Key Events In The Coming Quiet Week: CPI, Retail Sales, End Of Earnings Season

Tyler Durden

Mon, 08/10/2020 – 09:35

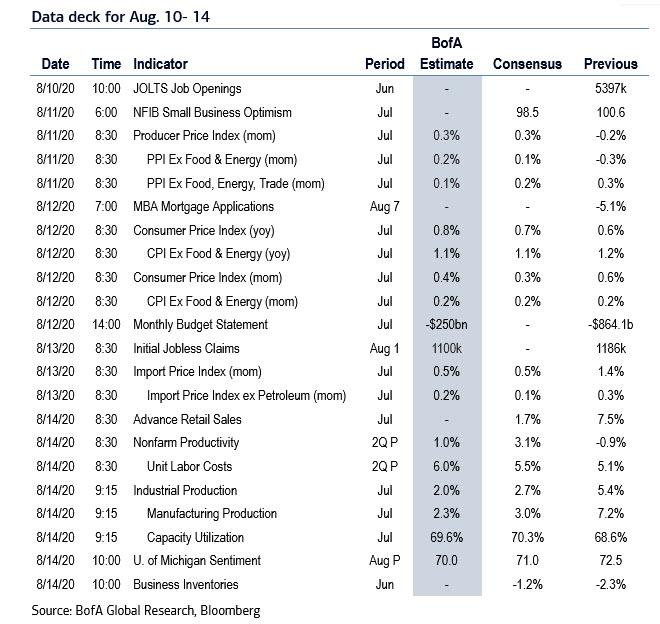

With much of Wall Street on vacation, there is a fairly sparse calendar this week so as Deutsche Bank’s Craig Nicol writes, it is likely that markets will be taking their temperature from the state of play in Washington. So far we’ve shrugged off the disappointment around the lack of agreement on the next US fiscal package, however with each passing day the greater the risk is to consumer confidence and spending as our US economists highlighted over the weekend, especially given that the over 31 million people receiving unemployment insurance as of the week of July 18 are set to see their monthly income decline by 60%-plus in August.

Aside from fiscal developments, the only notable data releases this week in the US are July CPI on Wednesday and July retail sales on Friday. The latest weekly jobless claims print on Thursday is also worth keeping an eye on.

In Europe we’ve got Germany’s August ZEW survey on Tuesday and a second look at Q2 GDP for the Euro Area on Friday. In China the highlight is on Friday with the July activity indicators data.

Finally, earnings season starts to wind down with the best part of 90% of the S&P 500 having already reported, with the most prominent reporters this week laid out below.

What’s notable is that the early trends of outsized and broad earnings beats has only continued, with forward estimates also ticking higher.

Courtesy of Deutsche Bank, here is a day-by-day calendar of events

Monday

- Data: China July CPI and PPI; Bank of France July industrial sentiment; Euro Area Aug Sentix investor confidence; US June JOLTS job openings

- Earnings: Duke Energy, Marriott, Barrick Gold, Saudi Aramco

- Politics: Democratic presidential nominee Joe Biden is expected to announce his choice for Vice President this week

Tuesday

- Data: Japan June trade balance; UK July jobless claims change and rate, June average weekly earnings, ILO unemployment rate; Aug ZEW survey expectations for Euro area and Germany; Germany Aug ZEW survey current situation; US July NFIB small business optimism, July PPI, July PPI ex Food and Energy

- Central Banks: Fed’s Daly Speaks; Brazil central bank minutes

- Earnings: Prudential, Vestas Wind System, Sysco

Wednesday

- Data: UK June Monthly GDP and preliminary 2Q GDP, June industrial, manufacturing, and construction production and June trade balance; Japan July machine tool orders; Italy July final CPI; Euro June area industrial production; US weekly MBA mortgage applications, July CPI, July real average weekly earnings, July monthly budget statement

- Central Banks: Fed’s Rosengren, Kaplan and Daly speak

- Earnings: Orsted, Novozymes, Genmab, Cisco

- Other: OPEC releases its monthly oil market report

Thursday

- Data: Japan July PPI; France 2Q ILO Unemployment; Germany and Spain final July CPI; US July import price index, export price index, weekly initial jobless claims and continuing claims

- Central Banks: Mexican central bank rate decision

- Earnings: Zurich Insurance, Carlsberg, Deutsche Telekom, Applied Materials

Friday

- Data: China July industrial production, July retail sales, surveyed jobless rate; France final July CPI; Euro area June trade balance, preliminary 2Q employment and preliminary 2Q GDP; US July retail sales advance, preliminary 2Q nonfarm productivity and unit labour costs, July retail sales, July industrial and manufacturing production, preliminary August U. of Michigan sentiment survey.

* * *

Focusing on the US, Goldman notes, that the key economic data releases this week are the CPI report on Wednesday and the retail sales report on Friday. There are several scheduled speaking engagements from Fed officials this week.

Monday, August 10

- 10:00 AM JOLTS Job Openings, June (consensus 5,300k, last 5,397k)

- 04:00 PM Chicago Fed President Evans (FOMC non-voter) speaks: Chicago Fed President Charles Evans will participate in a webinar on workforce issues during Chicago’s recovery from the pandemic.

Tuesday, August 11

- 06:00 AM NFIB small business optimism, July (consensus 100.4, last 100.6)

- 08:30 AM PPI final demand, July (GS +0.4%, consensus +0.3%, last -0.2%); PPI ex-food and energy, July (GS +0.2%, consensus +0.1%, last -0.3%); PPI ex-food, energy, and trade, July (GS +0.2%, consensus +0.2%, last +0.3%); We estimate that headline PPI increased by 0.4% in July, largely reflecting stronger energy prices. We expect a 0.2% increase in the core measure excluding food and energy, and also a 0.2% increase in the core measure excluding food, energy, and trade.

- 11:00 AM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Thomas Barkin will participate in a webinar hosted by the Center for Regional Economic Competitiveness.

- 12:00 PM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will participate in a virtual discussion hosted by the Professional BusinessWomen of California.

Wednesday, August 12

- 08:30 AM CPI (mom), July (GS +0.50%, consensus +0.3%, last +0.6%); Core CPI (mom), July (GS +0.23%, consensus +0.2%, last +0.2%); CPI (yoy), July (GS +0.88%, consensus +0.7%, last +0.6%); Core CPI (yoy), July (GS +1.17%, consensus +1.1%, last +1.2%): We estimate a 0.23% rebound in July core CPI (mom sa), which would leave the year-on-year rate unchanged at +1.2% on a rounded basis. Our monthly core inflation forecast reflects further rebounds in apparel, hotel lodging, and airline prices, as well as continued firmness in car insurance inflation following steep declines in the spring. On the negative side, we expect a decline in education prices reflecting tuition cuts of as much as 5-15% for the fall semester at some universities. We also look for another month of lackluster shelter inflation (+0.1% mom sa for both rent and OER) reflecting continued rent freezes and a drag from rent forgiveness in some areas. We estimate a 0.50% increase in headline CPI (mom sa), reflecting higher energy prices.

- 10:00 AM Boston Fed President Rosengren (FOMC non-voter) speaks; Boston Fed President Eric Rosengren will participate in a virtual discussion about the U.S. economy and current financial conditions hosted by the South Shore Chamber of Commerce. Audience Q&A is expected.

- 11:00 AM Dallas Fed President Kaplan (FOMC voter) speaks: Dallas Fed President Robert Kaplan will participate in a moderated Q&A hosted by the Lubbock Chamber of Commerce.

- 03:00 PM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will participate in a virtual discussion hosted by the Economic Club of New York. Audience and media Q&A are expected.

Thursday, August 13

- 08:30 AM Initial jobless claims, week ended August 8 (GS 1,050k, consensus 1,100k, last 1,186k); Continuing jobless claims, week ended August 1 (consensus 15,800k, last 16,107k): We estimate initial jobless claims declined, but remain elevated, at 1,050k in the week ended August 8.

- 08:30 AM Import price index, July (consensus +0.6%, last +1.4%)

- 11:00 AM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will discuss equitable solutions for the future of cities in a webinar.

Friday, August 14

- 08:30 AM Retail sales, July (GS +1.1%, consensus +1.9%, last +7.5%); Retail sales ex-auto, July (GS +0.8%, consensus +1.3%, last +7.3%); Retail sales ex-auto & gas, July (GS +0.5%, consensus +1.0%, last +6.7%): Core retail sales, July (GS +0.1%, consensus +0.8%, last +5.6%): We estimate that core retail sales (ex-autos, gasoline, and building materials) edged up by 0.1% in July (mom sa), reflecting a pause in reopening across the country, a strong seasonal factor arising from Amazon Prime Day (which is delayed until the fall this year), and as indicated by continued gains in credit card spending and other high-frequency data. We expect relatively stronger monthly gains for restaurants, gas stations, and autos, and we estimate a 1.1% increase in the headline measure and a 0.8% increase in the ex-auto measure.

- 08:30 AM Nonfarm productivity, Q2 preliminary (GS +1.4%, consensus +1.5%, last -0.9%); Unit labor costs, Q2 preliminary (GS +9.0%, consensus +6.2%, last +5.1%): We estimate non-farm productivity growth grew by 1.4% in Q2 qoq saar (+0.3% yoy). This reflects relatively larger declines in hours worked than in business output in Q2. We expect Q2 unit labor costs—compensation per hour divided by output per hour—to increase to +9.0% qoq ar (+4.1% yoy).

- 09:15 AM Industrial production, July (GS +3.1%, consensus +3.0%, last +5.4%); Manufacturing production, July (GS +3.3%, consensus +3.0%, last +7.2%); Capacity utilization, July (GS 70.6%, consensus 70.3%, last 68.6%): We estimate industrial production rose by 3.1% in July, reflecting a continued rebound in manufacturing output. We estimate capacity utilization rose by 2.0pp to 70.6%.

- 10:00 AM University of Michigan consumer sentiment, August preliminary (GS 72.5, consensus 71.9, last 72.5): We expect the University of Michigan consumer sentiment index to remain flat at 72.5, reflecting positive stock market gains and a high but declining number of daily new coronavirus cases.

- 10:00 AM Business inventories, June (consensus -1.1%, last -2.3%)

Source: Deutsche Bank, Goldman, BofA

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com