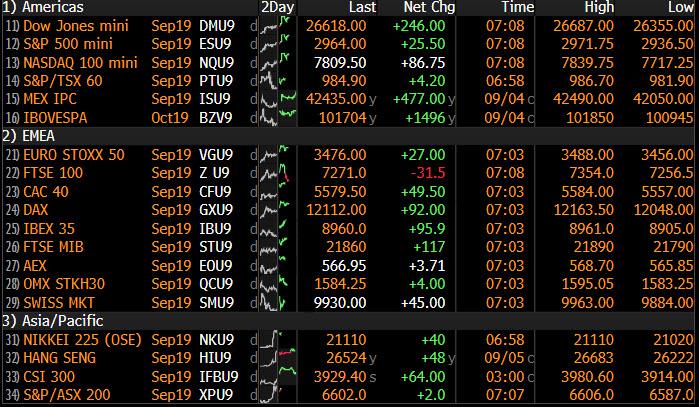

In a world where every single trading day’s mood is set by the latest trade war news, headlines, rumors and innunedo, it should come as no surprise that following news that the US and China are set to agreed to restart high-level trade talks in early October in Washington, that global stocks and US equity futures will be another sea of green, with the S&P jumping 26 point and now just 2% below its all time highs.

The latest round of talks, which was announced just 4 days after even higher tariffs were slapped on US and Chinese goods, was agreed to in a phone call between Chinese Vice Premier Liu He and USTR Robert Lighthizer and U.S. Treasury Secretary Steven Mnuchin, China’s commerce ministry said in a statement on its website. China’s central bank governor Yi Gang was also on the call.

“Both sides agreed that they should work together and take practical actions to create good conditions for consultations,” the ministry said. “Lead negotiators from both sides had a really good phone call this morning,” ministry spokesman Gao Feng said in a weekly briefing. “We’ll strive to achieve substantial progress during the 13th Sino-U.S. high-level negotiations in early October.”

The glimmer of hope in the global trade war – officials from the U.S. and China had been struggling to agree on new talks – added to a broad risk-on mood that took hold Wednesday, when British lawmakers moved to block an imminent no-deal Brexit and Hong Kong’s leader sought to quell unrest in Asia’s key financial hub. Focus will now shift to remarks from Fed Chair Jerome Powell and the latest U.S. jobs report, both due Friday, amid expectations for further monetary easing.

While it is virtually certain that nothing tangible will emerge from this latest attempt at de-escalation, which is meant to calm the popular mood around China’s October 1 National Day holiday, it was predictably sufficient to boost algo trading optimism and sent stocks sharply higher around the globe.

Indeed, news of the early October talks lifted most Asian share markets on Thursday, raising hopes these can de-escalate the U.S.-China trade war before it inflicts further damage on the global economy. Asian stocks climbed, led by technology firms and material producers. Almost all markets in the region were up, with Japan leading gains. The Topix jumped 1.8% for its biggest gain since July 19, as electronics firms and machinery makers advanced. The Shanghai Composite Index rose 1%, buoyed by large insurers and banks, while Hong Kong’s Hang Seng Index closed little changed following a 3.9% rally on Wednesday. China’s cabinet signaled further monetary easing to counter economic headwinds. India’s Sensex dropped 0.1% as investors assessed waning economic growth

European stocks followed Asia’s lead, pushing higher on renewed trade optimism as China and the U.S. are set resume talks next month. The Stoxx Europe 600 Index rose for a second day, led by technology, autos and industrials, with every major national benchmark except the U.K.’s FTSE 100 in the green and carmakers setting the pace. Traders ignored the latest batch of dismal German economic data, which saw German industrial orders fell more than expected in July on weak demand from abroad, suggesting that struggling manufacturers could tip Europe’s biggest economy into a recession in the third quarter. Orders for “Made in Germany” goods were down 2.7% from the previous month in July, driven by a big drop in bookings from non-euro zone countries. Consensus had expected a -1.5% drop. The June reading was revised up to an increase of 2.7 from a previously reported 2.5% increase.

“The misery in manufacturing continues. The decline in new orders significantly increases the risk of a recession for the German economy,” VP Bank analyst Thomas Gitzel said. “The danger is great that negative growth will also be recorded in the third quarter,” Gitzel added, eyeing the possibility of a technical recession after German GDP contracted by -0.1% in Q2, with Q3 GDP now widely expected to shrink as well.

Bond yields rose across most curves, with 10-yr bund and UST yields rising 3bps and 5bps, respectively. European yields curves steepened across the board as investors take heed of the doubters in the European Central Bank over a fresh package of quantitative easing. China’s government bonds advanced as sentiment got a boost from Beijing’s call for monetary easing and inclusion in a major global index. The yield on 10-year sovereign bonds fell 3 basis points to 3.02%, the lowest since Aug. 15. China’s cabinet has called for the “timely” use of tools such as reserve-ratio cuts to support the economy. Adding to the optimism, JPMorgan said it will include some onshore bonds into its benchmark emerging-market indexes, a move that would spur capital inflows. Meanwhile, traders are bracing for a PBOC cut in the RRR: “China is starting a new round of easing,” said Ming Ming, head of fixed-income research at Citic, adding the 10-year government yield could fall toward 2.8%. “The central bank will likely reduce broad RRR and also ease in a targeted manner to support smaller companies. We also can’t rule out a cut to interest rates.”

In FX, the pound added to Wednesday’s big gains following Parliament’s move to block both a no-deal exit from the European Union and an early British election. The dollar fell for a third day, sliding 0.1% lower, while the euro edged higher despite disappointing factory data in Germany. The SEK lead G-10 gains after the country’s central bank defied expectations it would turn more dovish, sticking with its plan to withdraw stimulus from the biggest Nordic economy.

Elsewhere, West Texas oil fluctuated. Florida orange groves seemingly escaped major damage from Hurricane Dorian, but concern is now turning to soy, corn and cotton fields as well as livestock in Georgia and the Carolinas as the storm churns northward.

Today, US investors will look forward to several big data points, including Challenger job cuts, jobless claims and services

Market Snapshot

- S&P 500 futures up 0.8% to 2,962.25

- STOXX Europe 600 up 0.5% to 385.24

- MXAP up 1.1% to 155.32

- MXAPJ up 0.8% to 502.11

- Nikkei up 2.1% to 21,085.94

- Topix up 1.8% to 1,534.46

- Hang Seng Index down 0.03% to 26,515.53

- Shanghai Composite up 1% to 2,985.87

- Sensex down 0.4% to 36,593.44

- Australia S&P/ASX 200 up 0.9% to 6,613.17

- Kospi up 0.8% to 2,004.75

- German 10Y yield rose 2.7 bps to -0.647%

- Euro down 0.02% to $1.1033

- Brent Futures up 0.2% to $60.83/bbl

- Italian 10Y yield fell 6.3 bps to 0.472%

- Spanish 10Y yield rose 4.8 bps to 0.197%

- Gold spot down 0.7% to $1,541.85

- U.S. Dollar Index down 0.08% to 98.37

Top Overnight News from Bloomberg

- Boris Johnson was humiliated by Parliament for a second day running, with his do-or-die Brexit strategy derailed and even his plan for a general election rejected. But having bet everything on getting Britain out of the European Union by Oct. 31, he can’t back down.

- China and the U.S. announced that face- to-face negotiations aimed at ending their tariff war will be held in Washington in the coming weeks, amid skepticism on both sides that any substantive progress can be made.

- Hong Kong leader Carrie Lam said her decision to scrap extradition legislation was only the “first step” to addressing the city’s unrest, but resisted protesters’ calls to immediately meet the rest of their demand

- Mario Draghi’s bid to reactivate bond purchases in a final salvo of stimulus is being threatened by the biggest pushback on policy ever seen during his eight-year reign as European Central Bank president.

- German factory orders fell in July, aggravating an industrial slump that has pushed Europe’s largest economy to the brink of recession. Demand fell 2.7% from June, when it rose at the same pace, as orders from outside the euro region plunged

Asian equity markets traded higher across the board as the region took impetus from the upside in global peers after dovish Fed rhetoric and positive developments in Hong Kong in which the extradition bill was fully withdrawn, while US-China trade hopes exacerbated the gains after the sides agreed to hold talks in Washington early next month. ASX 200 (+0.9%) and Nikkei 225 (+2.1%) were boosted by the trade developments and with the energy sector frontrunning the gains in Australia due to the recent advances in oil prices, while exporter names in Tokyo benefitted from a weaker currency. Hang Seng (U/C) and Shanghai Comp. (+1.0%) conformed to the heightened risk appetite after the phone call between China’s Vice Premier Liu He with US Treasury Secretary Mnuchin and USTR Lighthizer in which the sides also agreed on trade consultations mid-September ahead of next month’s talks and will take action to create good conditions for the consultations. Furthermore, expectations of PBoC easing after China’s Cabinet announced it will implement RRR reductions ‘in time’ have added to the optimism, although the advances in Hong Kong were restricted considering its benchmark had already surged just shy of 1000 points or a near-4% gain yesterday due to the extradition bill withdrawal. Finally, 10yr JGBs briefly slipped below the 155.00 level amid pressure across global bond futures triggered by the US-China trade talk announcement, although prices later nursed some of the losses after a mostly firmer than previous 30yr JGB auction.

Top Asian News

- Thailand’s Death Toll From Tropical Storms, Floods Rises to 16

- Singapore’s CXA Says Seeking $50 Million in New Funding Round

- China Strongly Opposes Escalation of Trade War, Gao Says

- Indonesia Allows Miners to Add Export Quotas; Nickel Tumbles

A positive session thus far for most of the major European bourses [Eurostoxx 50 +0.8%] as the region follows suit from a mostly positive Asia-Pac session as trade optimism bolstered sentiment after China’s Mofcom announced a US/China meeting in Washington next month, although an explicit date has not been reported. UK’s FTSE 100 (-0.7%) is the laggard and has slipped further due to a strengthening GBP after UK PM Johnson received a double whammy with UK Parliament voting to pass the bill to delay Brexit and defeated the PM’s bid for snap elections. Sectors are mixed with the IT sector the clear outperformer as chip names rally on US-China optimism; meanwhile defensive sectors are in the red amid the risk appetite. In terms of individual movers, Equinor (+7.9%) shares spiked higher after the Co. began a USD 5bln share buyback programme which is to be completed at the end of 2020. Elsewhere, Safran (+6.1%) and Melrose (+6.3%) rose on the back of earnings. On the flip side, William Hill (-1.7%) shares opened lower following on from the resignation of its CEO.

Top European News

- Drop in German Factory Orders Aggravates Recession Risk

- Italy’s New Finance Minister Is a Peace Offering to Europe

- Equinor Jumps After Starting $5 Billion Buyback Program

- Thyssenkrupp DAX Ouster a Sign of the Times for Struggling Group

In FX, The Swedish Crown is rallying in wake of the Riksbank policy meeting as a hike by the end of 2019 or in Q1 next year is still on the agenda even though the accompanying statement acknowledged looser monetary policy elsewhere, a deterioration in sentiment and included the caveat that the Central Bank will adjust rates if prospects for the domestic economy and inflation change. Moreover, the projected repo path was lowered and the Riksbank reiterated the need to proceed with caution. Nevertheless, Eur/Sek has tested support below 10.7000 in the form of the 100 DMA on relative policy outlooks given that the ECB is widely tipped to unleash more stimulus next week.

- NOK/NZD/AUD/CAD/GBP – Although Statistics Norway believes rates have peaked, the Norges Bank retains guidance for a further 25 bp tightening by the end of the year, and Eur/Nok is also retreating further from recent peaks amidst a broad upturn in risk sentiment with the cross eyeing 9.9250. Elsewhere, the Kiwi and Aussie are also buoyed by reports that the US and China are planning to hold trade talks in early October, while the Loonie is extending its post-BoC gains (less dovish than expected stance) through 1.3200. However, the Antipodean Dollars have switched places as Nzd/Usd builds a firmer base above 0.6350 and Aud/Usd is capped around 0.6825 with the Aud/Nzd cross topping out just above 1.0700 accordingly, perhaps in response to overnight Australian trade data revealing a moderately narrower than forecast surplus. Note also, decent option expiries between 0.6790-0.6800 may be hampering the Aussie. Meanwhile, a generally softer Greenback (DXY just off another new recent low, at 98.185, and under a key 50% Fib level of 98.464) alongside manoeuvres in Westminster to block a no deal Brexit continue to prop up the Pound, with Cable nudging above 1.2300, to just shy of 1.2350 at best, and Eur/Gbp back down under 0.9000 even though the single currency is outpacing the Buck as well.

- EUR/JPY/CHF – All narrowly mixed vs the Usd, as the Euro edges further above 1.1000 to test offer and option expiry interest at 1.1050 where 1.6 bn resides, but the Yen and Franc lose a bit more safe-haven appeal on the aforementioned improvement in market morale, with Usd/Jpy and Usd/Chf pivoting 106.50 and 0.9825 respectively.

- EM – Some loss of recovery momentum for the Lira ahead of next Thursday’s CBRT rate verdict as Turkish President Erdogan contends that more cuts are coming, while the Rand’s bull run has been somewhat hampered by worse than expected SA Q2 current account metrics. Usd/Try has bounced from circa 5.6500 and Usd/Zar is firmer after a temporary dip below 14.7500, but the PBoC set its Usd/Cny reference rate a smidge lower against the recent trend.

In commodities, WTI and Brent futures are relatively flat as the benchmarks take a breather yesterday’s above 4% rally which was fuelled by heightened risk appetite, a weaker USD and geopolitical tensions after US imposed sanctions, targeting the shipping network controlled by the IRGC, whilst last night’s surprise build in API crude stocks (+0.401mln vs. Exp. -2.5mln) did little to sway prices. WTI remains above the 56.0/bbl with its 200 and 50 DMAs at 56.13/bbl and 56.19/bbl respectively, meanwhile its Brent counterpart re-eyes 61.0/bbl to the upside. Next up, participants will be eyeing the delayed release of the weekly DoE crude stocks at 1600BST/1100EDT with the headline expected to print a drawdown of 2.488mln barrels. Traders may also take note of US production, which reached a record of 12.5mln BPD last week, ahead of next week’s JMMC meeting (12th Sept). Elsewhere, gold has retreated further below the 1550/oz despite a weaker USD amid safe-haven outflows whilst the risk appetite buoys copper and iron, with the former reclaiming 2.60/lb to the upside.

US Event Calendar

- 8:15am: ADP Employment Change, est. 148,000, prior 156,000

- 8:30am: Nonfarm Productivity, est. 2.2%, prior 2.3%; Unit Labor Costs, est. 2.4%, prior 2.4%

- 8:30am: Initial Jobless Claims, est. 215,000, prior 215,000; Continuing Claims, est. 1.69m, prior 1.7m

- 9:45am: Bloomberg Consumer Comfort, prior 62.5

- 9:45am: Markit US Services PMI, est. 50.9, prior 50.9; Markit US Composite PMI, prior 50.9

- 10am: Factory Orders, est. 1.0%, prior 0.6%; Factory Orders Ex Trans, prior 0.1%

- 10am: Durable Goods Orders, est. 2.1%, prior 2.1%; Durables Ex Transportation, est. -0.4%, prior -0.4%

- 10am: Cap Goods Orders Nondef Ex Air, prior 0.4%; Cap Goods Ship Nondef Ex Air, prior -0.7%

- 10am: ISM Non-Manufacturing Index, est. 54, prior 53.7

DB’s Jim Reid concludes the overnight wrap

There will be a lot of tears at home today although I’m not sure who will shed the most between my wife, daughter or me. Little Maisie starts at nursery today at the school she’ll be at until she’s 13 – assuming she’s not expelled. She may cry the least as I know my wife will be in floods of tears. As for me I’ve just paid my first ever school fees cheque and the tears will start to flow when I realise how many more years I’ll be paying for my children. I’m pretty sure it’ll be into the 2040s.

I’m half wondering whether we’ll still be debating Brexit into the 2040s. Yesterday in isolation was another dramatic day and the Government suffered another two big headline defeats including one asking for an election on October 15th (it still may happen). However given recent events, in a wider context the session wasn’t that remarkable so we’ll push the Brexit news down the pecking order to give you all a break. We may all need to pace ourselves over the coming weeks.

After the gloominess of Tuesday’s bad US manufacturing ISM print, markets staged a recovery yesterday as the service sector ISM in China and Europe held up reasonably well. Signs of political tensions easing in Hong Kong, Italy and hints of China stimulus helped. Not to break my promise but the fact that the no deal Brexit probabilities decreased a little also seemed to help a bit. Today’s US non-manufacturing ISM is going to be pretty important as to near term direction.

The positive momentum is continuing overnight as China’s Ministry of Commerce said in a statement that Vice Premier Liu He agreed to a visit “in early October” to Washington during an overnight telephone call with the US Treasury Secretary Steven Mnuchin and U.S. Trade Representative Robert Lighthizer. Meanwhile, the statement from the USTR’s office was a bit more cautious in nature and stated that ministerial-level discussions will take place in “the coming weeks,” without specifying when. The Chinese commerce ministry added that lower-level officials will have “serious” discussions this month to prepare for the talks while the USTR said that deputies will seek “to lay the ground-work for meaningful progress.”

Adding to the positive sentiment this morning, Hong Kong leader Carrie Lam told a news conference that her decision to formally withdraw the controversial bill allowing extraditions to China and other moves would only be the “first step to break the deadlock in society.” She further said, “it’s obvious to many of us the discontentment in society extends far beyond the bill,” and “We can discuss all these deep-seated issues in our dialogue platform to be established.”

This morning in Asia markets are moving up with the Nikkei (+2.30%), Shanghai Comp (+1.56%) and Kospi (+1.12%) all up. Hang Seng is up a more modest +0.38% after it advanced +3.90% yesterday. In FX, the Japanese yen is down -0.16% while the Chinese onshore yuan is up +0.17% to 7.1340. Elsewhere, futures on the S&P 500 are up +0.90% while the yield on the 10y UST is up 3.7bps this morning and the 2y yield is up 4.5bps. In commodities, spot gold prices are down -0.47% to 1545.17/ troy ounce while copper futures are up c. +2.46%.

For yesterday, the S&P 500 closed up +1.09% as cyclical sectors led the move while the NASDAQ and DOW ended +1.30% and +0.91% respectively. The broad rally came despite further confrontational comments from President Trump, who described the trade war with China by saying “to me, this is much more important than the economy,” perhaps undermining the view that he will prove to be responsive to economic pain. Energy was a significant driver, with energy stocks gaining +1.39% as WTI oil rallied +4.47%, its best day in two months. Crude was helped by evidence that the US is tightening sanctions on Iranian oil as well as comments from Russian energy minister Novak which signalled lower domestic production this month. As a result, HY spreads also tightened -3.5bps. Investment grade spreads traded -0.9bps tighter, amid a cascade of issuance (a reported $54bn over the last two days) as companies take advantage of low yields. Even though US IG spreads are +56bps wider from their lows last year, IG yields are at their lowest levels in three years at 2.79%.

Bond yields spent most of the first half of the day climbing with 10yr Gilts and Bunds +10.7bps and +6.8bps higher at their peak. However they closed up +8.7bps and +3.2bps respectively but with Gilts still seeing the largest move since April. In the US, Treasuries sold off as much as +4.0bps but retraced to close flat after some dovish Fedspeak. As you’ll see above yields are back up in the Asian session. US 2s10s steepened back into positive territory at 2.5bps, the highest since 20 August. Bucking the yield sell off trend in Europe was Italy which rallied another -6.4bps to 0.81% on the back of the announcement of Conte’s new ministers including Roberto Gualtieri as finance minister which was seen as market friendly, especially towards Europe. In any case, yesterday move means that the spread to Bunds is now down to 148.5bps. Just a -90bps move in less than a month then.

So to Brexit. As expected after the prior day’s proceeding, MPs voted in favour of legislation that seeks to avoid a no-deal Brexit, and then went on to reject Prime Minister Johnson’s call for a general election. The argument is mostly on the grounds that the legislation to prevent no-deal should be passed into law first.

The Press Association has reported overnight citing new chief whip Lord Ashton of Hyde that the UK government has agreed that all stages of legislation designed to stop a no-deal Brexit on Oct. 31 will be completed in the House of Lords by Friday 5pm. If Mr Johnson wants an election it is arguably now in his interest for this to be fast tracked and then argue that nothing now stops the country going to the polls. Suggestions are that there could be another vote on Monday for a General Election after the bill has been fully locked down. However it would not be impossible for the opposition parties to stall beyond that and put Mr Johnson into a very difficult situation. They would have to weigh this up against how it would look to the electorate if they were seemingly running scared of a poll. Indeed overnight, the BBC has reported that Labour’s Mr Corbyn will not allow an election before October 31 Brexit date. A few more fascinating days ahead.

Sterling rallied, up +1.21% against the dollar to $1.223 as markets perceived the likelihood of a no-deal exit to have fallen now that MPs have backed the principle of another extension. The rally came in spite of the UK services PMI coming in at 50.6 (vs. 51.0 expected), which along with the sub-50 manufacturing and construction PMIs earlier in the week suggest that the UK economy could be on course for another contraction this quarter.

Gilts may have taken some additional signalling from Chancellor Sajid Javid that there would be a review of the current fiscal framework ahead of the Budget. This spending round just covered 2020-21, with the next multi-year review planned for next year, but there was a real-term increase in day-to-day departmental spending of 4.1% compared to 2019-20, the biggest in 15 years. Anyone would think there was an election around the corner.

And finally on the UK, Governor Carney testified before the Treasury Select Committee, where the Bank of England’s updated assessment of the worst-case Brexit scenario was less severe than previously, as a result of progress in preparations for a no-deal exit. In this worst-case scenario, they now see a peak-to-trough fall in GDP of 5.5%, rather than 8% as before. It’s worth noting though that this is a worst-case scenario rather than a forecast of the most likely outcome.

Meanwhile as discussed above, Treasuries and global bonds did catch a bid after some of the Fedspeak yesterday. Kaplan said that risks to his forecasts are to the downside and that it’s “relevant that Fed Funds is above the whole yield curve”. Williams highlighted the usual series of headwinds affecting the US economy, but interestingly also referenced recent downward revisions to GDP and payrolls as signalling less momentum than previously thought. That was the first instance of a Fed official making this argument and bolsters the case for additional rate cuts. Evans said later in the day that “there’s increased uncertainty among the business community as a result of the new trade policy.” Later in the day, the Fed’s beige book of economic commentary indicated that the US economy expanded modestly in August, as “concerns regarding tariffs and trade uncertainty continued, (but) the majority of businesses remained optimistic.”

Over in Europe there was some anticipation ahead of ECB Chief Economist Lane’s speech. However it ended up a non-event with the presentation almost entirely technical in nature. This means we’re still starved of comments from the important trio of Draghi, Lane, and Coeure. Early in the morning we did hear from incoming ECB President Lagarde however, where some of the notable takeaways included agreement with the view of the Governing Council that a highly accommodative policy is warranted but also that “there are important questions on the horizon.” She also emphasized the side effects of policy easing and said that there needs to be a cost benefit analysis. At the margin she seems to be hinting at a slightly more concerned view as to the side effects of extreme monetary policy than Draghi has. Early days though.

European Banks got a boost from her comments, closing up +1.21% and outperforming the STOXX 600 (+0.89%). Staying with Europe, the final PMIs didn’t really move the dial all that much but there was some relief that they are not following manufacturing lower at the moment. The services reading was revised up 0.1pts to 53.5 for the Euro Area which left the composite at 51.9 versus 51.5 in July. The data for France and Germany was a little bit stronger along with Spain where the services reading rose 1.4pts to 54.3 (vs. 53.0 expected). However Italy disappointed with the services reading dropping 1.1pts to 50.6 (vs. 51.6 expected).

In the US the July trade deficit was a touch wider than expected at $54.0bn. The prior month was revised wider as well, weakening the trend for US net exports. As a result, the Atlanta Fed’s third quarter GDP forecast fell another 0.2pp to 1.5%, with the downward revisions concentrated in consumption and business equipment spending. Later on the August vehicle sales data surprised on the upside with reading at 16.97m (vs. 16.80m expected).

To the day ahead now, which this morning includes July new factory orders in Germany and August new car registrations for the UK. In the US this afternoon it’s a busy session for data. We’ve got the August ADP employment report, final Q2 nonfarm productivity and unit labour costs revisions, jobless claims, the final August PMI revisions, July factory orders and final capital and durable goods revisions, and last but by no means least the August ISM non-manufacturing print. If that wasn’t enough then we’re also due to hear from the ECB’s Guindos at two separate events this morning and the BoE’s Tenreyro.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com