The 4% Rule Is Dead. What Should Retirees Do Now?

Tyler Durden

Mon, 08/24/2020 – 12:45

Authored by Lance Roberts via RealInvestmentAdvice.com,

The 4% Rule Is Dead. A recent article by Shawn Langlois via MarketWatch pointed out this sobering fact but is one we have discussed previously. Retirees have long counted on being able to retire on their assets and take out 4% each year. However, a little more than 20-years later, the “death of the withdrawal rate” has arrived. What should retirees do now?

As noted by Shawn:

“The 4% Rule has long been used as a guideline for retirees in determining how much they should be able to withdraw from their retirement account while still maintaining a balance that will allow for the same income stream to flow through their golden years.”

The idea of the 4% rule originally suggested that once retired, the portfolio allocation is shifted to ultra-safe Treasury bonds. Such an allocation shift provided for the income required to live on, plus a Government guarantee of the principal.

Here’s the problem.

When the 4% rule was put into place, Treasury yields were 5%. Today, they are closing in on 0.5%.

This is a massive problem for retirees today. As shown, $1 million will no longer generate a $50,000 income for retirement. Today, it is just $6900/year.

Even more shocking has been the speed of the change. In 2016, it took roughly $5 million to generate $50,000/year. Just 4-years later, that number has skyrocketed to over $8 million.

For both young savers, and boomers approaching retirement, the challenges of planning for retirement today are daunting.

Problem #1: Very Few People Have $8 Million

While it is nice to think that throwing a few shekels into the market will magically turn into millions, the reality is far different. As discussed in “Why Are Boomers So Broke,” after two of the greatest bull markets in U.S. history during their lifetime, the savings statistics are depressing.

For many reasons, individuals simply don’t save money. Currently, almost 60% of ALL WORKING-AGE individuals DO NOT own assets in a retirement account.

However, it’s actually more dismal than that. The typical working-age household has ZERO DOLLARS in retirement account assets. Importantly, “baby boomers” who are nearing retirement had an average of just $40,000 saved for their “golden years.”

Lastly, only 4-0ut-of-5 working-age households have retirement savings of less than one times their annual income. This does not bode well for the sustainability of living standards in the “golden years.”

According to the study by MagnifyMoney:

“Although the average American household has saved roughly $175,000 in various types of savings accounts, only the top 10 percent to 20 percent of earners will likely have savings levels approaching or exceeding that amount. 29 percent of households have less than $1,000 in savings.”

You can’t get to $8 million if you can’t save to start with.

Problem #2: Can’t Save For Retirement

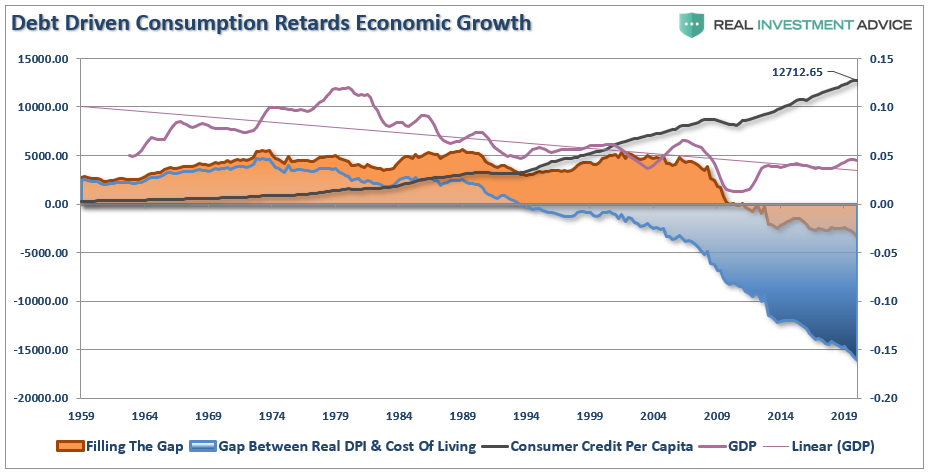

The ability of people to save money has become substantially more problematic. I showed the following chart recently, which illustrates the gap between income, savings, and the cost of living.

“The continued increases in debt, which was used to fill the gap between income and the cost of living, contributed to the retardation of economic growth.”

When viewing the “saving problem” from this perspective, it is easy to understand the survey responses from Kiplinger and Personal Capital. Americans said the biggest roadblocks to saving for retirement were:

-

The high cost of health insurance. “From 1999 to 2017, the cost of family health insurance coverage has more than doubled the amount of take-home pay it consumes.”

-

Disappointing investment performance. “Just under 30% of all respondents (29.4%) said that disappointing investment performance had stopped them from saving as much as they would have liked to for retirement.”

-

The amount of consumer debt they carried. “21.3% of Americans said that debt, not including student loans, kept them from saving for retirement combined with the increased costs of living.”

While the Fed keeps inflating stock markets, the “trickle-down” effect has yet to occur.

Problem #3: Don’t Forget The Inflation

In 1980, $1 million would generate between $100,000 and $120,000 per year while the cost of living for a family of four in the U.S. was approximately $20,000/year. Today, there is about a $50,000 shortfall between the income $1 million will generate and the cost of living.

This is just a rough calculation based on historical averages. However, the amount of money you need in retirement is based on what you think your income needs will be when you get there.

For most, there is a desire to live a similar, or better, lifestyle in retirement. However, over time our standard of living will increase with respect to our life-cycle stages. Children, bigger houses to accommodate those children, education, travel, etc. all require higher incomes. (Which is the reason the U.S. has the largest retirement savings gap in the world.)

If you are in the latter camp, like me, a “million dollars ain’t gonna cut it.”

Problem #4: Starting Your Plan With The Wrong Estimate

Let’s set up a simplistic example.

-

John is 23 years old and earns $40,000 a year.

-

He saves $14 a day

-

At 67 he will have $1 million saved up (assuming he actually gets that 6% annual rate of return)

-

He then withdraws 4% of the balance to live on matching his $40,000 annual income.

That pretty straightforward math.

IT’S ENTIRELY WRONG.

The living requirement in 44 years is based on today’s income level, not the future income level required to maintain the current living standard.

Look at the chart below and select your current level of income. The number on the left is your income level today and the number on the right is the amount of income you will need in 30-years to live the same lifestyle you are living today.

The Inflation-Equation

This is based on the average inflation rate over the last two decades of 2.1%. However, if inflation runs hotter in the future, these numbers become materially larger.

Here is the same chart lined out.

The chart above exposes two problems with the entire premise:

-

The required income is not adjusted for inflation over the savings time-frame, and;

-

The shortfall between the levels of current income and what is actually required at 4% to generate the income level needed.

The chart below takes the inflation-adjusted level of income for each bracket and calculates the asset level necessary to generate that income assuming a 4% withdrawal rate. This is compared to common recommendations of 25x current income.

So, if you need to fund a $50,000 lifestyle in 30 years, assuming a 4% withdrawal rate, it would require a future balance of more than $2 million. Unfortunately, this is no longer realistic.

Based on current valuations in the 95th percentile, and interest rates below 1%, the ability to get anywhere close to 4% is unlikely. Such is going to leave a majority of people working well into their retirement years.

Start Rethinking Your Plan

The analysis above reveals the important points individuals should consider in their financial planning process:

-

Expectations for future returns and withdrawal rates should be downwardly adjusted.

-

The potential for front-loaded returns going forward is unlikely.

-

The impact of taxation must be considered in the planned withdrawal rate.

-

Future inflation expectations must be carefully considered.

-

Drawdowns from portfolios during declining market environments accelerate the principal bleed. Plans should be made during up years to harbor capital for reduced portfolio withdrawals during adverse market conditions.

-

The yield chase over the last 11-years, and low interest rate environment, has created an extremely risky environment for retirement income planning. Caution is advised.

-

Expectations for compounded annual rates of returns should be dismissed in lieu of plans for variable rates of future returns.

Investing for retirement, no matter what age you are should be done conservatively and cautiously with the goal of outpacing inflation over time. This doesn’t mean you should never invest in the stock market, it just means that your portfolio should be constructed to deliver a rate of return sufficient to meet your long-term goals with as little risk as possible.

Things You Can Do Now

-

Save More And Spend Less: This is the only way to ensure you will be adequately prepared for retirement. It ain’t sexy, or fun, but it will absolutely work.

-

You, Will, Be WRONG. The markets go through cycles, just like the economy. Despite hopes for a never-ending bull market, the reality is “what goes up will eventually come down.”

-

RISK does NOT equal return. The further the markets rise, the bigger the correction will be. RISK = How much you will lose when you are wrong, and you will be wrong more often than you think.

-

Don’t Be House Rich. A paid-off house is great, but if you are going into retirement house rich and cash poor, you will be in trouble. You don’t pay off your house UNTIL your retirement savings are fully in place and secure.

-

Have A Huge Wad. Going into retirement have a large cash cushion. You do not want to be forced to draw OUT of a pool of investments during years where the market is declining. This compounds the losses in the portfolio and destroys capital which cannot be replaced.

-

Plan for the worst. You should want a happy and secure retirement – so plan for the worst. If you are banking solely on Social Security and pension plans, what would happen if the pension was cut? Corporate bankruptcies happen all the time and to companies that most never expected. By planning for the worst, anything other outcome means you are in great shape.

Most likely whatever retirement planning you have done is most likely overly optimistic.

Change your assumptions, ask questions, and plan for the worst.

The best thing about “planning for the worst” is that all other outcomes are a “win.”

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com