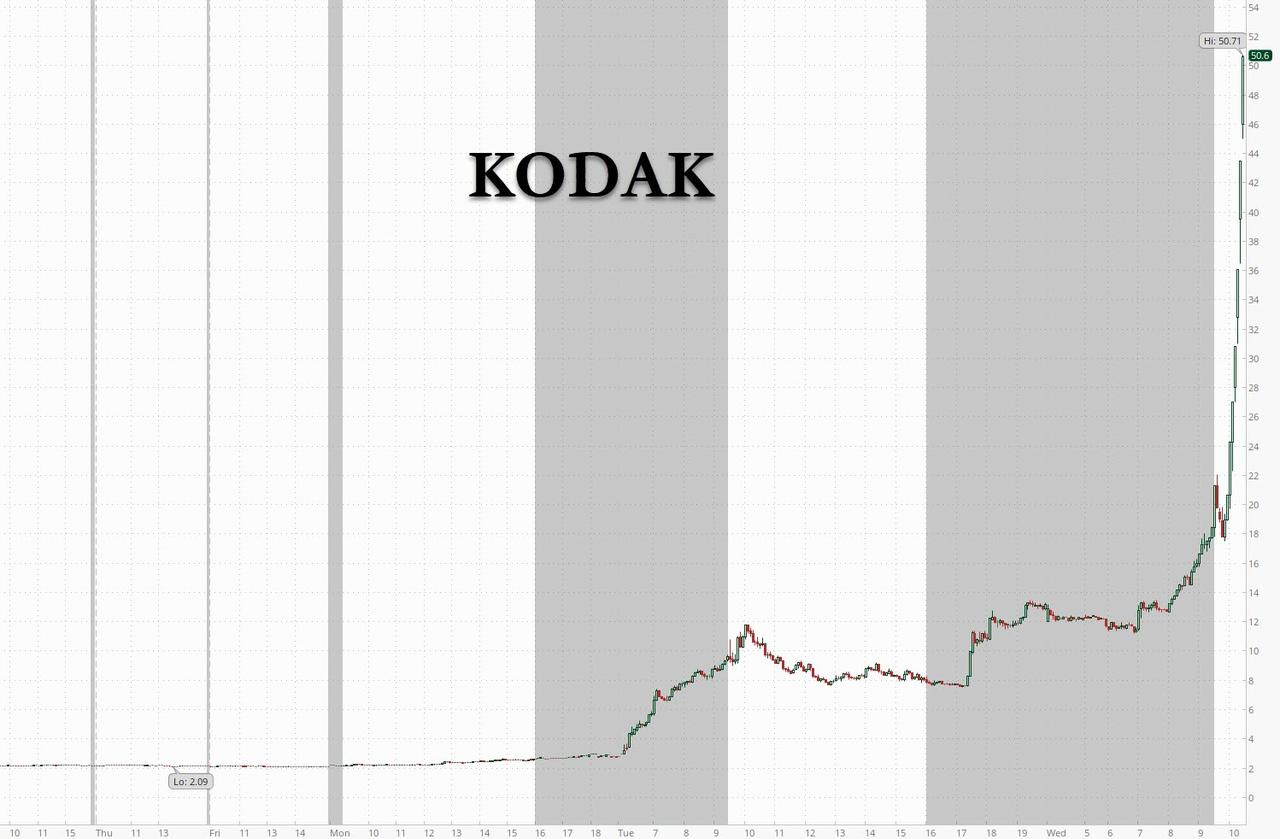

Yesterday morning we reported that the formerly giant and now tiny Kodak had received a $765m loan from the government to shift to producing chemicals needed for local production of generic medicines, a step taken to ensure that the US is no longer solely reliant on China and India for such inputs, and which sent the stock sharply higher on Tuesday, we had a simple question: why was the stock not much higher: after all with a market cap of just a few hundred million, this stock was about to be a call option on a US-government funded shift to non-China supply chains. And sure enough, we asked as much well before today’s market open.

If Trump plans to use Kodak as the anti-China stock with full government backing, shouldn’t it be trading at $100?

— zerohedge (@zerohedge) July 29, 2020

https://platform.twitter.com/widgets.js

We also noted that once Robinhooders discovered the company’s upward momentum, it would soon become the most popular stock on the retail-focused brokerage.

KODK be a top 10 RH stock in a few days pic.twitter.com/VDyAwb1cV1

— zerohedge (@zerohedge) July 29, 2020

https://platform.twitter.com/widgets.js

Well, we were right, because less than an hour into trading, Kodak stock has been already halted no less than 8 times…

… amid relentless surges in volatility, which have sent the stock which was trading at just $2/share a few days ago above $50, one of the biggest stock spikes in history.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com