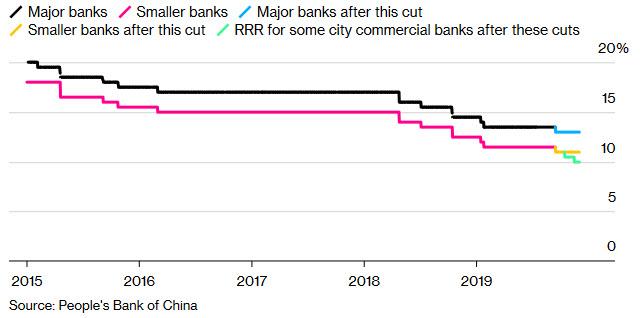

As had been widely previewed in China’s official financial press in recent days, on Friday the PBOC announced it would cut the required reserve ratio (RRR) for all banks by 0.5% effective Sept. 16 (and by 1% for some city commercial banks, to take effect in two steps on Oct. 15 and Nov. 15), releasing 900 billion yuan ($126 billion) of liquidity, helping to offset the tightening impact of upcoming tax payments.

While today’s rate cut – which was expected following the State Council meeting and ahead of the Oct.1 National Day Chinese holiday – was more than the previous cuts in January and May, which released 800 billion yuan and 280 billion yuan, respectively, the PBOC stated that “China won’t adopt flood-like monetary stimulus” and that they will continue “prudent” monetary policy to “keep liquidity at (a) reasonably ample level” and will “strengthen the counter-cyclical adjustment” which is basically gibberish for it will do whatever it sees appropriate.

With the Chinese economy slowing drastically in recent months, with various economic indicators at multi-decade lows, the RRR cut was aimed at supporting demand by funneling credit to small firms and echoes the earlier cuts this year. Indeed, as Bloomberg notes, China’s economy softened substantially in August after poor results in July, and will likely deteriorate further in the remainder of the year. Trade tension between China and the U.S. expanded onto the financial front recently after China allowed the currency to decline below 7 a dollar, prompting the U.S. to name it a currency manipulator.

Anticipating cries of foul play from Trump’s twitter account which is just minutes away from unleashing hell at the Fed for not doing what China is doing, the cut “doesn’t reflect an aggressive easing,” said Commerzbank economist Zhou Hao. “In fact, China has recently massively tightened property financing. Hence this is still a re-balancing – to lower the funding costs for the manufacturing sector but tighten liquidity in the property sector due to asset bubble concerns.”

The widely anticipated news of further Chinese easing helped boost US equity futures, with the Emini S&P 500 future spiking to session highs of 2,986 after the announcement, although it has since faded much of the gains.

The offshore yuan gained 0.35% to 7.1128 a dollar as of 6:30 p.m. in Beijing.

Amusingly, the PBOC pulled a page from the Fed’s “mid-cycle adjustment” playbook and emphasized that the policy change wasn’t a massive step up in easing. “The cut is not flooding the economy with stimulus and the stance of prudent policy has not changed,” it said in a separate statement. The RRR cut will offset the tax season in mid-September, and the overall liquidity in the banking system will stay basically stable, according to the PBOC.

“The cuts don’t mean significant easing in monetary policy,” said Standard Chartered economist Ding Shuang. “Rather it is something they must do, a sort of marginal easing, in order to prevent tightening in monetary policy.”

Whether the impact of the RRR cut is limited or not, it will certainly antagonize Trump, especially since PBOC officials indicated recently they are wary of larger-scale easing measures, and have so far refrained from following the U.S. Federal Reserve in cutting benchmark interest rates.

Meanwhile, even though the rate cut should – in theory – be currency negative, in today’s upside down world, the offshore yuan surged from around 7.14 to just stronger than 7.11 against the dollar.

And now we await Trump’s angry response, slamming the Fed for failing to keep up with every other central bank.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com